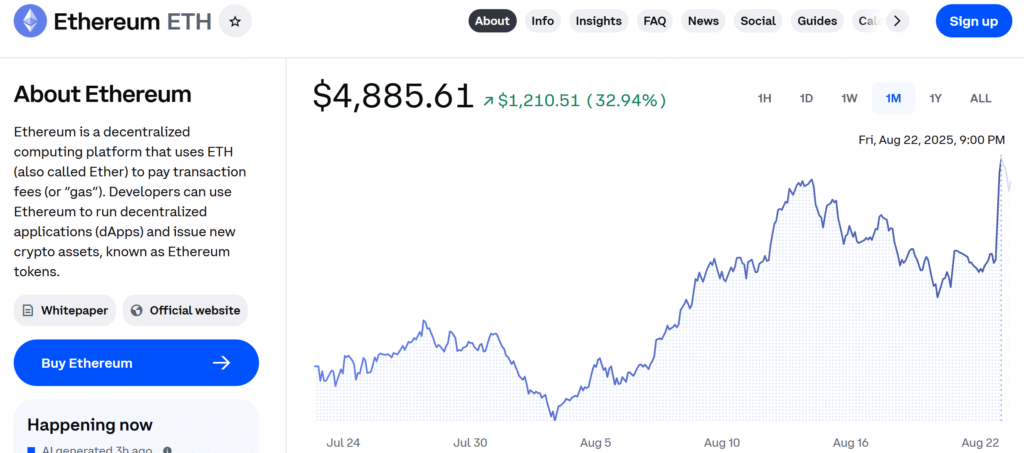

Ethereum has achieved another price milestone and reached a new all-time high of $4,885.61 on Coinbase and multiple exchanges.

The milestone surpasses its last peak from November 16, 2021, when ETH reached $4,891.70.

While the difference is narrow, the new high signals a resurgence of strong market confidence in Ethereum after years of volatility.

Coinbase CEO Brian Armstrong has, in tandem, made a post on X to acknowledge the community, crediting Ethereum for achieving the mark.

In his post, he stated, “Happy ETH all time high to all those that celebrate!”

At press time, ETH has since cooled off and traded at $4737.35, but it is a monumental moment for Ethereum in its historic price history and is another indication of Ethereum’s ongoing dominance in the world of digital assets.

Strong Price Momentum and Market Value

According to the latest data, Ethereum is at $4,748.11, up with a 10.16% rise over the last 24 hours, and a staggering 24-hour trading volume of $80.55 billion.

ETH remains in second place in terms of market cap, as the cryptocurrency is now valued at more than $573 billion.

The total circulating supply is nearly 120.7 million ETH and has no maximum supply limit.

Looking at Ethereum’s estimated fully diluted market cap, it has a market cap of $572.36 billion at its current price, emphasizing the importance of Ethereum and its dominant role in the digital asset ecosystem.

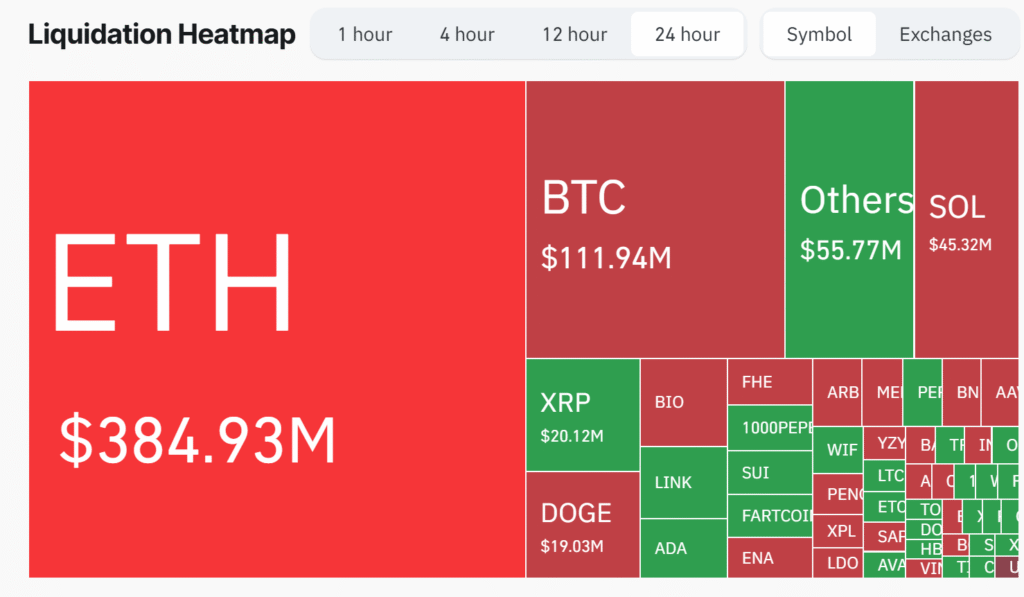

ETH has seen a spike in its price, resulting in liquidations across centralized exchanges.

