Ethena (ENA) experienced a sudden price surge on Monday, August 11, increasing by 9% to an intraday high of $0.85 before closing at approximately $0.79.

The surge equates to over 30% weekly increase and an outstanding 150% gain in the past 30 days.

ENA’s market capitalization stands at approximately $5.38 billion, courtesy of a circulating supply of 6.6 billion tokens.

Although the daily trading volume fell slightly, activity is still high, with over $1.69 billion worth of ENA having exchanged hands over the last 24 hours.

South Korea Becoming a Key Market Driver

Market watchers argue that a significant percentage of ENA’s price rally has been buoyed by retail investor demand from South Korea.

From an on-chain and market-tracking perspective, Korean investors have been “loading up” ENA, noted user Ponyo on X.

The trend is in line with a past investment pattern, where $443 million in net purchases of Circle Internet Group (CRCL), Korea’s most traded foreign stock, were made in June.

The move is also coherent within a larger movement within South Korean markets earlier today, where the monthly purchases of U.S. tech stocks hit a peak of $1.68 billion early in the year but crashed to $260 million in July.

Meanwhile, crypto-related stocks, which are among Korea’s 50 biggest net-bought overseas equities, have seen their share rise from 8.5% in January to 30% in mid-year, signaling a sharp turn toward digital asset exposure.

Also Read: Ethereum’s Market Cap Reaches $515.8B, Surpasses Netflix’s Cap, Briefly Crosses Mastercard

USDe Milestone Boosts Investor Confidence

Another force propelling ENA’s recent rally is the massive growth in USDe, Ethena’s synthetic stablecoin, which hit more than $10 billion in circulating supply recently.

This mark had been attained just 500 days from launch, making USDe one of the fastest-growing stablecoins in crypto history.

Such overgrowth of USDe has strengthened investor faith in the entire Ethena ecosystem since the performance of USDe directly contributes to the utility and perceived stability of ENA.

USDe’s growth is a sign of strong market adoption and affirms Ethena’s twin focus on decentralized finance (DeFi) utility and trailblazing collateral-backed stability protocols.

Also Read: Total Crypto Market Cap Reclaims the $4 Trillion Mark, What’s Happening?

Ethereum Breakout Injects More Fuel into ENA’s Momentum

The bullish Ethereum (ETH) price breakout has added another gigantic tailwind to ENA.

Ethereum surged more than 20% last week, blasting past the long-standing psychological barrier of $4,300 for the first time in months.

Given Ethena’s hedging strategies and collateral reserves are highly ETH-focused, this Ethereum run has assisted in inflating the value of its reserves, increasing market confidence in USDe’s backing.

By historical trends, ENA follows ETH closely so that a good performance of Ethereum is usually associated with ENA rallies.

By way of comparison, a lesser gain of 7% by Bitcoin over the same timeframe serves to underscore the large impact Ethereum holds over Ethereum-based projects, such as Ethena.

Also Read: Are ETH Treasuries Good? Ethereum Co-Founder Vitalik Says Yes, With A Stark Warning

Technical Analysis Indicators Possible Further Upswing

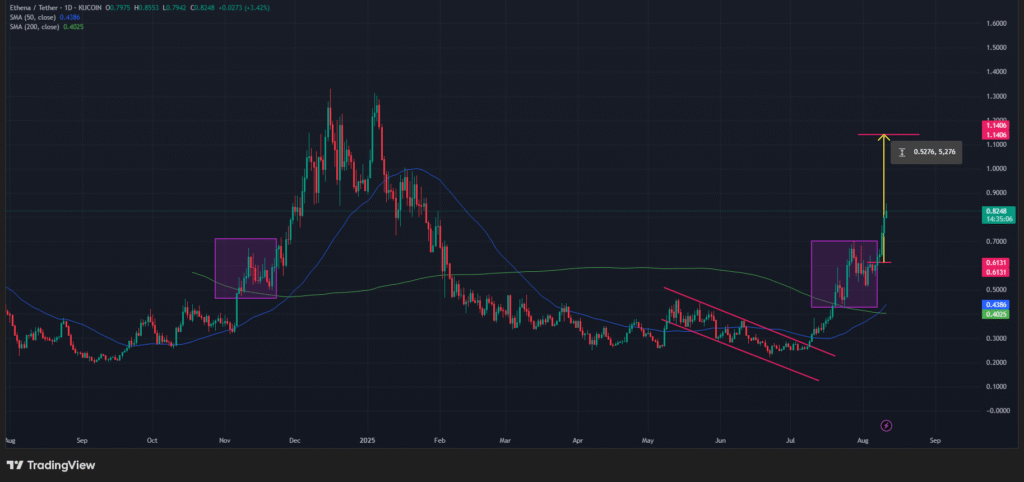

Technically, ENA broke out of a downtrend parallel channel at the start of July and has increased over 200% since then to the present price level.

Of particular note, the 50-day simple moving average (SMA) broke above the 200-day SMA, forming a bullish “golden cross” formation.

The company’s previous experience with this technical setup, in November, was an 87% rally to the December high of $1.33.

Momentum indicators strongly support the bullish case: the MACD line has indeed successfully crossed above the signal line, and the RSI remains firmly in overbought territory.

Such conditions could bring in a short-term pullback; however, with strong fundamentals, the overbought readings can last through the uptrend.

Outlook and Potential Price Targets

With strong South Korean buying on retail, Ethereum’s breakout, and the USDe milestone each a bullish catalyst, ENA’s short-term prospects look bright.

Price structure similar to November’s rally suggests the possibility of a repeat, driving ENA to a projected target of $1.14.

Analysts caution, though, that with such melodramatic increases, it is natural to expect any minor corrections or consolidations before the next upleg.

The key to sustaining momentum will be continued demand from Korean and global investors, along with the stability and acceptance of USDe.

If these fundamentals hold, ENA has a chance to be one of the best-performing cryptocurrencies in the next few weeks.