On December 19th, a U.S. federal lawsuit was filed against the creators of the Hawk Tuah (HAWK) memecoin after the cryptocurrency’s value plummeted by 93% within hours of its launch.

Burwick Law, representing the investors, filed the case in the Eastern District of New York, accusing the creators and promoters of failing to register the coin with the Securities and Exchange Commission (SEC) and leaving investors with significant losses.

What is the Lawsuit About?

The lawsuit targets Tuah The Moon Foundation, OverHere Ltd, its founder Clinton So, and social media influencer Alex Larson Schultz, who actively promoted the token online.

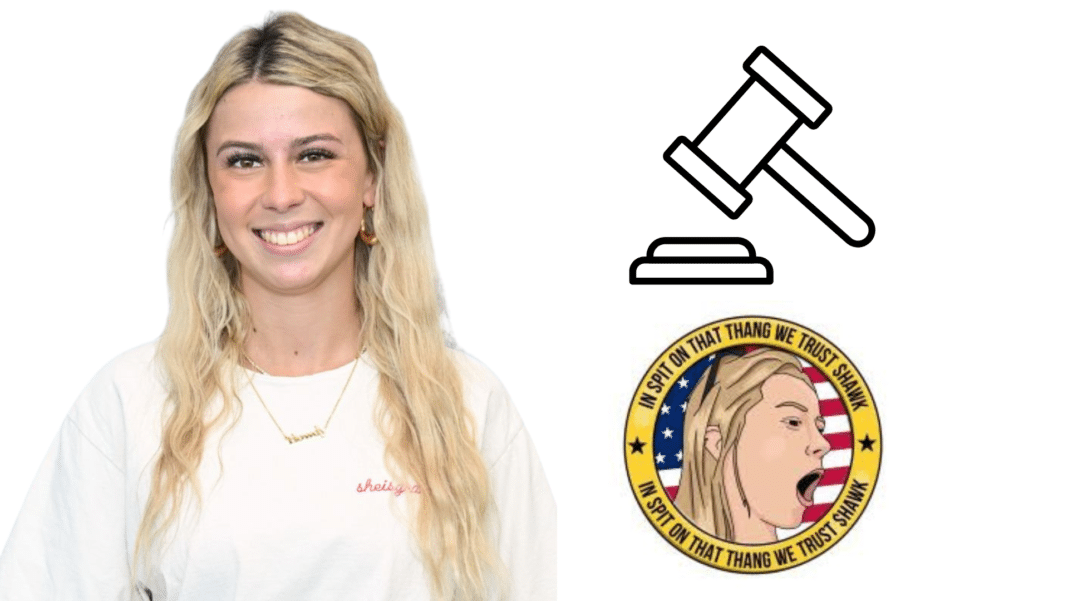

Investors claim they collectively lost over $151,000 after purchasing HAWK, a coin inspired by Haliey Welch, famously known as the “Hawk Tuah Girl.” Welch gained viral fame earlier this year for her social media content but has not been officially named as a defendant yet.

The Rise and Fall of Hawk Tuah

The Hawk Tuah coin launch, promoted as a Solana-based meme coin, initially gained traction with marketing campaigns featuring Welch. She actively promoted the coin on her social media platforms, podcast, and a pre-sale campaign that included free or discounted tokens. This strategy attracted significant attention and led to the token reaching a staggering $490 million peak market cap on its launch day.

However, the excitement quickly turned into chaos as the token’s price collapsed by 93%. Allegations of a rug pull surfaced, fueled by reports that a cluster of connected wallets, holding 96% of the token supply, had been selling off large amounts of the coin.

Also Read: South Korean Crypto Platform Haru Invest Files for Bankruptcy Amid $1 Billion Fraud Scandal

The controversy deepened as these revelations unfolded, leaving investors and observers questioning the legitimacy of the project.

Investor Backlash and Legal Action

Following the crash, angry investors voiced their frustration during an X Spaces event featuring Welch, OverHere representatives, and Doc Hollywood, another involved figure.

Welch attempted to defend the project but exited the discussion abruptly, leaving investors feeling abandoned. She has remained silent on social media since the incident.

Burwick Law quickly stepped in, urging affected buyers to come forward. Two weeks later, the lawsuit was filed, listing 12 plaintiffs who suffered financial damages. The legal team argues that the defendants marketed and sold unregistered securities, violating U.S. federal laws.

The Current State of Hawk Tuah

As of now, HAWK’s market cap has plunged to just $7.7 million, marking a sharp decline from its initial valuation. The coin’s reputation has been severely damaged, and online discussions have included community notes suggesting that Welch might face legal scrutiny for her role in the project’s promotion.

The lawsuit underscores the volatile and speculative nature of memecoins, which often rely on cultural references and online hype for their value. While these coins have a low barrier to creation and can attract large audiences, they also carry significant risks for investors.

The Hawk Tuah case serves as a cautionary tale for those lured by the promise of quick returns in the unpredictable world of cryptocurrency.

Also Read: Crypto Scam: Orderly Network Denies Links to IBXtrade Amid Rug Pull Concerns

Hawk tuerrrrrr hahahah