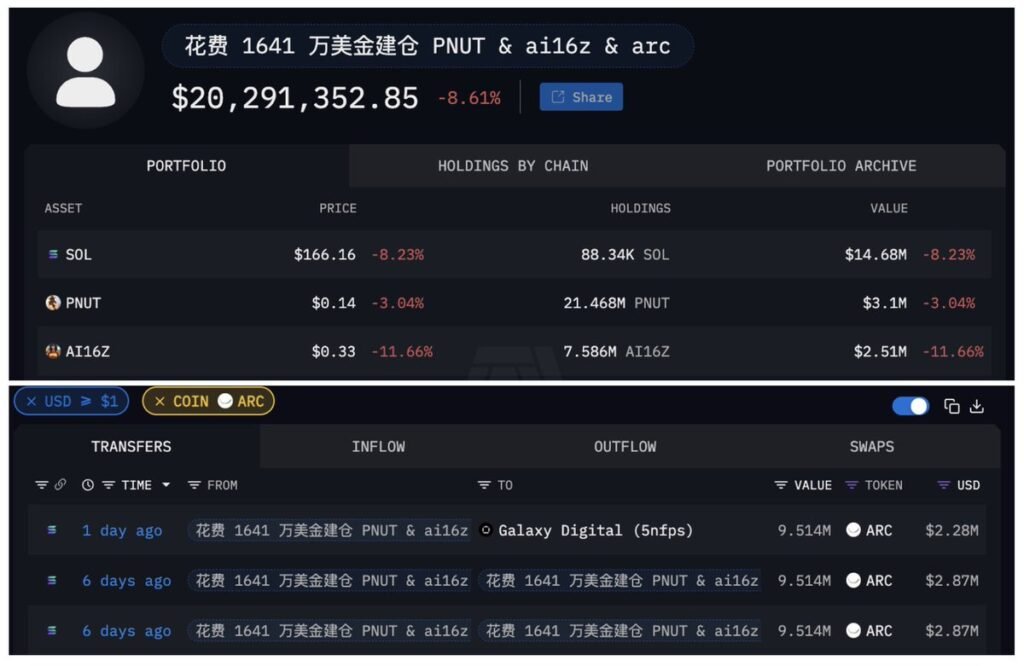

Galaxy Digital, a prominent crypto investment firm with the address FFDAa…8HWM, has earlier today encountered significant financial setbacks following its investments in three speculative memecoins: $PNUT, $ai16z, and $arc.

The firm reportedly spent $16.41 million over the past three months to acquire positions in these tokens, only to face a cumulative floating loss of $8.49 million.

The loss underscores the unpredictable and highly volatile nature of the memecoin market, where investments can rapidly fluctuate due to social media trends, hype, and market sentiment.

Despite the firm’s experience in managing large-scale crypto investments, the losses serve as a stark reminder of the inherent risks involved in such high-stakes, speculative bets.

Breakdown of Losses Across $PNUT, $ai16z, and $arc Tokens

Galaxy Digital’s position in $PNUT is particularly hit hard, with the firm holding 21.46 million tokens at an average cost of $0.3743 per token.

The incident has resulted in a floating loss of approximately $4.94 million. The firm also holds 7.53 million $ai16z tokens, purchased at an average cost of $0.7446 per token, resulting in a loss of around $3.13 million.

Finally, its investment in $arc has been deposited into the Gate exchange, where it was bought at $0.2913 per token, incurring a loss of $425,000.

These losses collectively demonstrate the volatility within the memecoin market, which has been prone to large price swings, especially when driven by social media-driven hype and short-term speculation.

Speculation and Risks in the Memecoin Market

The situation faced by Galaxy Digital highlights the high-risk, speculative nature of investing in memecoins.

These tokens are often driven by community enthusiasm, internet trends, and viral moments, which can lead to rapid and unpredictable price movements.

While they may promise quick profits, memecoins lack the fundamental backing and long-term value that other more established cryptocurrencies offer.

Institutional investors, such as Galaxy Digital, engage in such investments as part of a broader strategy to tap into emerging trends, but the steep losses faced by the firm highlight how quickly such speculative investments can turn against investors.

While potentially lucrative, memecoin investments are fraught with significant risk, particularly when the market experiences sharp fluctuations or changes in investor sentiment.

Future Outlook and Strategic Considerations for Galaxy Digital

It remains unclear whether Galaxy Digital plans to double down on its positions in $PNUT, $ai16z, and $arc or cut its losses moving forward.

The firm’s strategy may have been focused on short-term market movements, capitalizing on trends within the memecoin space.

However, with the substantial floating losses, it’s likely that the firm will reassess its approach to such volatile investments.

The situation raises broader questions about the sustainability of speculative memecoin investments, particularly as the crypto market continues to experience volatility.

The floating losses also emphasize the need for effective risk management strategies when investing in such unpredictable assets.

As Galaxy Digital and other institutional investors reflect on their memecoin bets, their future strategies may shift toward more traditional and lower-risk cryptocurrency assets.

Recent Market Profits and Contrasting Crypto Trader Success Stories

While Galaxy Digital struggles with its memecoin investments, other crypto traders are reaping substantial profits.

In clear comparison, it was earlier reported that 11 insider investors made a combined $43.8 million by selling off $LIBRA immediately after its launch, which saw its value crash by 85%.

The fueled accusations of market manipulation and increased calls for stricter regulatory oversight.

Meanwhile, a smart crypto investor has accumulated $14.84 million in $ai16z and $arc tokens, sitting on $4.38 million in unrealized profits as both tokens surged in value.

These contrasting stories further highlight the unpredictable nature of the memecoin market, with some traders benefiting from timing the market, while others, like Galaxy Digital, are facing substantial losses.