In order to facilitate real-time transaction monitoring, the Kenya Revenue Authority (KRA) has suggested establishing a tax system that is connected with cryptocurrency trading platforms. Local media reports highlight that the new tax system will help the regulatory authority to “monitor and record transactions”.

The KRA will record important details about every transaction, including the money and transaction time. According to the tax agency, there are significant tax losses because the existing system is unable to track cryptocurrency transactions. Kenya is also thinking about detecting tax evasion with the use of machine learning and artificial intelligence (AI).

KRA New Move Comes As Africa Becomes Crypto Hub

The new step by the Kenya Revenue Authority comes at a time when the region and Africa at large are seeing heightened use of crypto.

As of mid-2021, $20 billion worth of Bitcoin transactions had place in Africa, making the continent one of the fastest-growing cryptocurrency sectors in the world, Kenya, Nigeria, and South Africa are the three nations in the region with the highest user counts.

Furthermore, as of December 25, 2024, the Kenyan government intends to employ M-PESA Paybills and Till numbers as virtual Electronic Tax Registers (ETRs). This action is a component of the nation’s larger tax reforms, which aim to correct tax evasion and increase the revenue base.

Local media reports also highlight that as a result of an ongoing tax evasion case involving well-known cryptocurrency exchange Binance in Nigeria, Kenya plans to transition to a real-time tax system that will interface with marketplaces and exchanges for cryptocurrencies.

Will Kenya Crypto Exposure Grow in The Near-Term?

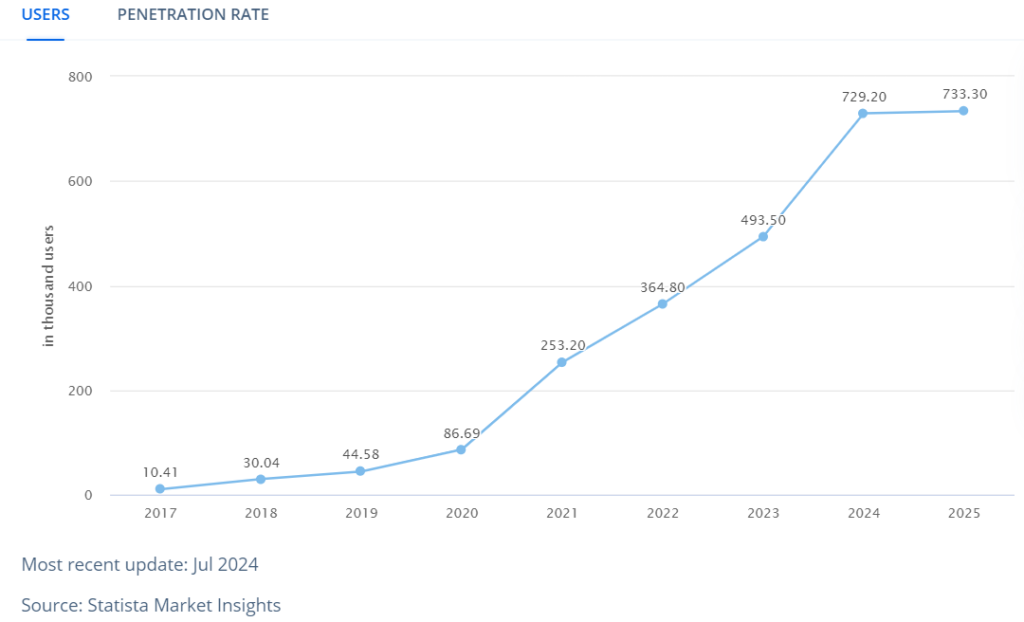

By 2024, it is anticipated that Kenya’s cryptocurrency sector will generate US$41.7 million in income. According to this prediction, there will be a predicted total revenue of US$40.0 million by 2025, with an annual growth rate (CAGR 2024-2025) of 4.03%.

The country’s user base is expected to keep growing in the near term thanks to higher transactions and an ever evolving friendly ecosystem.

In Kenya, the cryptocurrency sector is expected to generate an average revenue per user of US$57.2 in 2024. The number of users in the nation’s cryptocurrency sector is expected to increase to 733,30k by 2025.

In the same timeline, it is projected that the percentage of the population utilizing cryptocurrencies, or user penetration rate, will have decreased to 1.28% from 1.30% in 2024.

The use of cryptocurrencies has surged in Kenya due to the country’s expanding mobile money ecosystem and tech-savvy population.