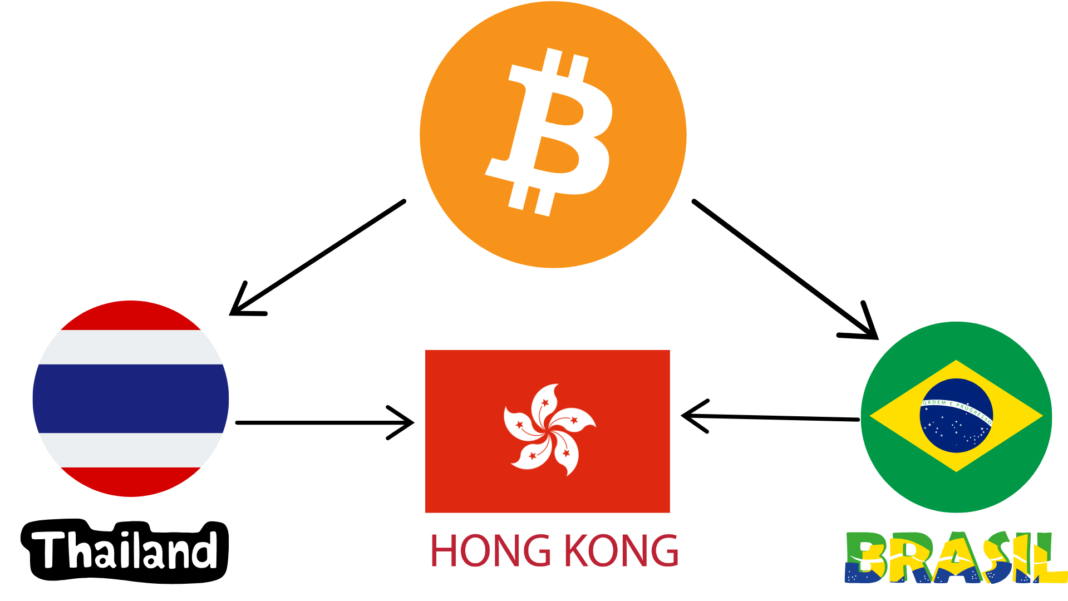

The Hong Kong Monetary Authority (HKMA) has announced strategic collaborations with the central banks of Brazil and Thailand, aiming to advance cross-border tokenization transactions. These initiatives will focus on atomic settlement for digital assets (delivery versus payment, or DvP) and wholesale central bank digital currencies (CBDCs) for payment versus payment (PvP) settlements.

To support Hong Kong’s position as a leading tokenization hub, the HKMA is also offering grants of up to HK$2.5 million for digital bond issuances, marking a significant step in promoting tokenization as a viable financial market solution.

Hong Kong’s Efforts to Boost Digital Asset Initiatives

Hong Kong has previously pioneered two tokenized green bonds, with one of them being a $750 million issuance, holding the record as the largest of its kind across multiple currencies until recently.

This ongoing investment in digital bond infrastructure highlights Hong Kong’s commitment to innovation in tokenized finance, even as cryptocurrency mining remains banned in mainland China.

The city’s financial regulators have been proactive, with the Hong Kong Securities and Futures Commission (SFC) working on regulatory guidelines to better oversee digital assets, strengthening the region’s reputation as a leader in digital finance.

In the Asia-Pacific region, the SFC recently hosted a groundbreaking meeting with 12 securities regulatory agencies, exploring critical issues related to crypto assets, tokenization, and artificial intelligence. This high-level engagement signals Hong Kong’s interest in setting regional standards for the future of digital assets and maintaining transparent, regulated markets.

Further promoting its digital ecosystem, Hong Kong’s push for tokenization is also bolstered by a recent partnership between Circle and HKT, a major telecommunications player in Hong Kong. This collaboration seeks to explore blockchain-based loyalty solutions for consumers and merchants across the region.

Additionally, Hong Kong’s digital bank ZA Bank has received regulatory approval to incorporate virtual asset transactions into its services, expanding its reach in the growing digital finance sector.

Hong Kong’s Digital Bond Grant Scheme

One of Hong Kong’s new projects, the Digital Bond Grant Scheme, will offer issuers grants of up to HK$2.5 million for each qualifying digital bond issuance. The initiative underscores Hong Kong’s vision of becoming a hub for digital asset issuance and financial innovation, catering to the increasing demand for tokenized financial instruments in global markets.

Collaboration with Brazil’s central bank introduces DREX, Banco Central do Brasil’s CBDC and tokenization project, to Hong Kong’s Project Ensemble tokenization efforts. Brazil’s experience with Pix, its successful real-time payment system, has spurred expectations for DREX, especially with applications now open for its pilot trials on various use cases, including trade finance and carbon credits.

Similarly, HKMA’s partnership with the Bank of Thailand builds on past work under Project Inthanon-LionRock, an initiative that evolved into the mBridge project, which is a cross-border CBDC platform which has now reached the minimum viable project stage.

Through these initiatives, Hong Kong is establishing itself as a progressive force in digital finance, providing both regulatory clarity and economic incentives. With a comprehensive framework for tokenized assets, cross-border payments, and a thriving digital ecosystem, Hong Kong is well-positioned to attract global participants in the region.