Joseph Lubin, co-founder of Ethereum and founder of Consensys, has advocated that Ether (ETH) could increase in value by 100 times as more Wall Street institutions adopt staking and decentralized finance (DeFi) infrastructure.

Lubin announced on X that all major financial institutions today will eventually move off the siloed technology systems that they currently heavily pay for and utilize Ethereum’s decentralized rails.

Lubin stated that Ethereum will replace a large portion of this fragmented infrastructure of Wall Street, which will create huge demand for ETH and send its valuation far above where it is today.

“ETH will likely 100x from here. Probably many more,” Lubin said.

Ethereum Seen as Wall Street’s Gateway to Decentralization

Lubin pointed out that for financial institutions to remain competitive, they will need to become what he called “TradFi companies on decentralized rails.”

Lubin outlined that this entails staking ETH, running validators, entering DeFi markets, hosting layer-2 scaling solutions, and creating smart contract applications on a variety of financial instruments.

His comments follow comments made by vanEck CEO Jan van Eck, who referred to Ethereum as “the Wall Street token” and warned that banks that continue not to use Ethereum for stablecoin transfers risk falling behind in the global financial race.

The Flippening Debate: Ethereum vs. Bitcoin

He reiterated his view that Ethereum could indeed flip Bitcoin and become the global base unit of digital monetary value, which has been hotly debated for a while now.

He said he was “100% aligned” with Fundstrat Global Advisors’ Tom Lee, who has also argued that Wall Street adoption will drive Ethereum’s network valuation above Bitcoin’s.

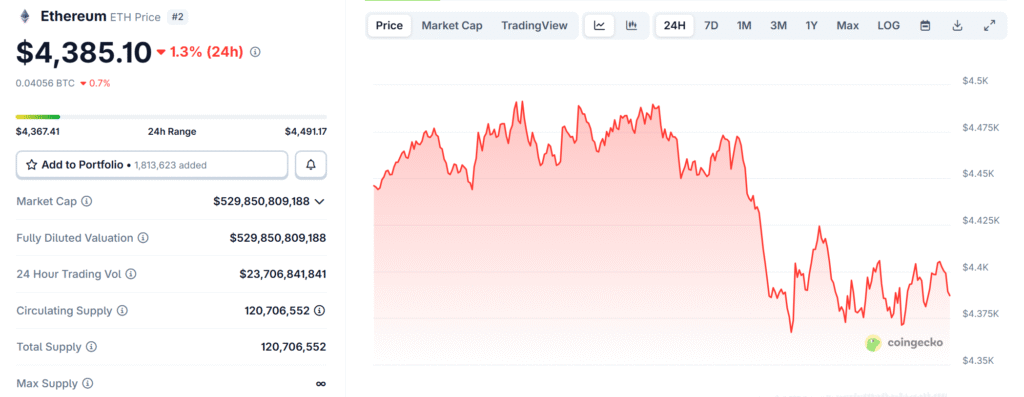

However, despite Lubin’s buoyant outlook, Ethereum’s current market cap is only about $530 billion, still only a quarter of bitcoin’s market cap.

That said, Ethereum’s market share has doubled since it was at 7% in April and is about 14.3% right now, according to TradingView, and it still demonstrates solid growth in its market position.

Ethereum as the “Highest Octane” Trust Commodity

Lubin has gone a step further, describing Ether not simply as cryptocurrency, but as a new form of virtual commodity.

“Trust is a new kind of virtual commodity. And ETH, the highest octane decentralized trust commodity, will eventually flippen all the other commodities on the planet,” he stated.

Given that ETH is the fastest decentralized trust commodity, it is eventually going to flip all the other commodities on the planet,” he stated.

Lubin said the decentralized economy, leveraged by Ethereum, supported by hybrid human-machine intelligence, will scale faster than anyone can wrap their minds around.

Institutional players appear to share Lubin’s audacity: Nassar Achkar, chief strategy officer at CoinW exchange, stated Lubin’s vision resonates with clients that are increasingly allocating treasury assets to ETH for its staking yields and tokenization.

Stablecoin Growth Highlights Ethereum’s Expanding Ecosystem

Ethereum’s growing role in global finance is illustrated by its exploding demand for stablecoins on the network.

The supply of stablecoins on Ethereum has recently crossed $160 billion, and the supply of stablecoins on Ethereum has made new all-time highs.

This explosion in demand signifies that Ethereum has clearly risen to be the main layer-1 settlement layer for stablecoins and tokenized assets.

While the recent run-up brought a sense of optimism, the ETH price has been experiencing resistance at $4500 as it dipped back to $4385.38 for a slight daily decline of -1.13%, and a -5.37% loss for the week.

Given a circulating supply of 120 million ETH, it puts Ether’s market cap at or around $530 billion, suggesting that Lubin’s 100x prediction could be a stretch, but it isn’t entirely out of the realm of possibility.