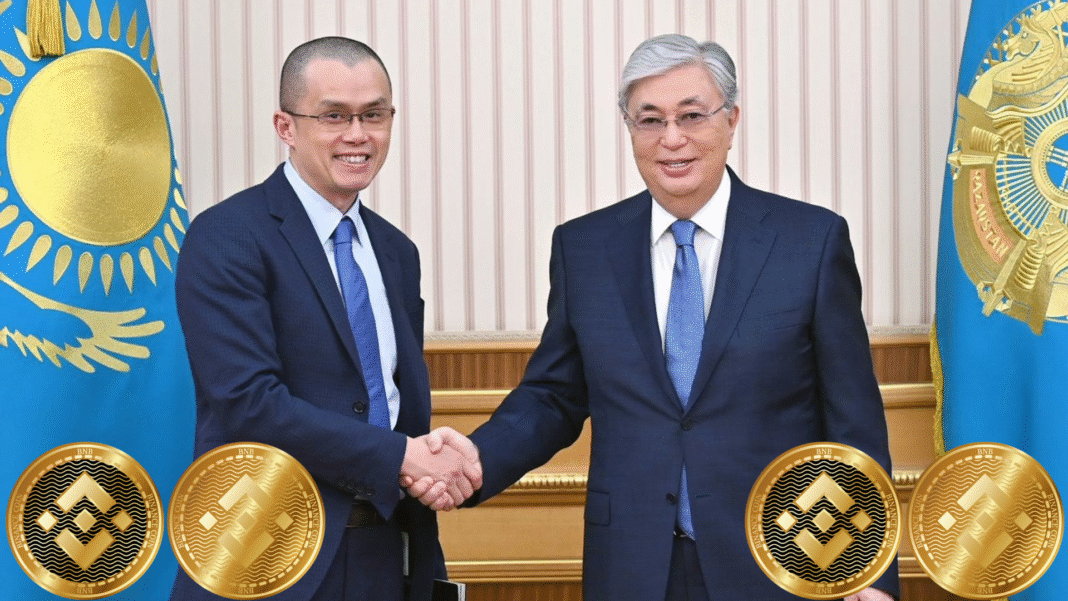

Kazakhstan has unveiled its first national crypto reserve, called the Alem Crypto Fund. The fund has selected BNB as its inaugural digital asset through a partnership with Binance Kazakhstan. Binance Co-founder CZ made a post on X sharing the recent development.

The fund was established by the Ministry of Artificial Intelligence and Digital Development and is managed by Qazaqstan Venture Group. They are also registered under the Astana International Financial Centre (AIFC).

Officials say the fund represents a significant step toward Kazakhstan’s intent to adopt digital assets and institutional recognition of cryptocurrency at a national level.

The General Manager for Binance Kazakhstan, Nurkhat Kushimov, said selecting BNB represents “a new chapter for institutional recognition of cryptocurrencies in Kazakhstan” and reiterated Kazakhstan’s strategic stance of adopting blockchain technologies.

BNB Chosen as Core Asset in Kazakhstan’s Digital Strategy

The decision to choose BNB emphasizes Kazakhstan’s intention to include a globally established and popular digital currency within its digital assets.

The Binance Coin has a market cap of over $140 billion, and BNB is also one of the largest digital currencies in the world.

BNB is the native currency of the BNB Chain blockchain, which is designed to facilitate transaction processing, fees, and governance.

Deputy Prime Minister Zhaslan Madiyev stated that the purpose of the Alem Crypto Fund is to be a “secure mechanism for large investors and a basis for digital state reserves” and could be a state savings instrument in the future.

This work is part of President Kassym-Jomart Tokayev’s direction to the National Bank to establish values for a strategic reserve of “promising assets” as part of the long-term economic strategy for Kazakhstan.

Also Read: Kazakhstan Lists Central Asia’s First Crypto ETF As Fonte’s Spot BTC Fund Prepares AIX Listing

Building a Broader Crypto and Fintech Ecosystem

The creation of the crypto reserve is a complementary component of Kazakhstan’s recent regulatory and financial ecosystem development.

Earlier this month, stablecoin payments were approved by the AIFC for registration fees and regulatory fees, and Bybit became the first exchange to sign a multilateral agreement with the Astana Financial Services Authority (AFSA).

According to AFSA CEO Evgeniya Bogdanova, this marks the first regulatory framework in the region to allow stablecoin payments in a regulated context.

In July, the National Bank also confirmed plans to allocate portions of Kazakhstan’s gold and foreign exchange reserves and National Fund assets to crypto-linked investments following the strategy of sovereign wealth funds in Norway, the U.S., and the Middle East.

Kazakhstan also launched Central Asia’s first spot Bitcoin ETF in August and is preparing to launch the digital tenge as a central bank digital currency (CBDC) by 2025.

Also Read: Kazakhstan National Bank Governor Announces Plans to Establish a National Cryptocurrency Reserve

From Mining Hub to “CryptoCity”

Kazakhstan’s ascent in the crypto industry can be traced back to 2021, when it became one of the world’s Bitcoin mining centers after China cracked down and miners relocated to other jurisdictions.

At the time, Kazakhstan accounted for 27% of global Bitcoin mining, dropping to roughly 4%, due to damage to the power grid and tougher regulations.

As of now, Kazakhstan has registered 415,000 mining machines, issued 84 mining licenses (64 active), and launched the “70/30 project” initiative, where foreign investors upgrade the power grid with shared usage for 70% of regular consumers and 30% for miners.

Looking ahead, President Tokayev announced plans for “CryptoCity” in Alatau, which will be a regulated pilot zone for daily transactions in cryptocurrency and to better regulate payments beyond crypto.

The plan also includes a banking system that allows for crypto that can be exchanged in compliance with AML, thereby enhancing Kazakhstan’s brand as a crypto innovation hub.

Also Read: Kazakhstan Partners with Solana in Strategic Move to Establish a Blockchain-Powered Economic Zone

Kazakhstan Regional and Global Crypto Adoption

In recent times, Kazakhstan’s Government has made various developments in crypto adoption, echoing a larger trend across the region.

On September 23rd, we reported that Kazakhstan launched a pilot stablecoin initiative (KZTE) based on the tenge and developed with support from Solana and Mastercard through the central bank’s sandbox. Meanwhile, neighboring countries are pursuing parallel moves.

For example, Bhutan is partnering with Binance Pay and DK Bank for cryptocurrency tourism payments.

Thailand rolled out its TouristDigiPay program, and the Riviera in France has allowed luxury merchants to accept cryptocurrency payments for goods and services.

By moving forward early with a state-backed cryptocurrency reserve, Kazakhstan is indicating its desire to become a regional leader in blockchain adoption in the public and private sectors.

Also Read: Kazakhstan To Launch “CryptoCity” Pilot Zone, Aiming To Make Crypto Payments Familiar