The FTX Token (FTT) price has dropped by a whopping 10%. This big fall comes right after the token’s value had shot up over 90% over the past few days. Why did it go up so much? Well, people were excited about FTX’s plan to pay back some of its investors. But now, it seems that excitement has turned into worry.

Market Volatility and Investor Reaction

The cryptocurrency market witnessed a significant event as the FTX Token (FTT) experienced a sharp 10.3% decline in value over a mere 24-hour period. This dramatic downturn followed an impressive 92% rally in the preceding days, which was largely driven by optimism surrounding FTX’s asset compensation plan.

The initial positive reaction from investors quickly gave way to a more cautious sentiment, resulting in a substantial sell-off. The volatility in FTT’s price underscores the speculative nature of short-term market movements in the cryptocurrency space.

FTX Compensation Plan Dilema & Sentiment Shift

The catalyst for this market shift was the Delaware District Bankruptcy Court’s approval of FTX’s compensation plan. While this news initially spurred the token’s value, it subsequently triggered a wave of profit-taking among investors. The realized profits for FTT holders saw a significant spike in the last 24 hours as many rushed to sell their holdings.

This sudden change in investor behavior suggests a growing skepticism about the potential benefits of the compensation plan, leading to a preemptive cashing out by token holders even before the actual distribution of FTX’s assets among creditors.

Bearish Outlook and Market Indicators

The rapid price drop signals a broader shift towards bearish sentiment in the market. As more investors lock in their gains, the selling pressure continues to mount, potentially driving FTT prices even lower.

The bear market sentiment has been linked to some technical indicators. According to Coinalyze, the open interest of the FTT token has plummeted by 14.20%, now standing at $239,400.

Additionally, the relative strength index (RSI) is at 41.83, affirming the bearish entry into the market. These indicators suggest that the ongoing sell-off could persist, especially if the broader cryptocurrency market remains volatile.

FTT Current Market Status

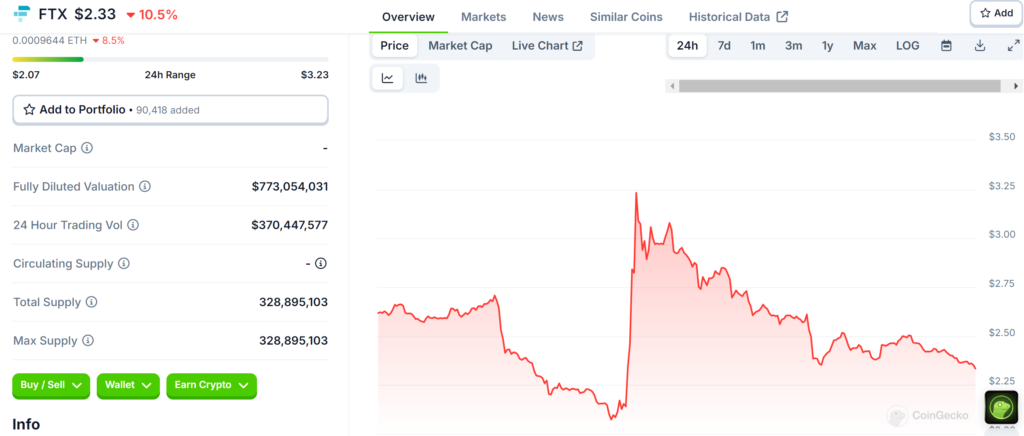

As of the latest update, the price of FTX (FTT) price stands at $2.33, with a 24-hour trading volume of $370,447,577. This represents a 10.50% price decline in the last 24 hours, although it still maintains a 10.82% price increase over the past week.

It’s worth noting that the market capitalization data for FTX is currently unavailable due to unreported circulating supply of FTT tokens.

This lack of complete market data adds another layer of uncertainty to the situation. As the market continues to digest the implications of the FTX compensation plan and investors reassess their positions, the future trajectory of FTT remains uncertain, with potential for further price fluctuations in the short term.