An astute cryptocurrency investor has achieved an extraordinary return on investment through early participation in the GAME token market, generating profits of $6.42 million from an initial investment of just $9,600, representing a staggering 66,776% return rate.

The investor, identified by the wallet address 0xBD4…c87E1, executed a strategic accumulation of 47.9 million tokens between October 16 and October 19, with a remarkably low entry price of $0.0001943 per token.

The investor’s calculated approach included selling 50% of their position during the market’s upward trend, securing $624,000 in realized profits, while maintaining 24 million GAME tokens with an unrealized profit of $5.6 million.

Current Market Status and Token Performance

GAME token, operating within the Base network Virtuals ecosystem as a Memecoin, has demonstrated strong market performance.

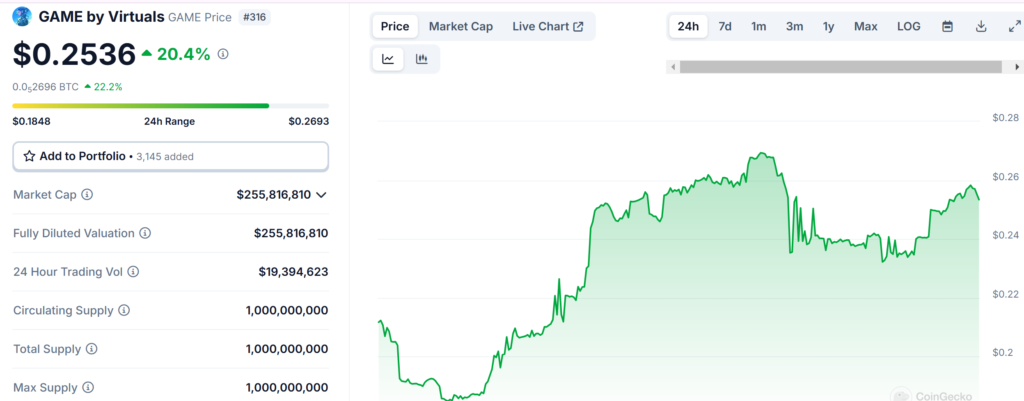

Currently trading at $0.2536, the token has experienced significant positive momentum with a 20.41% price increase over the last 24 hours and a 160.46% gain over the past week.

The token’s market metrics show a circulating supply of 1 Billion GAME tokens, resulting in a market capitalization of $255,816,810.

AI Meme Sector Growth and Market Impact

The success of this investment highlights the growing popularity and potential of AI Meme tokens in the cryptocurrency market.

The timing of the investment coincided with increasing market interest in this sector, demonstrating how early positioning in emerging cryptocurrency niches can lead to substantial returns.

The investor’s strategy of partial profit-taking while maintaining a significant position suggests confidence in the token’s long-term potential, even after securing substantial initial returns.

Industry Context and Parallel Success Stories

This remarkable investment success story aligns with other significant cryptocurrency investment victories in the broader market.

Notable parallel cases include a PENDLE early investor who transformed $46,000 into $1.7 million over a 2.5-year holding period, culminating in the sale of 312,500 tokens, though this led to a 17.5% price correction with trading volumes exceeding $208 million in 24 hours.

Similarly, an AAVE investor has accumulated 9,702 AAVE tokens using GHO and WBTC as part of a $17.8 million investment strategy, currently holding unrealized profits of $15.3 million.

These cases collectively demonstrate the potential for substantial returns in strategic cryptocurrency investing, while also highlighting the importance of early market entry and patient capital deployment.