Marathon Digital, a leading cryptocurrency mining and infrastructure company, has announced that its Bitcoin holdings have exceeded $2 billion in value.

This remarkable milestone underscores the company’s successful strategy of accumulating and holding Bitcoin as a long-term investment.

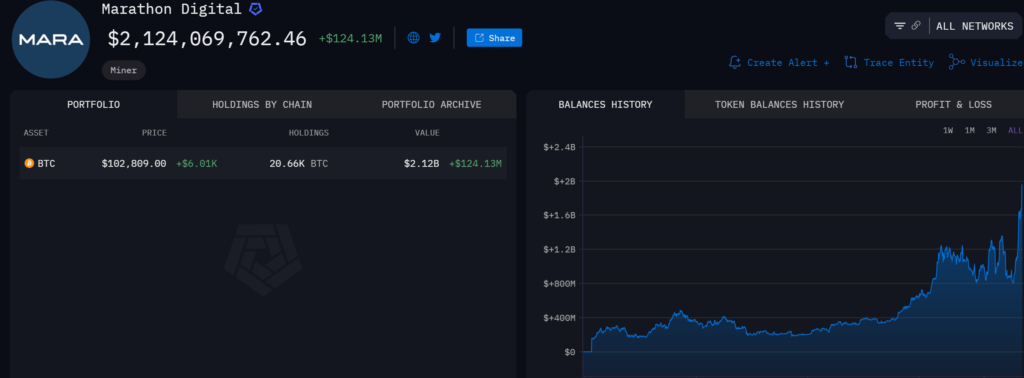

According to Marathon Digital’s latest financial dashboard, the company is currently holding 20.66 BTC, which are valued at over $2.12 billion based on Bitcoin’s current market price of around $102,889 per coin.

By steadily growing its Bitcoin reserves, Marathon Digital has positioned itself as a major player in the cryptocurrency space, demonstrating its confidence in the long-term potential of the digital asset.

Bitcoin’s Record-Breaking Rally

The rapid growth in the value of Marathon’s Bitcoin holdings can be attributed to the sustained rally in the cryptocurrency’s price over the past few months.

Bitcoin (BTC), the largest cryptocurrency by market cap, has shattered records, surpassing the $100,000 milestone for the first time.

Trading at $102,705.80 as of now, Bitcoin’s surge has been fueled by optimism surrounding the election of Republican Donald Trump as U.S. President, with expectations of a favorable regulatory environment for digital assets.

Since Trump’s victory on November 5, Bitcoin’s value has soared by approximately 49%, driven by substantial capital inflows into the U.S.-based Bitcoin-backed exchange-traded funds (ETFs).

This rally marks one of the most significant moments in the cryptocurrency’s history, drawing widespread attention from both retail and institutional investors.

Marathon’s Bitcoin Price Appreciation

The achievement of surpassing $2 billion in Bitcoin holdings represents a significant milestone for Marathon Digital and underscores the company’s commitment to being a leading player in the cryptocurrency mining and infrastructure space.

Bitcoin has seen a resurgence in investor interest and has gained over 146.58% in value since the start of the year, outperforming many traditional asset classes.

This rapid appreciation in the value of Bitcoin has directly contributed to the substantial growth in the value of Marathon Digital’s cryptocurrency holdings, highlighting the company’s strategic decision to invest heavily in the digital asset.

Marathon’s Convertible Notes Offering

In a related development, Marathon Digital Holdings (MARA) announced a $700 million private offering of 0% convertible senior notes due in 2031.

The offering, subject to market conditions, will target institutional investors under the Securities Act.

The notes, classified as unsecured senior obligations, will not bear interest, and MARA may convert them into cash, MARA common stock, or a combination of both at the company’s discretion.

MARA plans to allocate $50 million from the proceeds to general corporate purposes, including Bitcoin purchases, capital expenditures, and other growth initiatives, while also using a portion to repurchase its 2026 convertible notes to optimize its capital structure.

Also Read: Binance Founder’s Witty Take On Bitcoin’s $100K Milestone, Says “Everything Else Got Cheaper”

Implications for the Cryptocurrency Market

These developments highlight the growing interest in Bitcoin as a strategic asset among publicly traded companies.

Firms like Marathon Digital are demonstrating an extremely bullish outlook for the leading cryptocurrency, using their significant resources to accumulate and hold Bitcoin as a long-term investment.

As the digital asset market continues to evolve, investors will be closely watching to see how Marathon Digital and other industry leaders capitalize on the growing demand for Bitcoin and other cryptocurrencies, potentially driving further adoption and price appreciation in the cryptocurrency space.

Also Read: Michael Saylor’s MicroStrategy Hits $18 Billion In Bitcoin Profits Amid Bitcoins New ATH Milestone