In a significant market event earlier today, prominent Ethereum trader James Fickel has concluded his year-long ETH/BTC exchange rate position with a substantial liquidation.

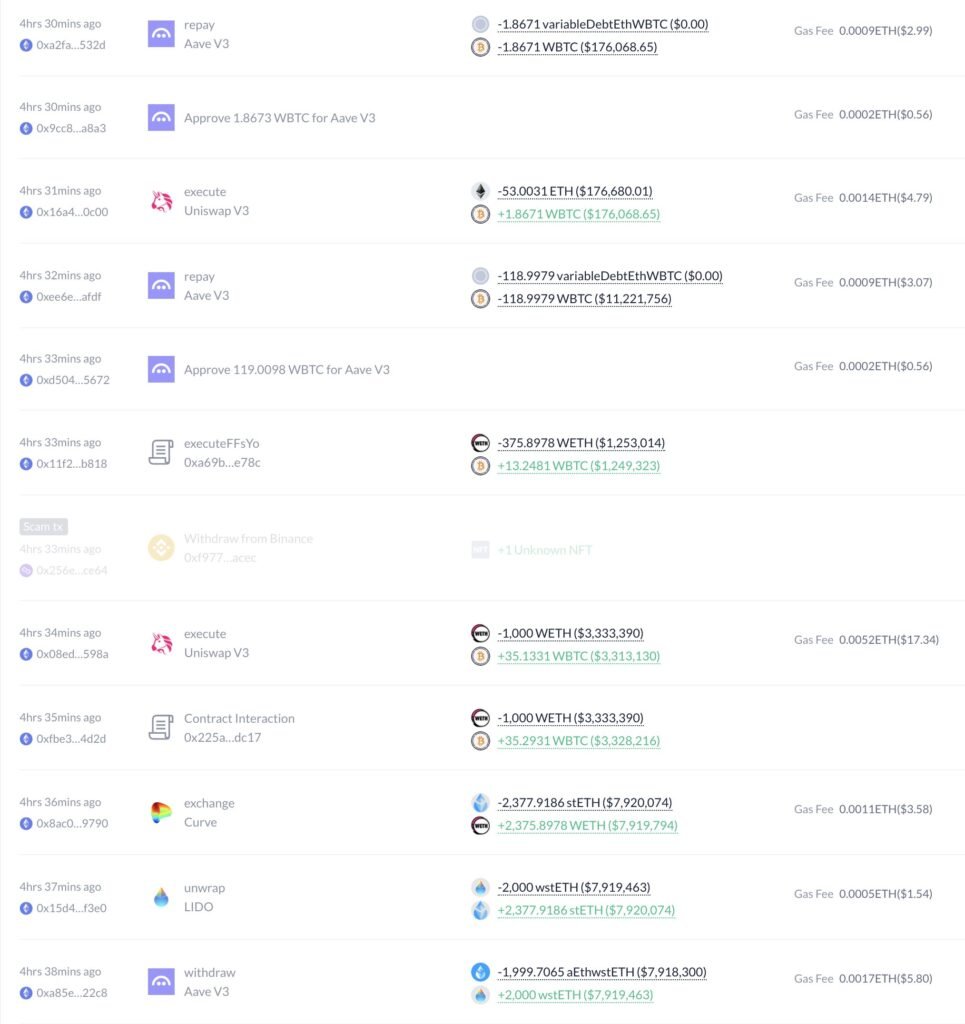

The final phase of this closure occurred when Fickel sold 6,429 ETH, valued at approximately $21.45 million, in exchange for 227 Wrapped Bitcoin (WBTC).

Trading Strategy and Position History

The comprehensive trading strategy employed by Fickel was both bold and complex, beginning in the first half of the year.

Lookonchain revealed that this transaction, executed approximately four hours ago, was specifically conducted to settle all outstanding WBTC loans, marking the definitive end of his long-running position in the ETH/BTC trading pair.

His initial position involved borrowing 2,987 WBTC through the Aave lending platform at an ETH/BTC exchange rate of 0.054.

The borrowed WBTC was subsequently sold for 55,315 ETH, effectively establishing a long position on the ETH/BTC exchange rate.

The strategy represented a significant directional bet on Ethereum’s value increasing relative to Bitcoin, utilizing substantial leverage through the Aave platform.

Also Read: Nexo Dumps 109,251 ETH Worth $405M Via Binance, ETH Price Dump Ahead?

Unwinding Process and Losses

The position’s unwinding began in August when market conditions necessitated action. Fickel was compelled to progressively sell ETH to repurchase WBTC for loan repayment.

The process resulted in the expenditure of 75,947 ETH to reacquire the 2,987 WBTC at a considerably less favorable exchange rate of 0.0393.

The substantial difference between the entry and exit rates led to the position’s devastating outcome – a total loss of 20,632 ETH, equivalent to approximately $68.84 million at current market values.

The sequence of events illustrates the significant risks inherent in leveraged cryptocurrency trading.

Current Market Context

This major trading loss occurs against the backdrop of current Ethereum market conditions. As of today, ETH is trading at $3,339.14, with a 24-hour trading volume of $23,072,850,212.

The cryptocurrency has shown recent weakness, registering a 1.22% decline in the past 24 hours and a 3.65% drop over the last week.

With a circulating supply of 120 Million ETH, the total market capitalization stands at $402,280,688,743.

The market context underscores the magnitude of Fickel’s trading loss, representing a significant portion of daily trading volume and highlighting the substantial risks associated with large-scale, leveraged cryptocurrency trading positions.

Also Read: Ethereum Layer-2 Ecosystem TVL Skyrockets to $51.58B As ETH Price Crosses $3,600