A long-dormant Bitcoin wallet, believed to be part of the “Satoshi-era” cohort, has reawakened after more than 14 years of inactivity.

The whale transferred and sold a staggering 40,000 BTC, worth approximately $4.7 billion.

The enormous cache was originally acquired in 2011 when Bitcoin was trading for around $2 to $4 per coin, meaning the original investment totaled just over $200,000.

Blockchain data confirms that this holder had not made any moves since that time, making the transaction one of the most significant wallet reactivations in Bitcoin history.

The sale was made through Galaxy Digital, a well-known institutional crypto investment firm, suggesting the transaction was handled over-the-counter to avoid immediate market impact.

Bitcoin Price Dips After Whale Movement, Analysts Signal Caution

The transfer coincided with a dip in Bitcoin’s price, falling from a new all-time high of $123,000 to around $116,700.

The drop occurred shortly after approximately 17,000 BTC, worth over $2 billion, was moved to Galaxy Digital.

The timing has raised concerns among analysts that whales could be preparing to unload assets while retail traders are still buying into the rally.

Analysts from CryptoQuant and others warn that while new highs excite the market, the actions of long-term holders and institutions often foreshadow a shift in market direction.

These reactivations, especially of decade-old wallets, are often interpreted as profit-taking signals rather than casual moves.

Also Read: Dormant Ethereum Whale Cashes Out $38M After 8 Years Of Dormancy

80,000 BTC Shifted from Dormant Wallets, Some Sent to Exchanges

Blockchain analytics firm Spot On Chain flagged that a total of 80,000 BTC, valued at roughly $8.68 billion, was moved from eight wallets that had remained untouched since 2011.

Some of these wallets originally received Bitcoin in April and May of that year, when the asset was worth under $4.

The activity marks the first movement of these funds in over a decade.

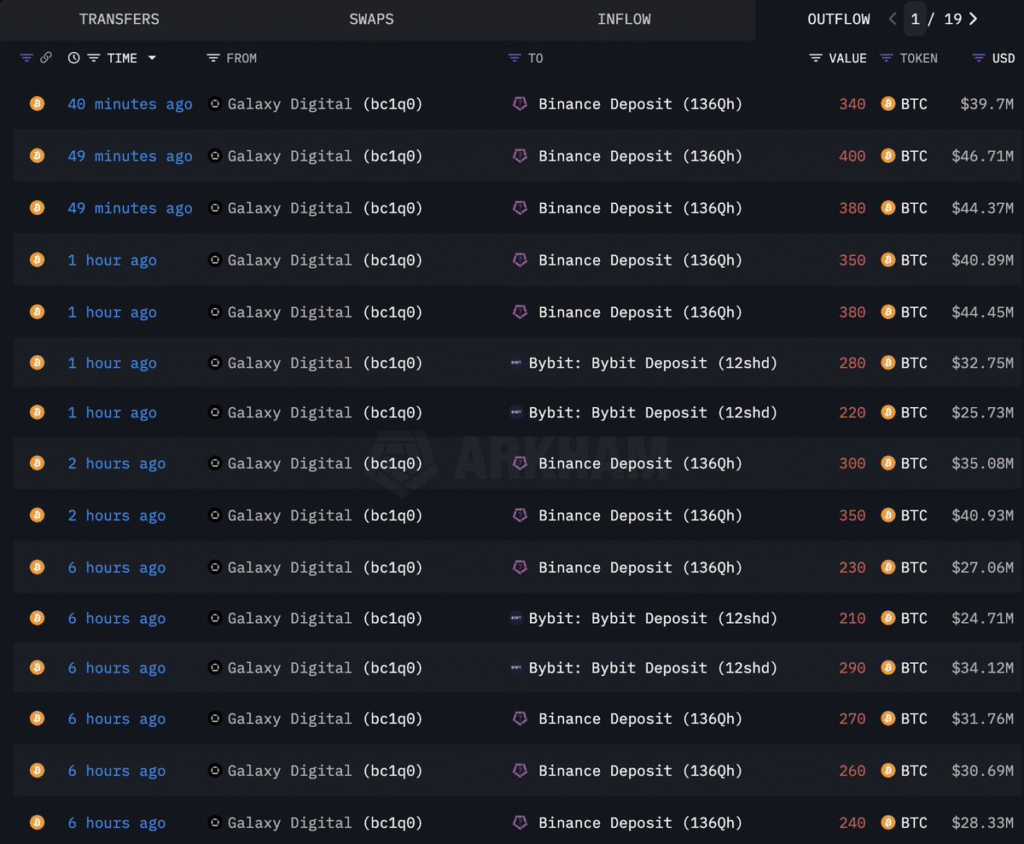

Galaxy Digital appears to be the main recipient of a large portion of these coins, having received at least 16,843 BTC valued at over $2 billion.

Notably, 2,000 BTC (~$236 million) has been deposited directly to exchanges like Binance and Bybit, which suggests that a portion of the holdings may soon enter open markets.

Also Read: Dormant Ethereum Investor Holding 400k ETH Dumps $224M Worth of Tokens, Price Impact Ahead?

Market Eyes Whale Behavior Amid Retail Frenzy and Institutional Growth

Bitcoin’s rally to a new all-time high of $123,000 has been largely fueled by increased demand from institutions, ETF inflows, and strong on-chain activity.

BlackRock’s IBIT fund now holds over 700,000 BTC, and long-term holders have increased their accumulation by over 71% in the last 30 days.

Still, while retail interest grows, the movements of long-term whales indicate a shift in sentiment.

Some analysts interpret the whale’s decision to sell now as a sign that even seasoned investors are positioning ahead of anticipated volatility.

These moves, regardless of whether they are part of private deals or sales, have a psychological impact on the broader market and could dampen bullish momentum if repeated by other whales.

Historical Context and Implications for Future Whale Activity

The reactivation of dormant wallets, especially those with coins acquired or mined during Bitcoin’s earliest days, is a rare event, and it often carries significant implications.

The wallet involved in this case still holds about 80,000 BTC after the selling of 40,000 BTC off his 120K BTC stash, leaving open the possibility for further sales.

While some speculate these movements could be tied to compromised private keys or inheritance events, others believe they reflect strategic profit-taking.

Also, another transfer of 612 BTC sale worth $57.6 million was done, which supports the idea that early holders are beginning to cash in.

The market’s maturity has allowed prices to remain relatively stable despite these sales, but traders are now on high alert for the next major move.

Also Read: Ethereum Investor Offloads $2.93M After 2-Months Of Dormancy While Facing $5.34M Unrealized Loss