Hyperliquid, a growing player in the decentralized trading ecosystem, has announced a comprehensive overhaul of its fee structure and staking tier system, set to take effect on May 5 at approximately 03:00 UTC.

The platform aims to enhance its user incentives and create a more tiered, performance-based rewards system.

The core of this upgrade revolves around staking the platform’s native token, HYPE, which will now play a direct role in reducing transaction fees.

Users who stake HYPE tokens will enjoy lower fees, adding a tangible utility to the token and promoting longer-term engagement from the community.

Distinct Fee Schedules Introduced for Perpetual and Spot Trading

One of the key changes includes the introduction of separate fee structures for perpetual contracts and spot trading.

The distinction allows for greater customization of trading costs depending on the type of market activity users engage in.

In addition, Hyperliquid is doubling the weight of spot trading volume when calculating a user’s fee level, giving spot traders a strategic advantage in climbing the fee tiers.

This move reflects the platform’s effort to balance the incentive structure between speculative derivatives trading and traditional spot activity, ultimately making the ecosystem more inclusive for a broader user base.

Also Read: Hyperliquid Expands to 21 Unlicensed Nodes in Major Network Upgrade

Cross-Account Staking Discounts and Fee Tier Logic

Hyperliquid is also enhancing account flexibility with a new feature that allows staking and trading accounts to be linked.

Currently available on the testnet, this feature enables users to apply staking benefits from one account to another, such as a separate trading account, an innovation expected to go live shortly after the full launch of the new system.

Additionally, fee tiers will now be determined based on a rolling 14-day trading volume. Sub-account activity contributes to the overall volume of the master account, ensuring that high-volume users across multiple accounts benefit from a unified fee tier.

However, vault trading volume will be tracked independently, maintaining a distinction for users who manage assets in that category.

Also Read: HyperCore & HyperEVM Integration Goes Live, Enabling Seamless DeFi Trading On Hyperliquid

Maker Rebates, Referral Bonuses, and Volume-Based Incentives

The revamped structure also refines how incentives like maker rebates and referral rewards are distributed.

Maker rebates will be paid out continuously and directly into the user’s trading wallet, improving liquidity provider compensation and encouraging greater order book participation.

Referral rewards will apply to a user’s first $1 billion in trading volume, while referral-based fee discounts will be honored for the first $25 million, providing substantial value for community-driven onboarding.

Overall, these changes represent a strategic shift toward rewarding loyalty, high-volume participation, and ecosystem contributions, positioning Hyperliquid for more sustainable and user-centric growth in the evolving DeFi trading space.

Market Reaction and HYPE Token Performance

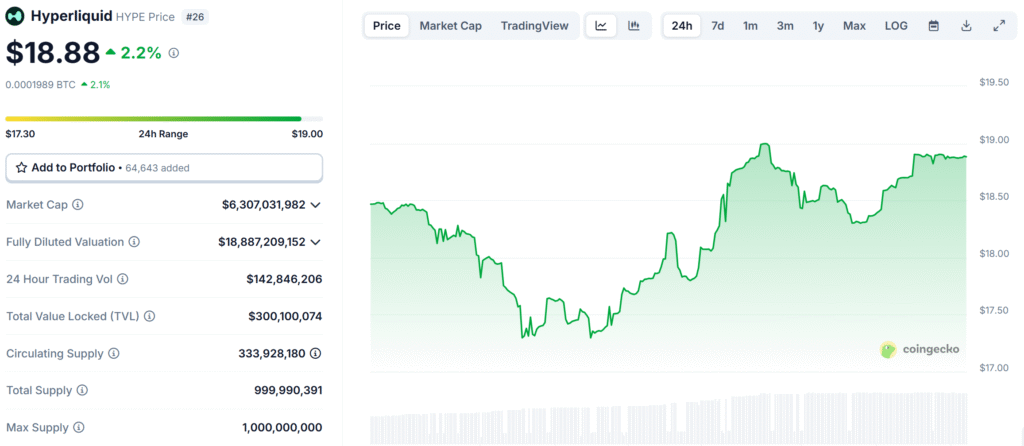

In anticipation of these significant structural changes, the market has responded positively to Hyperliquid’s announcements.

As of today, the HYPE token is priced at $18.88, reflecting a 2.25% increase over the last 24 hours and a 3.45% gain over the past week.

With a circulating supply of 330 million tokens, HYPE’s market capitalization has reached approximately $6.31 billion.

The surge in trading volume, over $142 million in the past day, signals growing interest and investor confidence.

As Hyperliquid prepares to implement these major updates, the platform positions itself for deeper market penetration and more sustained user growth within the DeFi trading space.