Aggregate liquidations summed $384.93 million in the last 24 hours, including $274.78 million in short positions liquidated due to the increase in ETH’s price.

Whale Activity and Movements Across Exchanges

On-chain data also reveals that whale activity on a larger scale had a substantial influence on Ethereum’s price movement in recent weeks.

A Bitcoin “OG”, a long-term holder who had sat on his BTC for seven years, recently deposited 300 BTC ($34.86M) into Hyperliquid to swap for ETH.

The investor is now sitting on over $100M in unrealized profits, holding a long position of 135,265 ETH valued at $581M with an average entry of $4,295, plus a spot buy of 122,226 ETH valued at $535M with an average of $4,377.

The activity comes just days after UnoCrypto reported that a Bitcoin whale sold 100,784 BTC to obtain 62,914 ETH, and then opened a 135,265 ETH long position.

Furthermore, institutional buyers have continued to absorb selling pressure, reflecting Ethereum’s resiliency even during volatile conditions.

Macro Factors Driving Ethereum’s Outperformance

Ethereum’s rally isn’t only attributable to whale accumulation; of course, there are macroeconomic factors at play too.

At the recent Jackson Hole Symposium, U.S. Federal Reserve Chair Jerome Powell hinted there may be a rate hike in September, and this possibility sent ripples of hope across financial markets, including crypto, and we saw rates bounce back up.

Inflow data continues to point towards institutions switching their preference to Ethereum. As SoSoValue stated, BlackRock’s ETHA fund had net inflows of $233 million, while $127 million was withdrawn from its IBIT Bitcoin fund.

In total, Ethereum products have seen a combined net inflow of $12 billion, showing a substantial appetite and confidence of institutions in ETH as a core digital asset.

Rising Open Interest and Technical Strength

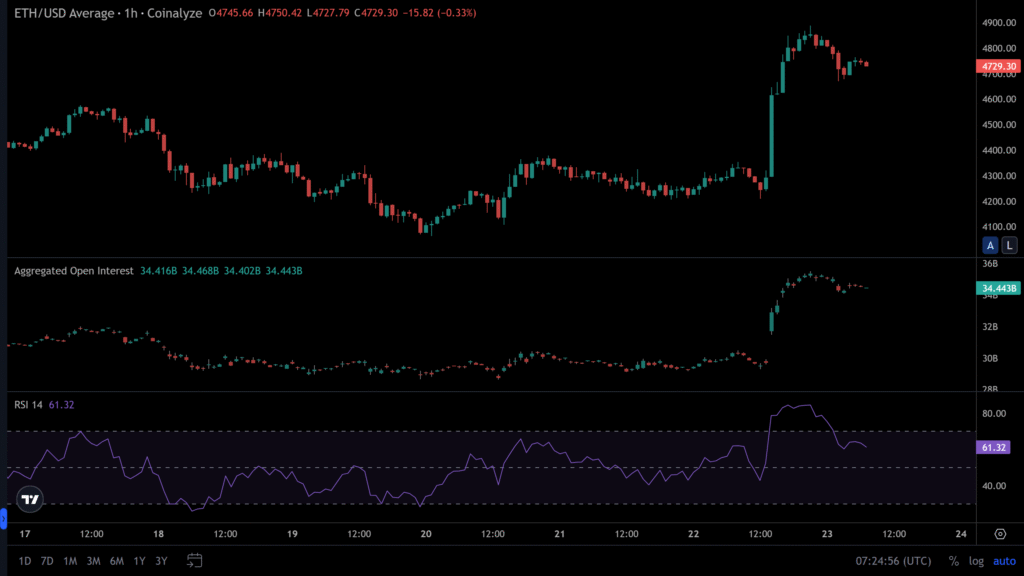

Ethereum’s bullish trend is being reinforced, according to market data, with a massive uptick in derivatives activity.

According to Coinalyze, the open interest in ETH derivatives is up 14.24% to $34.5 billion, indicating speculation and bullish confirmation by traders.

Furthermore, the Relative Strength Index (RSI) is at 61.32, which is still bullish momentum, but near the extreme bullish level and has not gone into overbought territory.

Combined with institutional accumulation, whale confidence, and macro tailwinds for bullish ETH, the technical picture still looks bullish in the short term.

With ETH at all-time highs, there are a lot of eyes on whether ETH has broken significantly past the $4,900 resistance and may even be targeting the big $5,000 resistance level.