In a notable development for the EIGEN token, two new whale wallets, suspected to belong to the same entity, have made substantial purchases in the past 30 hours. These wallets collectively spent 2,471 ETH, equivalent to approximately $6.03 million, to acquire 1.63 million EIGEN tokens.

According to data from Lookonchain on X, the first wallet, identified as 0x45cE, invested 1,234 ETH ($3.01 million) to purchase 791,845 EIGEN at an average price of $3.8 per token.

The second wallet, 0x2425, spent a similar amount of 1,237 ETH ($3.02 million) to buy 835,391 EIGEN at a slightly lower price of $3.61 per token.

EIGEN Price Rally and Market Performance

The EIGEN token price has experienced a substantial increase. As of the latest data, EIGEN is trading at $4.06, marking a 12.19% increase in the last 24 hours and an even more impressive 13.55% gain over the past week. The token’s 24-hour trading volume has reached $574,220,469, indicating high market activity and interest.

With a circulating supply of 190 million EIGEN, the project’s market capitalization now stands at $756,510,193. This rally has positioned EIGEN as a notable performer in the cryptocurrency market, attracting attention from both retail and institutional investors.

Open Interest and Trading Activity

According to data from Coinalyze, the open interest in EIGEN tokens has been on an upward trajectory. The current open interest stands at $137.8 million, representing a significant 21.39% increase over the last 24 hours. This metric is crucial as it indicates the total number of outstanding derivative contracts that have not been settled.

The rising open interest suggests an influx of new money into the market and potentially increased trading activity. This growth in open interest, coupled with the price rally, could be interpreted as a bullish signal, indicating that traders are opening new positions in anticipation of further price appreciation.

Technical Indicator Analysis and Future Speculation

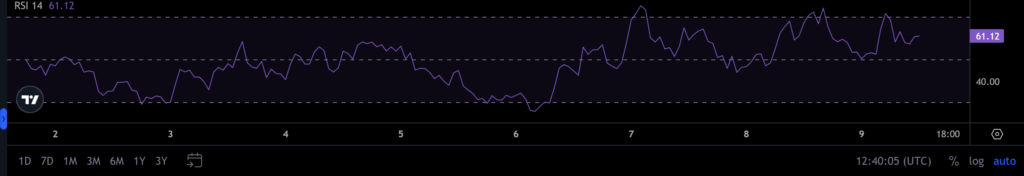

The Relative Strength Indicator (RSI) for the EIGEN token provides additional insights into its market momentum. Currently, the RSI is positioned at 61.12, having fluctuated between the 50 and 100 zones recently. This placement in the upper half of the RSI range suggests moderate to strong buying pressure.

Traders and analysts are closely watching for a potential breach of higher RSI levels, particularly if it approaches or crosses the 70 mark, which could signal overbought conditions.

If EIGEN’s RSI continues its upward trajectory, it could indicate sustained bullish momentum and potentially lead to further price increases. However, investors should remain cautious, as rapid price increases can also lead to short-term corrections.