A previously inactive cryptocurrency whale has made waves in the market by depositing $83.51 million worth of MANTRA ($OM) tokens into Binance after a year of dormancy.

Accoding to data from Onchain Lens earlier today, the whale with the address 0xE1A2…E1013 offloaded 11.3 million $OM, capitalizing on a massive profit of $107.25 million from its long-term holdings.

The unexpected market movement was detected just an hour ago, sparking discussions about its impact on $OM’s price and market sentiment.

The transaction underscores the influence that large holders, or “whales,” can have on token valuations, as traders analyze potential ripple effects on $OM’s liquidity and price action.

Whale’s Accumulation Strategy and Remaining Holdings

Before this significant sell-off, the whale had accumulated 15 million $OM, initially purchased for just $3.21 million from Binance.

Despite liquidating a substantial portion, the whale still retains 3.7 million $OM, valued at approximately $26.96 million.

Blockchain analysts have been closely tracking the wallet, identified as 0xE1A2…E1013, as its trading patterns could influence future price movements.

With such a large amount still held, market watchers remain cautious, anticipating whether the whale will continue selling or hold onto the remaining tokens for future appreciation.

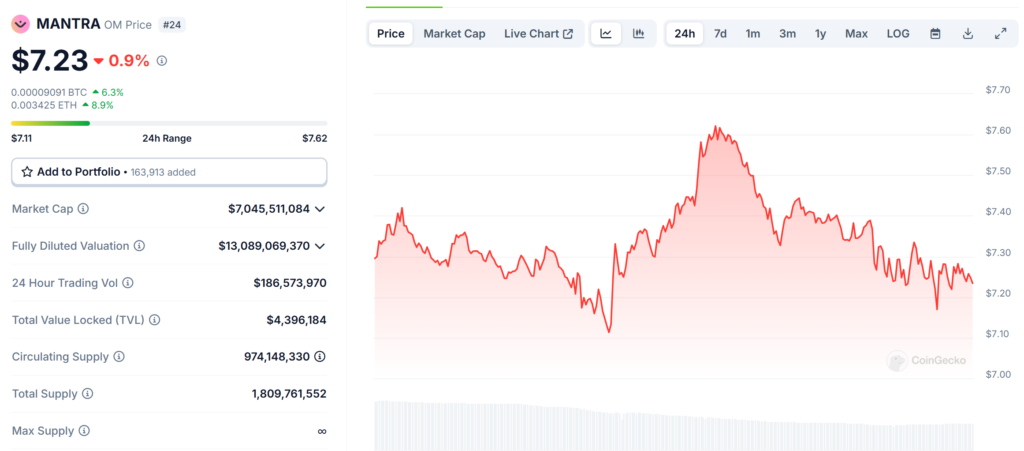

MANTRA ($OM) Price Declines Amid Market Uncertainty

Following the whale’s massive deposit into Binance, MANTRA ($OM) has seen a slight downturn, currently trading at $7.22.

The token has dropped by 0.98% in the last 24 hours and 7.33% over the past week. While the sell-off has not triggered extreme volatility, the bearish sentiment has raised concerns among investors about further declines.

With a circulating supply of 970 million $OM and a market capitalization of approximately $7.04 billion, traders are monitoring whether increased selling pressure from whales could lead to a broader correction.

Despite the decline, $OM’s trading volume remains robust, indicating continued investor interest despite short-term market uncertainty.

Broader Market Sell-Offs Highlight Whale Influence Across Tokens

The $OM whale’s transaction is part of a broader trend of major crypto investors offloading their holdings for significant profits.

A top TRUMP token trader recently liquidated $7.53 million in assets after securing $6.03 million in gains, with potential profits reaching $13.56 million if remaining holdings are sold.

Similarly, a Solana investor offloaded 96,155 SOL, earning $4.5 million after a year-long stake, which contributed to a 13.92% price drop in SOL.

Meanwhile, a meme coin trader suffered a $3.46 million loss despite initially making $39.15 million in profits.

These events highlight the volatile nature of the crypto market, where whale movements can trigger both gains and losses, influencing price trends and investor sentiment across multiple assets.