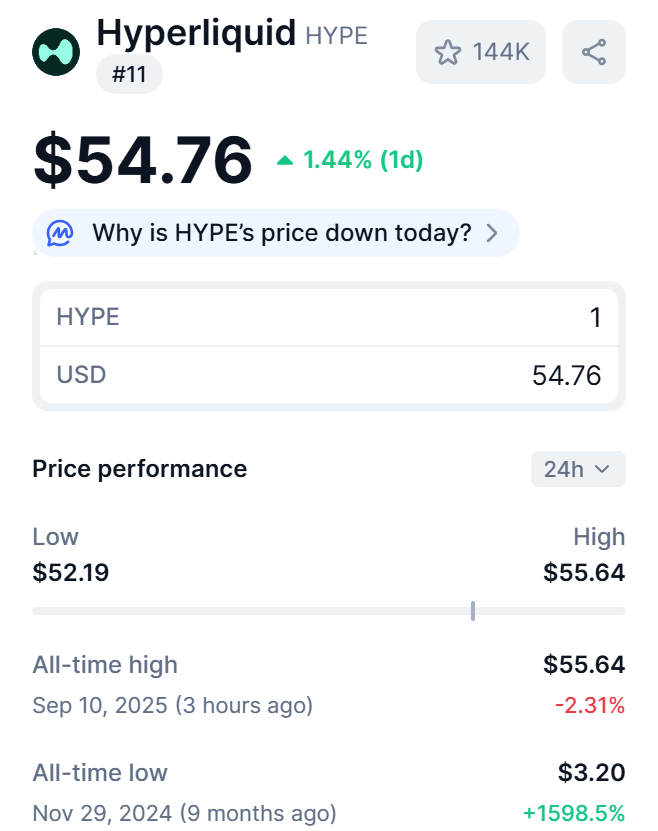

Hyperliquid ($HYPE) has just hit a new all-time high at $55.64 and is now a top digital asset by market cap.

The surge came after weeks of consolidation within the $44–$47 range, supported by increasing institutional interest and new liquidity flowing into the Hyperliquid ecosystem.

The Nasdaq-listed Lion Group also acted as a stamp of approval when it announced the intent to convert its SOL and SUI holdings to HYPE, indicating the growing interest among institutions linked to traditional finance.

HYPE Token Technical Breakout

From a technical viewpoint, the rally in Hype stock was ignited when HYPE emphatically broke above its 50-day EMA ($48.15) and its 100-day EMA ($46.74) in early September.

This crossover created a wave of buying momentum, which was backed by a decent volume of trade and a series of bullish candles.

The first level of resistance was at around $54, resulting in a minor $1 pullback to $53, but sellers have not shown any real pressure.

With the shorter EMA sitting above the longer EMA, analysts have noted that the bullish structure has not deteriorated.

The former resistance area near $44-$47 has now become a support, and potential targets are higher in the range of $55 to $57.

Market Performance and Trading Activity

Today, HYPE is priced at $54.42, with daily growth of 0.58% and weekly growth of 19.47%.

Its market cap is at $14.77 billion, with a 24-hour trading volume of more than $617 million.

This is supported by strong fundamentals, as Hyperliquid did $106 million in revenues in August, on the back of nearly $400 billion in perpetual futures volume.

DeFiLlama data shows the exchange is now estimated to have about 70% of the DeFi perpetual futures market, which few competitors can compete with in terms of market share.

Also Read: Hyperliquid Achieves World’s Highest Revenue Per Employee At $1.13B Annual Revenue With 11 Employees

Strategic Developments: USDH Stablecoin and Institutional Support

The bidding war on Hyperliquid’s proposed USDH stablecoin has propelled a lot of the momentum behind Hyperliquid.

The stablecoin will be backed by USDtb, a token associated with BlackRock’s BUIDL fund.

Ethena Labs was the sixth bid to submit and initiated their proposal on returning 95% of all revenue generated from reserves to the community and implementing a “guardian network” of validators to oversee secured operations.

In that same timeframe, BitGo began supporting institutional custody for HYPE and HyperEVM, suddenly solidifying legitimacy and streamlining access for larger funds.

Simultaneously, Jan van Eck, CEO of VanEck, publicly supported Hyperliquid’s governance and design, further bolstering confidence from traditional finance.

Whales Cashing In and Market Speculation

The rise of HYPE has been catapulted by whale activity as well.

Trader James Wynn tried to open a 10x leveraged long on HYPE on September 9th, but was liquidated in less than 24 hours, which now extends a number of bad trades, which some investors are now jokingly using as a contrarian indicator.

The same day, whale “mlmabc” made news by converting $38 million of ETH and SOL into HYPE – that investment is now worth $279 million, making it a $241 million profit, according to UnoCrypto.

Since mlmabc had 5.07 million HYPE tokens, they are now ranked in the top 5 holders of HYPE and represent yet another exciting example of the amount of capital that is flowing into Hyperliquid.

All of this is a testament to both the risks and rewards surrounding HYPE as the token appears to be solidifying its place as a major player in the DeFi markets.