A major Ethereum investor, often referred to as a whale, has faced a staggering loss of $6.62 million after selling 5,000 ETH on Binance.

According to data from Onchain Lens on X earlier today, just 15 days ago, the investor withdrew 10,000 ETH, valued at approximately $25.6 million, from the crypto exchange Deribit.

However, as Ethereum’s price continued to decline, the whale decided to liquidate half of their holdings, transferring 5,000 ETH worth around $9.46 million into Binance.

The significant loss highlights the volatility of the crypto market, where even large-scale investors struggle to navigate rapid price swings.

The decision to sell suggests concerns about further price drops, indicating a lack of confidence in Ethereum’s short-term recovery.

Ethereum Price Decline Drives Heavy Losses for Investors

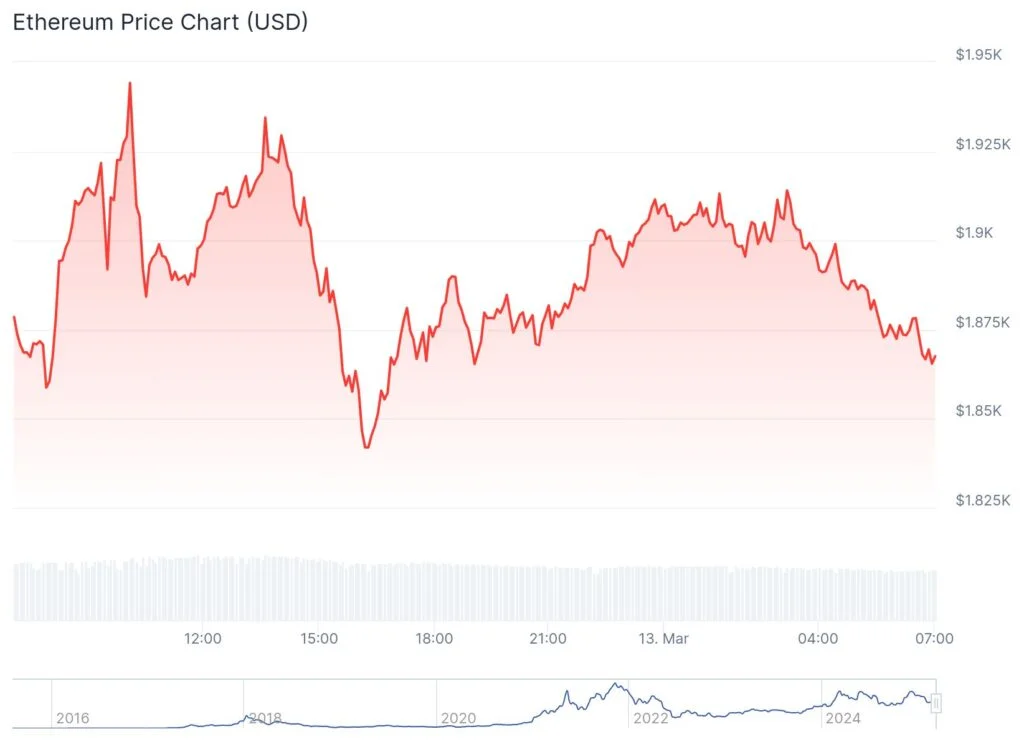

Ethereum’s ongoing price decline played a crucial role in the whale’s financial setback. At the time of the sale, ETH was trading at approximately $1,868.60, marking a 0.33% drop in the past 24 hours and a sharp 18.69% decline over the past week.

The dramatic decrease severely impacted the investor’s holdings, reducing the overall value of their Ethereum portfolio.

Despite a 24-hour trading volume exceeding $20.3 billion, persistent selling pressure continues to weigh down ETH’s price.

The broader bearish sentiment across the cryptocurrency market, fueled by macroeconomic concerns and Bitcoin’s dominance, has further exacerbated Ethereum’s struggles.

Whale Retains 5,000 ETH Amid Market Uncertainty

Despite suffering significant losses, the whale has chosen to hold onto their remaining 5,000 ETH, currently valued at approximately $9.51 million.

The decision suggests the investor may be hoping for a price rebound before making any further moves.

However, holding large amounts of cryptocurrency during a downtrend carries considerable risk, as continued price declines could further devalue their holdings.

If Ethereum stages a recovery, the investor could potentially regain some of their lost value. On the other hand, further market downturns could force additional sell-offs, compounding the losses already incurred.

Ethereum Faces Further Declines as Market Sentiment Worsens

Ethereum’s outlook remains uncertain, with its value against Bitcoin reaching its lowest level since mid-2020.

Prominent crypto trader and economist Alex Krüger suggested that investors should consider shifting funds into higher-performing altcoins, stating, “If still stuck on ETH, it is likely a good time to dump it to buy a higher beta altcoin.”

Additionally, another major crypto investor recently suffered a $2.2 million immediate loss after purchasing 15,292 ETH at $2,014 per token, only for Ethereum to drop more than 9% within 24 hours.

The ETH/BTC exchange rate has now fallen below 0.023 for the first time since December 2020, indicating that Ethereum is struggling compared to Bitcoin.

These factors suggest Ethereum may face further downward pressure in the near term.