Justin Sun, founder of Tron, has initiated a public protest of Donald Trump’s DeFi project, World Liberty Financial (WLFI), after his wallet was blacklisted and 595 million WLFI tokens, valued at approximately $104 million, were frozen.

Sun, the project’s largest investor, asserts that the freeze contravenes “investors’ legitimate rights,” which he says goes against fairness and decentralization of blockchain.

The controversy stems from recent price swings in WLFI, with accusations of pump-and-dump activity being connected to the recent hype surrounding its listing on Binance.

Sun Denies Manipulation Allegations Amid Wallet Blacklisting

According to Arkham Intelligence, on-chain data validated that shortly after Sun transferred $9 million worth of WLFI tokens, World Liberty Financial blacklisted Sun’s wallet.

This transaction happened while WLFI’s price dropped 24% within days, leading to speculation that Justin Sun was preparing to sell-off a large amount of WLFI tokens.

Threatened by the accusations, Sun explained on X that his transactions as a “generic exchange deposit test” with small amounts, and couldn’t have influenced anything in the market.

Justin Sun dismissed any accusations of manipulation and claimed he has no plans for a dump.

Sun Calls for Fairness, Transparency, and Trust

Sun specified in a succession of posts that he was an early backer and had provided capital and support to the WLFI ecosystem.

He suggested that the Trump-led project should be more altruistic and transparent, and that simply blacklisting wallets was not going to be effective, nor was it an action that would gain investor trust.

“Tokens are sacred and an inviolable right. That should be like a bare minimum value of any Blockchain,” Sun explained.

He further elaborated that freezing investor assets simply goes against the decentralized nature of DeFi and is also going to undermine the credibility of World Liberty Financial.

Sun’s demand is for his frozen tokens to be released and for the project to recommit to protecting investor rights.

Also Read: Trump Family Wealth Surges By $6 Billion Following Success of World Liberty WLFI Token Launch

Community Backlash Fuels Controversy

Even with Sun’s defense, many in the community are still doubtful. Some even say they do not trust him. The critics call him out for his previous controversial token actions and accuse him of ‘pump and dump’ WLFI.

The critics said Sun used promotion, including a token burn, and a 20% APY yield program to lure retail investors and then sold his tokens.

Sun continues to express that he did not sell his WLFI tokens, and even says two days earlier he promised not to. Still, the community is mixed, with some calling him a scammer.

If true, then the claims could validate World Liberty freezing up Sun’s assets and widen the divide between Sun and the project.

Also Read: Influencer Andrew Tate Suffers $67,500 Loss On Trump Family Backed WLFI Token Long Position

WLFI Market Outlook Remains Volatile

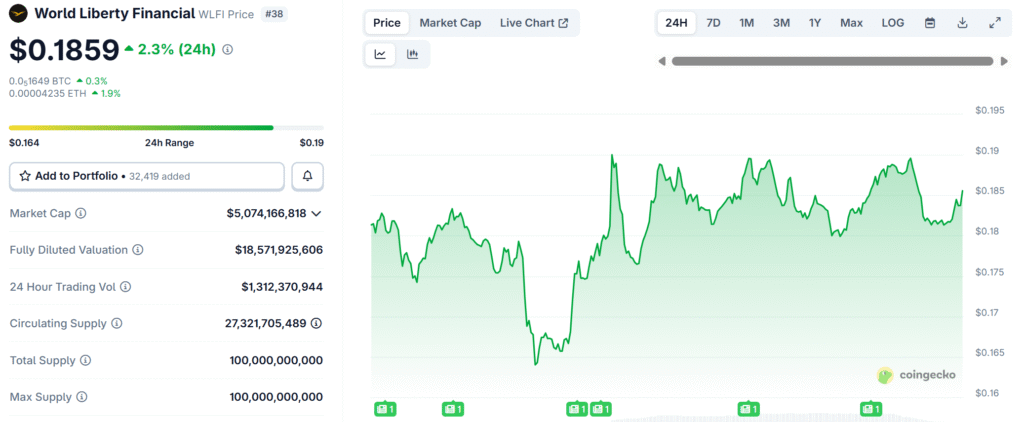

In the meantime, World Liberty Financial appears to be seeing substantial trading activity despite the controversy.

At the time of writing, WLFI is priced at $0.186, +2.46%, with trading volume of $1.31 billion.

The market cap of WLFI is approximately 5 billion dollars, with a circulating supply of 27 billion WLFI.

Although the price recovered slightly from recent losses, the ongoing dispute with Justin Sun has created an increased level of uncertainty.

The conclusion of this dispute – either the project keep its freeze or unlock the tokens of Justin Sun, could be pivotal in world equity and investor confidence in WLFI going forward.

Also Read: Trump Family Backed WLFI Blocks 2 Crypto Hacker Attacks From Compromised End Users, Here’s All