A strategic cryptocurrency investor, identified by wallet address 0x2BE…d40CC, has made waves in the crypto community after securing a $298,000 profit through a calculated investment in the $AUCTION IPO.

The investor took a bold stance by committing $810,000 to acquire 71,517 $AUCTION tokens, making them the top participant in the token’s fundraising event.

The move highlights the substantial profit potential in auction-based crypto investments when executed with precise market timing.

While the investor successfully capitalized on an early-stage opportunity, the market’s continued rally suggests they may have left even larger gains on the table.

Strategic Execution and High Return on Investment

The investor’s trading strategy was executed with remarkable precision, leading to a 1,335% return on investment.

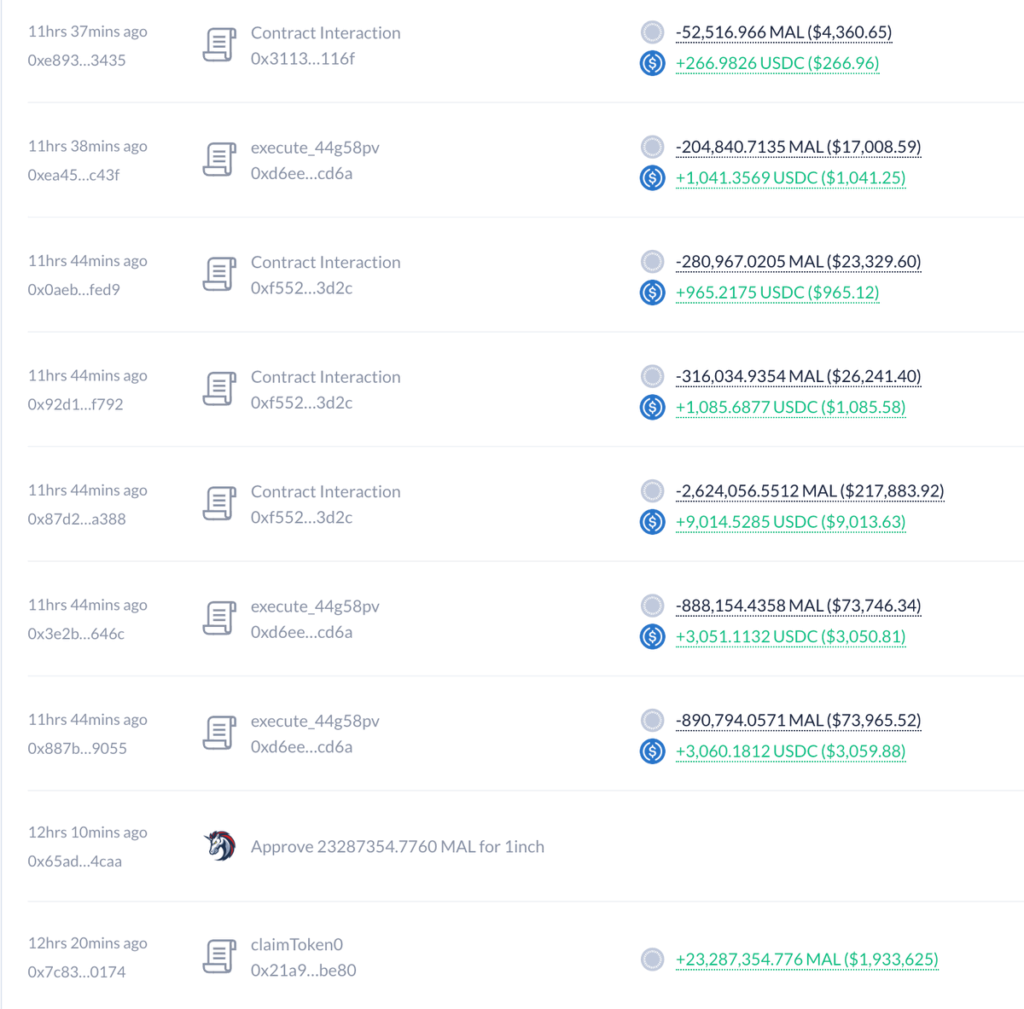

By using 1,963 $AUCTION tokens, they were able to subscribe for 23.28 million new tokens, which were later sold in multiple batches at an average price of $0.01377.

The strategy ensured not only a substantial profit but also maintained market liquidity.

The investor’s ability to capitalize on auction-based trading mechanisms demonstrates how well-informed traders can navigate token sales to maximize returns.

Such strategies, when coupled with strong market awareness, can yield significant profits before external factors like volatility impact the asset’s value.

The Fine Line Between Gains and Missed Opportunities

Despite the investor’s success, they narrowly missed an opportunity for even larger gains.

Had they held onto their $AUCTION tokens at the current market price, their holdings would now be valued at $1.32 million, effectively doubling their profits.

However, given the unpredictable nature of cryptocurrency markets, securing profits at the right time remains a priority for risk-averse traders.

The case echoes broader market movements, such as the unexpected rebranding of $MAL to $Broccoli, which surprised many investors and highlighted the volatile nature of crypto assets.

Timing the market remains a challenge, as the difference between a strategic exit and a missed opportunity can be substantial.

A Growing Trend Among On-Chain Traders

This event reflects a broader trend of high-stakes crypto investments, where traders leverage market momentum to generate massive returns.

In a similar instance, a whale investor reinvested $1.82 million in $TRUMP after earning $2 million in profits, following the token’s listing on Upbit.

Meanwhile, another investor currently holds $14.84 million in AI16Z and ARC tokens, sitting on $4.38 million in unrealized gains as AI16Z surged 52.75% and ARC skyrocketed 93.31% in a week.

However, crypto trading is not without risks—one trader who made $2.9 million in profit from $TRUMP suffered a $1.8 million loss on $CAR, which plummeted 96% in just 24 hours.

These cases underscore both the high-reward potential and the extreme volatility that defines the cryptocurrency investment landscape, where even the most successful traders must remain vigilant against unexpected market shifts.