According to on-chain analysis, an Ethereum (ETH) whale has continued their short position on Bitcoin (BTC) in the past hour.

The whale borrowed an additional 200 WBTC (Wrapped BTC) from the Aave lending protocol and sold them on-chain in exchange for 20.9 million USDT.

This latest activity adds to the whale’s ongoing BTC shorting strategy. In total, the whale has now borrowed 420 WBTC from Aave and sold them at an average price of $103,402 per BTC.

However, this aggressive shorting position has resulted in an unrealized loss of approximately $750,000 for the whale, as the price of WBTC has increased over the past day.

Also Read: ICO-Era Ethereum Whale Dumps 3,000 ETH Worth $7.64M, Why Are Whales Dumping ETH?

Continued Bearish Sentiment Despite WBTC Price Increase

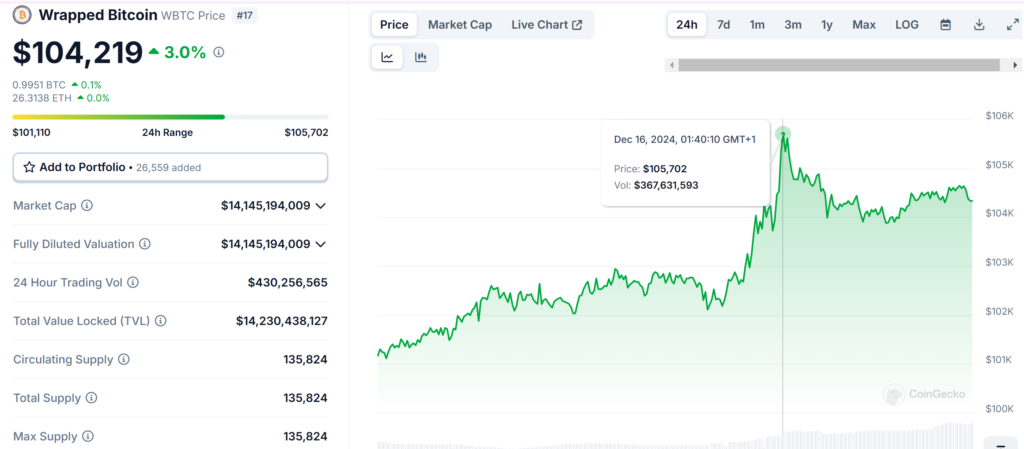

The price of Wrapped Bitcoin (WBTC) has indeed seen a 3.02% increase in the last 24 hours, trading at $104,219 with a 24-hour volume of $430,256,565.

Over the past 7 days, WBTC has appreciated by 5.04%. Despite this bullish price action, the ETH whale appears to be doubling down on their bearish BTC position, potentially hoping for a reversal in the near future.

Potential Risks and Implications

The whale’s strategy of repeatedly shorting BTC, even in the face of rising prices, suggests a high-risk, high-reward trading approach.

While the whale may be betting on a future BTC price decline, the current $750,000 unrealized loss demonstrates the potential pitfalls of such an aggressive short position.

The whale’s actions could also have broader implications for the cryptocurrency market, potentially exerting downward pressure on BTC prices if the short position is maintained or expanded.

Whale’s Trading History and Market Impact

This is not the first time the Ethereum whale has taken a short position on BTC. The whale has a history of active trading, with a record of 15 wins and 4 losses in their previous 19 trading rounds.

The whale’s exceptional market timing has allowed them to secure substantial profits in the past, including a $1.8 million gain in a single day.

However, the current short position and associated unrealized loss highlight the inherent risks and volatility of the cryptocurrency market.

Also Read: Ethereum Whale Sells Remaining 4,802 ETH For A $2.8M Profit