Crypto analyst Ali Martinez has identified a crucial price level for Litecoin (LTC) to confirm a bullish breakout.

According to Martinez, LTC must achieve and sustain a daily candlestick close above $136 to signal a strong upward trend. This prediction comes at a time when Litecoin is showing resilience despite a broader market downturn.

While major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) have struggled to maintain momentum, LTC’s recent movement suggests an internal catalyst is fueling demand.

Investors are closely monitoring price action, as a confirmed breakout could lead to further gains in the near term.

Whale Activity Plays a Key Role in Litecoin’s Market Behavior

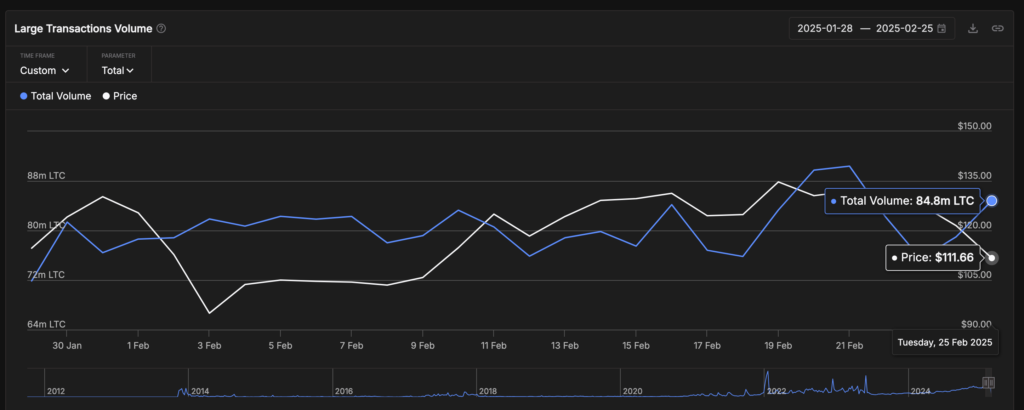

On-chain data indicates that large investors, commonly referred to as whales, have played a critical role in supporting Litecoin’s price movements.

IntoTheBlock’s Large Transactions metric, which tracks transactions exceeding $100,000, reveals that whales transacted approximately 75.5 million LTC when the market took a hit following former U.S. President Donald Trump’s tariff announcement.

Instead of joining the broader sell-off, these investors increased their buying pressure as prices dipped. This strategic accumulation suggests that institutional players have confidence in Litecoin’s long-term potential, reinforcing bullish sentiment despite short-term fluctuations.

Also Read: Canary Capital’s Litecoin ETF Filing Gets Close To Approval As Per Reports, Litecoin Surges 16%

Current Market Conditions Show Short-Term Weakness Despite Optimism

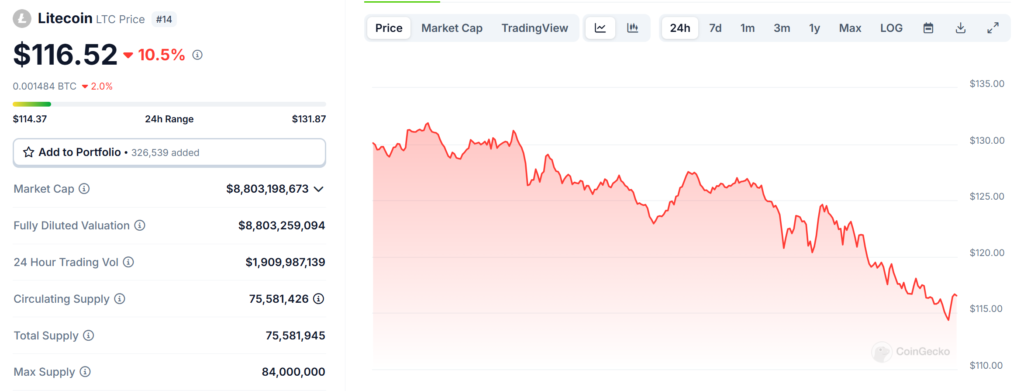

Despite growing optimism for a breakout, Litecoin’s price has experienced a notable decline in recent days. As of today, LTC is trading at $116.45, reflecting a 10.49% drop over the past 24 hours.

The token has also seen a 12.35% decline over the past seven days, aligning with overall market volatility.

With a circulating supply of 76 million LTC, the cryptocurrency’s market capitalization currently stands at approximately $8.8 billion.

While these figures indicate short-term weakness, the ongoing accumulation by whales and the $136 resistance level highlight potential upward momentum if market conditions stabilize.

Litecoin’s Path Forward: Will It Confirm a Breakout?

For Litecoin to confirm its bullish breakout, market participants will need to see sustained buying pressure pushing the price above the $136 threshold.

Analysts suggest that whale accumulation, combined with broader market recovery, could help LTC regain lost ground.

If Litecoin successfully breaks past this key resistance level, it could attract increased investor interest and trigger a stronger rally.

However, if selling pressure persists, LTC may continue facing resistance, delaying its upward trajectory.

In the coming days, traders will be closely watching technical indicators and whale activity to determine whether Litecoin can fulfill its bullish potential.