A long-term Ethereum whale has made a staggering profit of $65.68 million after offloading 34,125 ETH on Coinbase for approximately $67.18 million.

The transaction is among the most notable long-term Ethereum liquidations in recent months, highlighting the immense gains early adopters of the cryptocurrency can achieve.

According to Onchain Lens, the whale strategically capitalized on Ethereum’s long-term growth, despite recent market volatility and shifting investor sentiment.

The move comes at a time when Ethereum’s price has experienced fluctuations, demonstrating the profitability of patience in the crypto market.

Eight-Year Accumulation Strategy Pays Off

On-chain data shows that the whale acquired these 34,125 ETH over eight years through multiple crypto exchanges, including ShapeShift, Changelly, and Bitfinex.

At the time of purchase, Ethereum was trading at an average price of just $44 per token, meaning the total acquisition cost for the whale was a mere $1.5 million.

The recent dynamic illustrates the power of long-term cryptocurrency investment, where those who believed in Ethereum’s potential from its early days have been handsomely rewarded.

The whale’s wallet address, 0x0862…68e482, now serves as a prime example of the rewards that come with patient crypto investing.

Ethereum Market Performance Amid Whale Activity

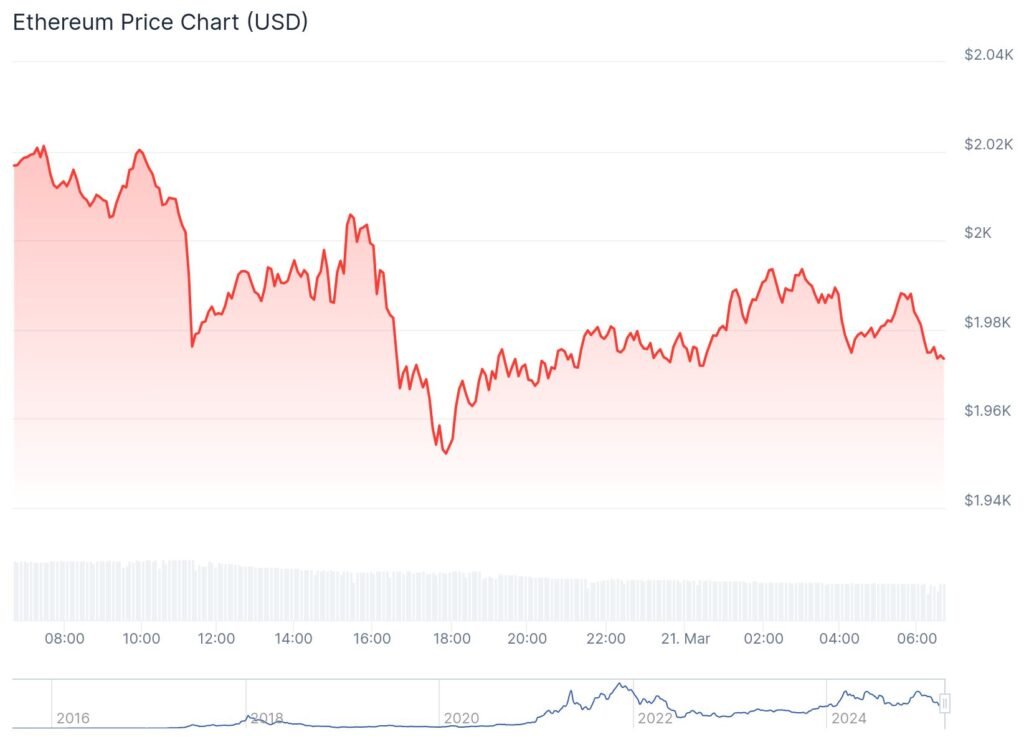

Following the whale’s large-scale sale, Ethereum’s price has seen a minor decline, currently sitting at $1,973.14.

Over the past 24 hours, ETH has fallen by 2.18%, while maintaining a 4.29% increase over the past seven days.

Ethereum’s market capitalization remains strong at approximately $238 billion, with a circulating supply of 120 million ETH.

The whale’s liquidation, combined with broader market sentiment, suggests that Ethereum’s price could continue experiencing short-term fluctuations as investors react to large-scale movements.

Contrasting Market Outcomes: Other Investors Face Losses and Gains

While the Ethereum whale enjoyed massive profits, not all investors have been as fortunate.

Another Ethereum investor recently faced a $6.62 million loss after selling 5,000 ETH on Binance following just a 15-day holding period.

The investor’s decision to sell came amid an 18.69% weekly price drop, further emphasizing the risks of short-term trading in volatile markets.

Conversely, another crypto whale secured a $56.87 million profit by selling 26 million XRP after staking for over two years, demonstrating the varied outcomes within the crypto space.

Recent Whale Crypto Offloads & Market Outcomes

The contrasting stories of crypto whales highlight the unpredictable nature of digital asset investments.

While the Ethereum whale’s patience yielded significant gains, the short-term ETH investor faced heavy losses due to market timing miscalculations.

Meanwhile, another whale who held 751 million FUN tokens for four years ended up selling at a $16.7 million loss, only for FUNToken to rebound by 20.39% within 24 hours.

These cases reinforce the importance of strategic decision-making in crypto markets, where long-term holders often reap higher rewards, but timing plays a crucial role in maximizing gains.