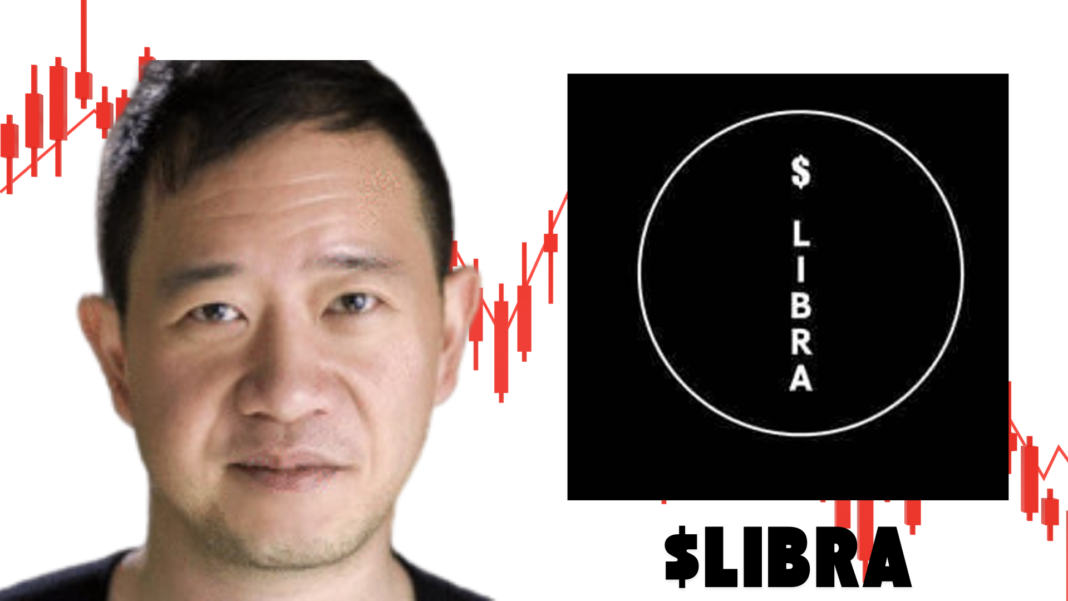

Ben Chow, the co-founder of the Solana-based decentralized exchange Meteora, has resigned amid growing allegations linked to the controversial LIBRA memecoin.

Chow’s departure was officially confirmed by Meow, the pseudonymous co-founder of both Meteora and Jupiter, in a post on X.

While the full details of Chow’s resignation remain unclear, Meow emphasized the commitment of both Meteora and Jupiter to transparency, reassuring the community that neither platform was involved in any insider trading or financial misconduct.

Chow had been instrumental in the leadership of Meteora for over a year, and his resignation marks a pivotal change for the project moving forward.

Allegations of LIBRA Token Mismanagement Spark Legal Investigation

The controversy surrounding Chow’s resignation centers on his alleged involvement with the LIBRA token, particularly whether he had privately received or managed the asset.

These allegations have raised suspicions of improper conduct, prompting Meteora and Jupiter to retain the prestigious law firm Fenwick & West to conduct an independent investigation into the matter.

In a statement, Meow assured the public that the findings of the investigation would be made available in due course.

While Meow expressed confidence in Chow’s overall character, he acknowledged recent lapses in judgment regarding the management of Meteora, calling attention to potential issues that led to his resignation.

Also Read: Bermuda Prime Minister Exposes Fake X Account Promoting Scam Token

The Rise and Fall of the LIBRA Memecoin

The controversy around LIBRA has intensified due to its meteoric rise and rapid collapse. LIBRA’s value soared to over $4 following a public endorsement from Argentine President Javier Milei, before crashing back down to less than 50 cents.

The token’s volatile price swings triggered rumors of market manipulation, as insiders reportedly cashed out more than $100 million while ordinary investors faced severe losses.

The scandal has sparked outrage, with critics accusing those involved of taking advantage of uninformed retail investors.

The sudden liquidity crisis and the token’s erratic behavior have called into question the lack of regulatory oversight in the memecoin space, raising alarm bells within the cryptocurrency community.

Political Fallout and Legal Scrutiny in Argentina

The LIBRA token scandal has spilled over into the political arena, especially in Argentina, where President Milei’s involvement in promoting the token has led to political fallout.

The endorsement from Milei, followed by the token’s dramatic rise and fall, has fueled calls for his resignation from opposition figures.

In response, the Argentine Anti-Corruption Office has initiated an investigation into the scandal, with Federal Judge María Servini overseeing the case.

The legal scrutiny highlights the broader implications of the LIBRA crash, particularly its potential impact on the political landscape in Argentina and the cryptocurrency market’s reputation.

The fallout is far from over, as both legal and regulatory bodies continue to probe the event.

Broader Impact on the Crypto Industry and Regulatory Debate

The LIBRA scandal has sent ripples through the global cryptocurrency industry, exacerbating concerns about the risks of market manipulation and the lack of investor protections in the memecoin space.

The controversy has intensified the ongoing debate around the need for stronger regulatory frameworks within the crypto market.

Insider trading and questionable token launches, such as the LIBRA crash, have brought renewed focus to the issue of market oversight.

According to reports, 11 insiders generated $43.8 million in profits by selling LIBRA tokens immediately after launch.

On the other hand, 74,000 traders lost a collective $286 million in the collapse. The incident has fueled calls for stricter regulations to prevent similar incidents in the future.

As investigations unfold and legal proceedings continue, the crypto community is watching closely, as the outcome may have lasting implications for how tokens and exchanges are regulated worldwide.

Also Read: Gemini’s Winklevoss Announces MIT Hiring Ban Over Ties With Former SEC Chair Gary Gensler