An Ethereum whale has made an extraordinary $92 million in unrealized profits by strategically shorting ETH at $3,220 using a highly leveraged position.

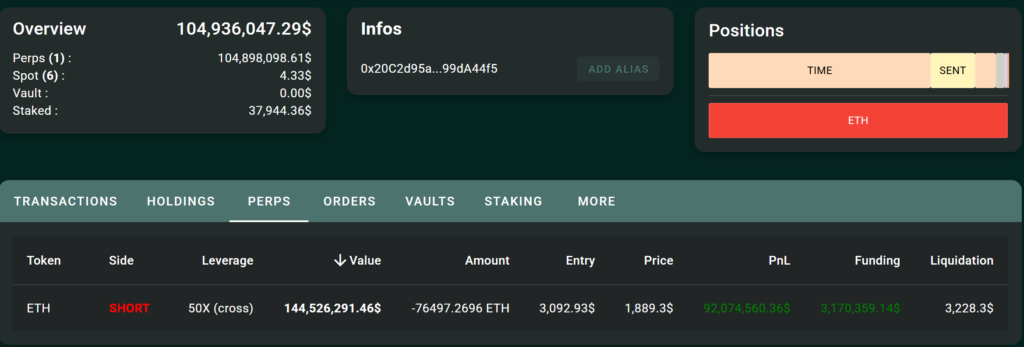

According to on-chain data from Hypurrscan, the trader with the address 0x20C….A44f5 initially invested $3,154,283.16 and utilized 50x leverage to amplify potential gains.

The high-risk, high-reward approach has proven to be a lucrative bet as Ethereum’s price continues to decline.

The whale had previously accumulated $58 million in unrealized profits, but with Ethereum’s price falling significantly, their earnings have soared, highlighting the substantial profit potential in leveraged short trading.

Ethereum Price Drop Fuels Massive Short-Seller Gains

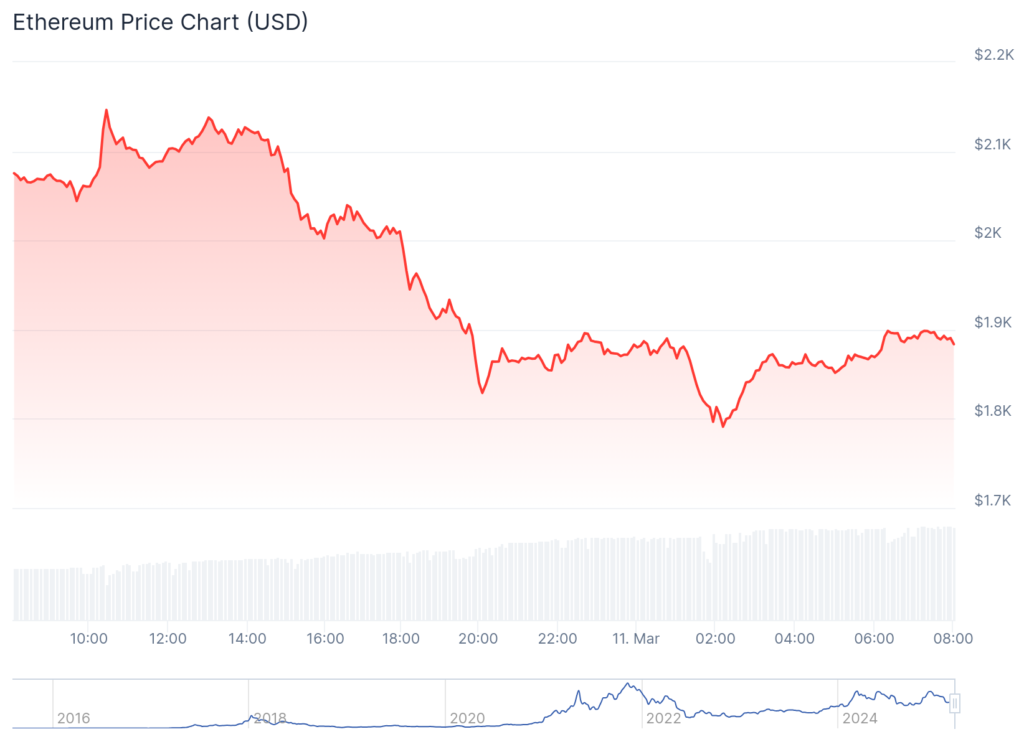

The trader’s impressive profit surge has been driven by Ethereum’s ongoing price slump. Currently, ETH is trading at $1,915.20, marking a sharp 7.10% decline in the last 24 hours and a 10.55% drop over the past week.

As Ethereum’s value decreases, the whale’s short position gains even more traction, as short sellers profit when an asset’s price declines.

With 50x leverage applied, even minor downward price movements result in exponential profit increases.

The strategy has been particularly effective in Ethereum’s bearish market conditions, allowing the whale to capitalize on ETH’s continued downward trend.

Ethereum’s Market Volatility Reflected in Market Cap and Trading Volume

Ethereum’s market conditions remain highly volatile, with a current market capitalization of $227.86 billion and a circulating supply of 120 million ETH.

The 24-hour trading volume has surged to $41.9 billion, indicating increased investor activity amid market uncertainty.

While long-position holders face significant losses, short sellers like the whale have leveraged these conditions to their advantage.

The heightened market turbulence has sparked widespread debate among investors about Ethereum’s next potential price movement, with some fearing further declines and others hoping for a rebound.

Ethereum’s Short-Term Outlook: Further Declines or Rebound?

The sharp decline in Ethereum’s price has left traders and analysts speculating on what’s next for the second-largest cryptocurrency.

While some believe ETH could drop even further, boosting the whale’s profits, others predict a potential rebound driven by market corrections, investor accumulation, or broader macroeconomic shifts.

However, leveraged trading remains a double-edged sword—any sudden price reversal could wipe out a significant portion of the whale’s unrealized gains, emphasizing the risks associated with extreme leverage.

Market participants are closely watching Ethereum’s price action, as the outcome of this trade could set the tone for the broader market sentiment in the coming days.

Other Ethereum Trades Highlight Both Gains and Losses

While this whale has benefited tremendously from the market downturn, not all Ethereum traders have been as fortunate.

One crypto investor suffered a $2.2 million immediate loss after purchasing 15,292 ETH at $2,014 per token for $30.8 million, only to see Ethereum drop over 9% shortly afterward.

Meanwhile, another trader profited from Ethereum’s volatility by closing a 50x leverage short trade on Hyperliquid, securing a $2.15 million gain in just 40 minutes.

The rapid shifts in market sentiment, combined with the prevalence of high-leverage trading, have fueled concerns about potential market manipulation and the risks associated with extreme speculative strategies in the crypto space.

Also Read: Crypto Investor Increases Long Positions in SOL, ETH, WIF, BTC, and kPEPE Amid $14.39M Floating Loss