Leading self-custodial cryptocurrency platform Exodus Movement, Inc. (NYSE American: EXOD) announced today that it has reached an agreement to purchase Grateful, a stablecoin payment orchestrator for merchants that offers reduced costs, immediate access to cash, and returns on balances.

A dead with Grateful

Grateful, a Uruguayan startup, enables independent contractors and small enterprises to easily receive and handle digital payments using stablecoins.

A merchant dashboard, wallet-to-wallet payments, offramping, QR-based point-of-sale capabilities, and e-commerce checkout interfaces are just a few of the features that Grateful’s blockchain-native payments stack offers.

“Grateful is a natural complement for our efforts to expand access to digital payments and cryptocurrency in Latin America. The gig and creator economy is rapidly growing in emerging markets, and stablecoin-based payment rails allow for important tools such as invoicing, recurring payments and on-chain settlements,” commented JP Richardson, Co-Founder and CEO of Exodus.

Also Read: Mercado Bitcoin and Polygon Labs Set to Debut $200M in Tokenized Assets Across Latin America

Why is the deal important?

Exodus’s present solutions, which are designed to facilitate multichain development on top blockchains like Polygon, Optimism, Base, Arbitrum, and Solana, easily include Grateful’s technology. Exodus expects the implementation of Grateful technologies throughout its present technological stack and a seamless integration of Grateful into current wallets.

Today, on November 10, Exodus will present its third-quarter financial results and give a business update. “By pairing Grateful’s platform with our innovative and industry-leading self-custodial wallets, users will benefit from full ownership of their hard-earned funds and access to faster, cheaper and borderless transactions,” Mr Richardson added.

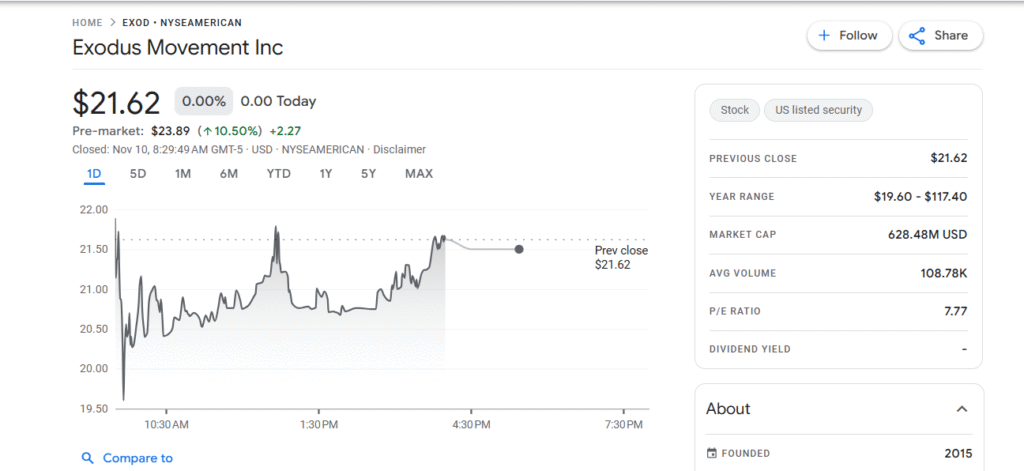

EXOD share price up

After the news broke out, EXOD shares rose. It is trading at $21.62 and is up by 10.57%.

Exodus gives users complete control over their money using self-custodial wallets, allowing them to purchase, sell, and trade cryptocurrency.

The industry-leading tools for integrated cryptocurrency wallets and swap aggregation, Passkeys Wallet and XO Swap, are among its commercial offerings.

Crypto growth in Latin America

Central banks and authorities in Latin America are adjusting to the increasing usage of cryptocurrencies. In 2024, Bolivia inked a deal with El Salvador to promote digital assets and abolished its ban on cryptocurrencies.

Roberto Campos Neto, vice-chairman of Nubank, stated at the Meridian 2025 event this month that the bank intends to test dollar-pegged stablecoin payments on its credit cards.

Serving over 100,000,000 clients in Brazil, Mexico, and Colombia, Nubank initially entered the cryptocurrency space in 2022 with a 1% stake in Bitcoin and a customer trading facility.

These kinds of advancements across Latin America welcome more and more institutional giants and businesses to enter the crypto space.

Also Read: Latin American Developers Favour Ethereum And Polygon Over New Base Chains: Report