Eric Trump, son of U.S. President Donald Trump, made headlines on Friday after publicly celebrating a massive liquidation of Ethereum short positions.

Posting on the X platform, Eric Trump wrote, “It puts a smile on my face to see ETH shorts get smoked today. Stop betting against BTC and ETH – you will be run over.”

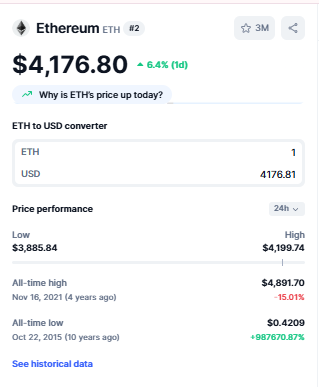

His comment came as Ethereum’s price surged to the $4,199.74 mark, triggering one of the largest short position wipeouts in the crypto market this year.

Trump’s remarks have sparked discussions in both political and cryptocurrency circles, with many noting the unusual intersection between presidential family members and the digital asset space.

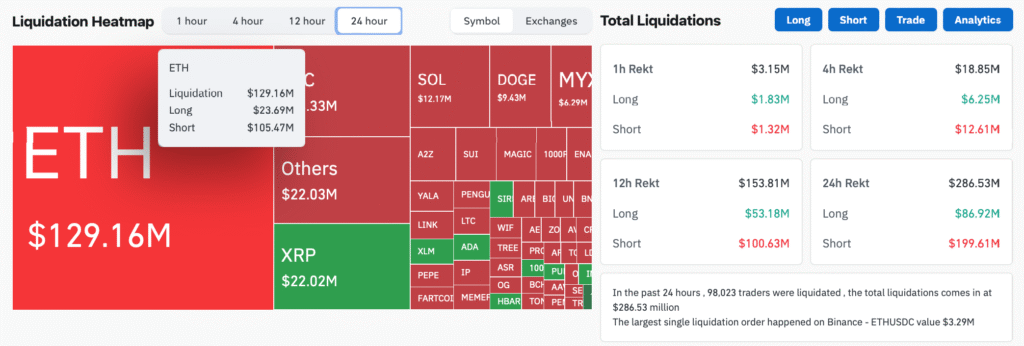

Ether Leads Market in Short Position Wipeouts

Data from CoinGlass revealed that Ethereum experienced the single largest short liquidation event in the market on Friday.

Earlier today, a report from Watcher Guru says the total is approximately $110 million in just 60 minutes.

The liquidation accounted for 53% of all shorts closed across the crypto market, which saw a combined $129.16 million in positions wiped out during the same period.

The surge in ETH price marked the first time the asset has traded above $4,100 since December 2024, signaling renewed bullish momentum after months of price consolidation.

Analysts say such a high percentage of market-wide liquidations concentrated in a single asset reflects an unusually aggressive shorting pattern against ETH that backfired sharply.

Also Read: ETH Whale Banks $220K Profit After Trading 12,178 ETH, Nets $7.19M Total Profit

Key Price Levels and Short Squeeze Opportunity

The $4,100 level has become the most crucial price level for Ethereum traders, with many of them viewing it as a strong point of resistance.

Leading crypto trader Ash Crypto highlighted that a breach above this level would risk an instant “short squeeze” that would propel ETH to $4,400-$4,500 in hours.

Short squeeze is a possible situation when traders betting on a price decline are forced to buy back assets, adding to the price momentum.

The rapid liquidation of shorts this week indicates that a squeeze may very well be underway.

However, observers have warned that for a sustained rally to come through, a continuation of the buying pressure must occur.

Ethereum’s Market Performance and Trading Activity

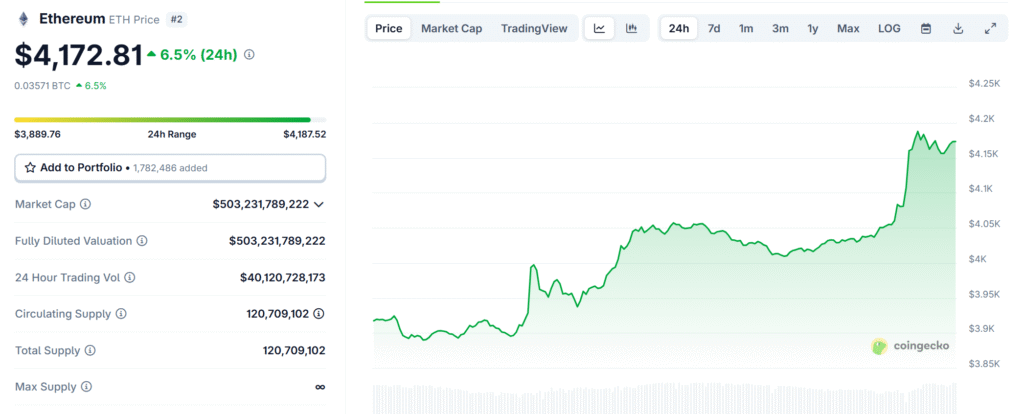

As of 9th August, Ethereum was trading at $4,172.82, up by 6.52% in the past 24 hours and 20.07% over the past week.

With a trading volume of $40.12 billion in 24 hours, the market activity around this recent price surge is highly intense.

The circulating supply of Ethereum is around 120 million ETH, and the market cap now stands at $503 billion.

With these parameters, Ethereum is firmly positioned in second place to Bitcoin in terms of overall market value, and renewed investor interest could likely be positioning it for a run at new multi-year highs.

Also Read: Crypto Market In Turmoil As Liquidations Cross $1.4 Billion Amid Inflation Fears & Bybit Hack