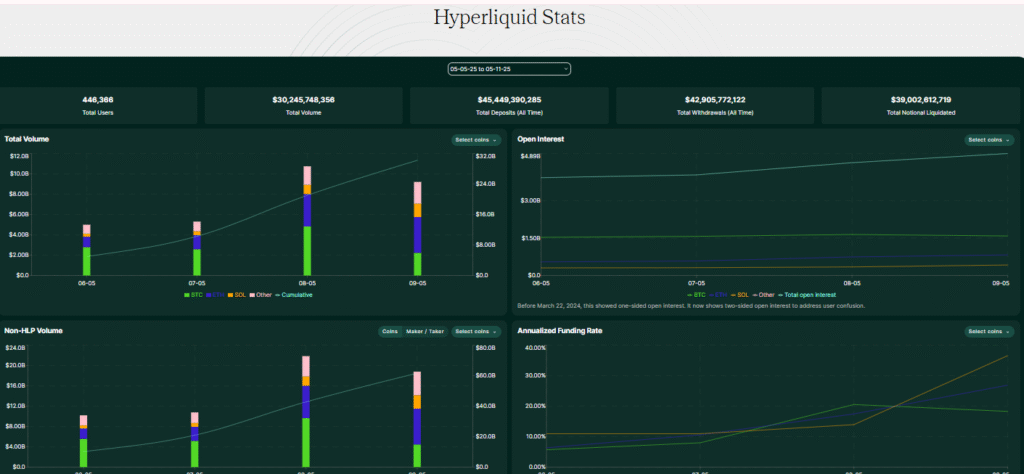

Hyperliquid had its largest weekly total to date during the week of May 5–11, with a net inflow of $548 million, according to on-chain data.

This milestone shows that traders looking for non-custodial alternatives to centralized platforms are becoming more interested in the decentralized perpetuals exchange.

The increase in inflows indicates that users are becoming more confident in Hyperliquid’s trading model and infrastructure.

Hyperliquid Logs Record $200M Daily Inflow on May 8

On May 8, the platform recorded a record-breaking $200 million net inflow in a single day, making it a new ATH. This surge accounted for over one-third of the weekly total and is the biggest daily influx in Hyperliquid’s history.

As users seek for trading settings that are capital-efficient, transparent, and trustless, the larger trend reflects the growing momentum in the decentralized finance (DeFi) derivatives sector.

Hyperliquid is positioned as a major player in this developing market, particularly while centralized exchanges continue to be impacted by regulatory uncertainty.

Record inflows like this could become a recurrent trend for Hyperliquid as more traders switch to on-chain alternatives, enhancing its position in the upcoming DeFi innovation wave.

Also Read: Crypto Analyst Predicts Major Price Drop for Hyperliquid $HYPE as Price Eyes $13 Target

$HYPE Token Price Surges 20% in Past 7 Days

It is interesting to note that Hyperliquid’s record weekly inflows come at a time when the $HYPE token has seen extremely bullish trading in the past week.

Hyperliquid’s HYPE token is currently selling at about $25.31 as of May 12, 2025, being up over 20 % in the past 7 days trading streak.

However, the technical indicators for $HYPE give conflicting readings. Neither overbought nor oversold circumstances are indicated by the Relative Strength Index (RSI), which is hovering close to neutral.

Short-term bullish momentum is indicated by moving averages, while increasing trading interest is shown by volume patterns. But volatility is still strong, suggesting that there may be significant price swings soon.

Hyperliquid Rises on Strong Design and DeFi Demand

Hyperliquid is gaining popularity due to a combination of strong technical design, user-focused features, and growing demand for decentralized alternatives to traditional crypto trading platforms.

As a fully on-chain perpetuals exchange, Hyperliquid offers low-latency, high-throughput trading without relying on centralized intermediaries—addressing a core concern for traders seeking transparency and custody over their assets.

Its seamless user experience, similar to centralized exchanges, makes it attractive to both retail and professional traders. Features like zero gas fees for trades, high liquidity, and an expanding list of supported tokens have further boosted its appeal.

Additionally, the platform benefits from growing distrust in centralized exchanges following past collapses, driving users toward more secure and transparent DeFi options.