A significant development in the cryptocurrency space has emerged with Canary Capitals’ filing for a Litecoin ETF with the U.S. SEC, prompting Litecoin founder Charlie Lee to express strong optimism about its potential approval.

Lee’s confidence is backed by substantial evidence of growing institutional demand, particularly highlighting the performance of the Grayscale Litecoin Trust (LTCN), which is trading at more than double its net asset value.

Lee draws important parallels between Litecoin and Bitcoin, emphasizing their shared peer-to-peer transactional nature and commodity status, factors he believes strengthen the case for ETF approval.

This development gains additional significance considering the recent approvals of Bitcoin and Ether ETFs by the U.S. SEC, suggesting a broader trend of institutional acceptance in the cryptocurrency space.

Also read: Litecoin Price Skyrockets Over 6% After Canary Capital Submits SEC Application for ETF

Expert Analysis and Global ETF Landscape

The prospect of a Litecoin ETF has garnered attention from prominent market analysts, with James Seyffart of Bloomberg Intelligence declaring its approval “inevitable.”

This assessment is supported by Litecoin’s established presence in European markets through exchange-traded products, including $LITE in Switzerland and $ELTC in Germany.

The cryptocurrency’s current market performance adds weight to these projections, with LTC trading at $71.02, showing impressive gains of 6.24% and 5.88% over the past week and month respectively.

The surge in 24-hour trading volume, marking a 31.15% increase, further demonstrates growing market interest and participation in Litecoin trading activities.

Mini-Bull Run and Market Indicators

Market data platform Santiment has identified a mini-bull run in Litecoin’s performance, marked by its breakthrough above $73 – a level not seen since July.

This upward momentum is supported by two crucial factors: a remarkable surge in on-chain transaction volume, reaching $4 billion within 24 hours (the highest since June 2023), and a significant uptick in retail sentiment.

Social media discussions about LTC have increased notably, focusing on recent developments within the Litecoin ecosystem. These positive sentiment indicators have historically been reliable predictors of price movement, often attracting additional buyers to the market.

Technical indicators also support this bullish trend, with the RSI maintaining a position above 50 (currently at 62.85%) and open interest showing a modest increase of 1.08% to reach $206.8 million.

Current Market Statistics and Performance Metrics

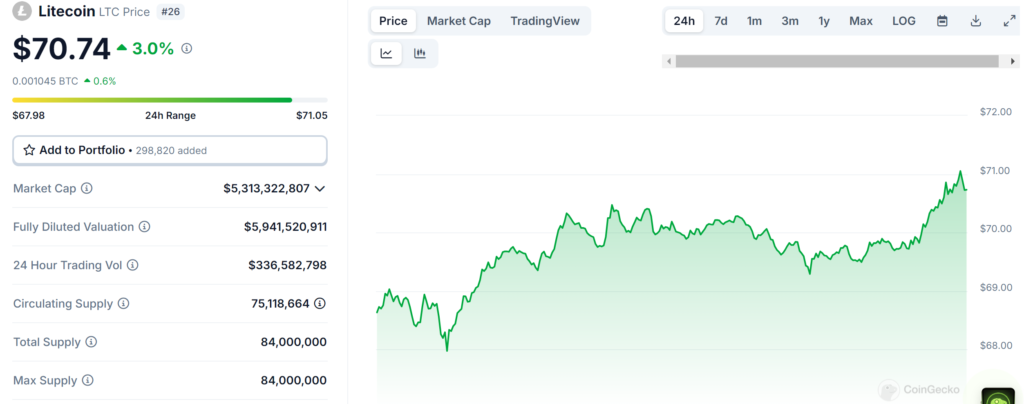

As of the latest market data, Litecoin is maintaining strong market presence with a price of $70.89 and a substantial 24-hour trading volume of $338,397,139.

Despite a minor 1.29% decline over the past week, the overall market performance remains robust, with the cryptocurrency showing a 3.0% increase in the last 24 hours. With a circulating supply of 75 Million LTC, Litecoin commands a significant market capitalization of $5,323,894,166.

These metrics, combined with the aforementioned technical indicators and market sentiment, paint a picture of a cryptocurrency that continues to demonstrate resilience and potential for growth, particularly in light of the pending ETF decision.