After an extraordinary dormancy period of 9.4 years, an Ethereum initial coin offering (ICO) participant has shown signs of activity earlier today on December 27th, executing their first transaction since the platform’s launch.

The whale wallet, which originally received 1,940 ETH during Ethereum’s ICO in 2015, initiated a minimal transaction of 0.01 ETH to a new wallet address.

What makes this movement particularly noteworthy is the remarkable value appreciation of the holding – an initial investment of just $601 has transformed into an estimated $6.56 million, demonstrating the extraordinary returns possible for early cryptocurrency investors.

The awakening has captured significant attention within the cryptocurrency community, not just for its historical significance but also for the potential market implications of such a long-dormant wallet becoming active.

Recent Major Whale Movements

In parallel with this historic awakening, other significant Ethereum ICO whales have been notably active in recent weeks.

A particularly substantial movement came from an ICO participant who sold 40,000 ETH, approximately worth $101 million, over a two-week period.

The major holder in particular reduced their holdings from 139,500 ETH to 99,500 ETH, representing a significant liquidation of their position.

Additionally, another early investor executed a sale of 3,000 ETH, valued at $7.64 million, while maintaining a substantial position of 37,070 ETH (approximately $94.21 million).

These coordinated movements from multiple whale addresses have raised questions about potential market implications and the strategic thinking behind these decisions.

Also Read: Interchain Foundation Unloads 4,000 ETH Worth $9.5 Mln Raised During 2017 ICO

Market Impact and Current Conditions

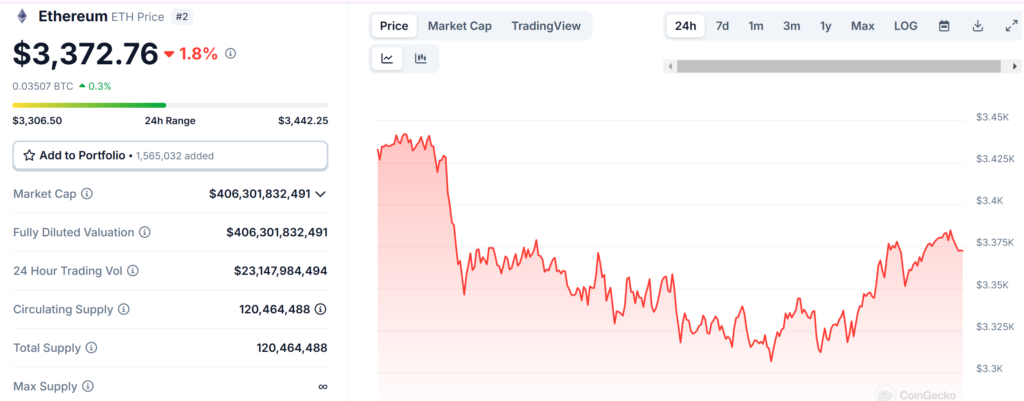

The confluence of these whale movements has coincided with notable market volatility. Ethereum’s current price stands at $3,372.00, with a substantial 24-hour trading volume of $23,147,984,494.

The market has shown signs of pressure, with a 1.78% decline in the last 24 hours and a 1.14% decrease over the past week.

The total market capitalization remains robust at $406,301,832,491, supported by a circulating supply of 120 Million ETH.

However, the previous week saw more dramatic movements, with ETH experiencing a significant drop from $2,650 to $2,365, representing a more than 10% decline amid these substantial sell-offs.

Strategic Implications and Future Outlook

The pattern of activity from these ICO-era whales provides valuable insights into potential market dynamics and long-term holder behavior.

While the awakening of the 9.4-year dormant wallet represents more of a symbolic movement given the minimal transaction size, the substantial sales from other whales suggest a strategic reduction rather than a complete market exit.

The behavior indicates a measured approach to position management by early investors, potentially influenced by current market conditions and future outlook.

The timing of these movements, particularly as Ethereum continues to evolve with major technical upgrades and ecosystem developments, raises important questions about long-term holder confidence and market sentiment.

The sustained holdings by these whales, even after significant sales, suggests a balanced approach between profit-taking and maintained exposure to Ethereum’s future potential.

Also Read: Ethereum Investor Dumps $84M ETH After 810x Profit, Still Holds $1B Worth