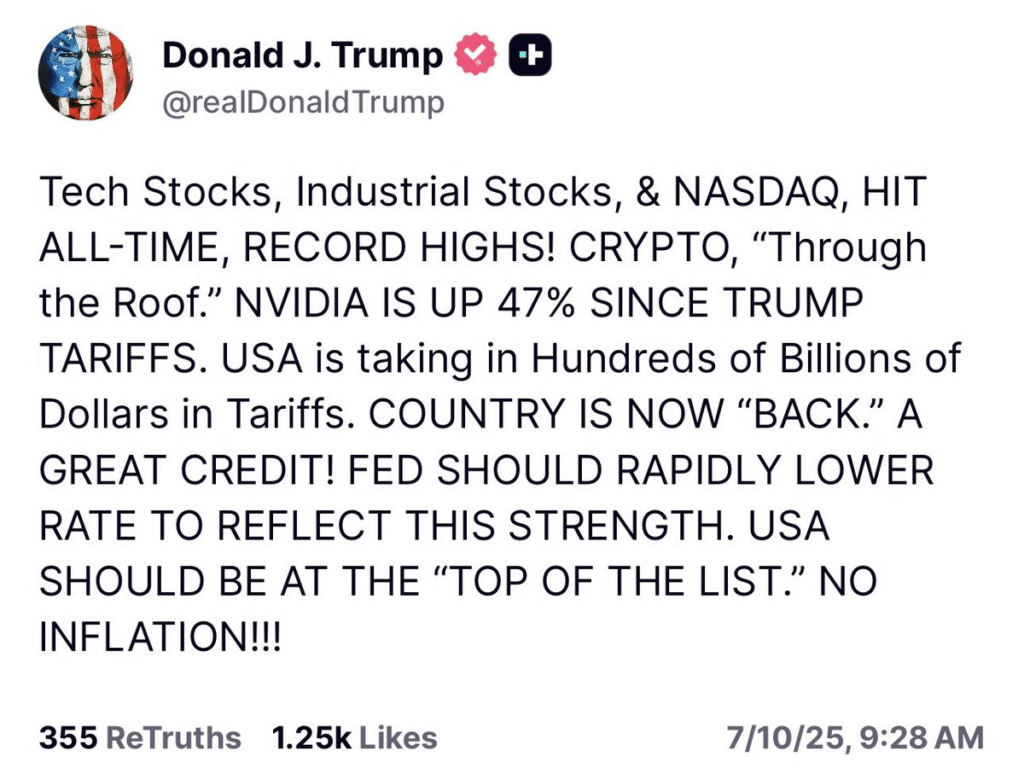

Former U.S. President Donald Trump has made bold remarks on social media amid a historic rally in Bitcoin and other digital assets.

Posting on Truth Social, Trump highlighted that “Crypto [is] through the roof,” while celebrating record-breaking performance in tech stocks, industrial sectors, and the NASDAQ.

He also pointed out that NVIDIA’s stock is up 47% since the imposition of his administration’s tariffs.

Trump credited strong U.S. economic performance to tariffs and trade strength, urging the Federal Reserve to cut interest rates rapidly, arguing there’s no inflation and that the U.S. should be “at the top of the list.”

His statement aligns with the crypto market’s recent momentum, especially Bitcoin’s ascent to a new all-time high, reflecting renewed optimism in the digital asset space.

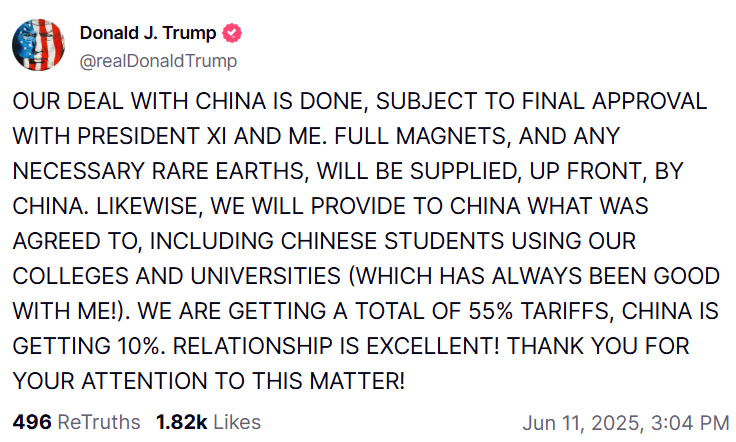

US-China Trade Agreement Finalized, Boosting Market Confidence

The crypto rally comes amid confirmation from Trump that the long-anticipated trade deal between the United States and China is finalized, pending final approval between him and Chinese President Xi Jinping.

The deal reportedly includes the U.S. securing a 55% tariff advantage, while China receives 10%, alongside agreements on rare earth supply and student visas.

Trump emphasized a restored “excellent” relationship between the two nations.

The announcement alleviates long-standing trade tensions, especially over critical materials like magnets and rare earths, which are vital to tech manufacturing.

Analysts note, however, that despite this announcement, clear policy implementation remains vague. Wall Street responded cautiously, with minor dips in futures trading after the news broke.

Also Read: ARK Invest Ups Bitcoin Price Projection For 2030 to $2.4M, Citing Institutional Adoption

Bitcoin Surges Amid Corporate Accumulation and Institutional Endorsement

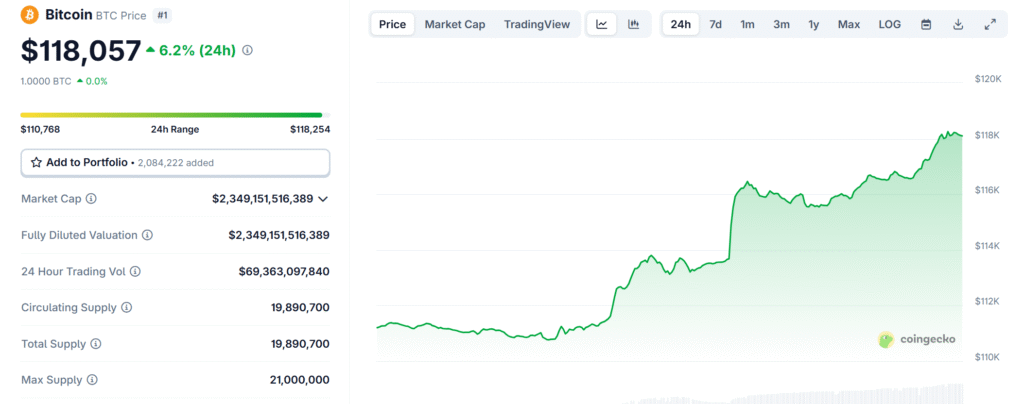

Bitcoin’s price rose to a record-breaking $118,057, reflecting a 6.2% increase in the last 24 hours and 8.02% over the past week.

With a market capitalization now surpassing $2.34 trillion, Bitcoin’s momentum is being fueled not just by macroeconomic optimism but also by aggressive corporate accumulation.

Notably, UK-based The Smarter Web Company has increased its holdings to 1,000 BTC, with its CEO Andrew Webley encouraging other UK firms to adopt Bitcoin as a treasury reserve.

U.S.-based tech firms have similarly begun shifting portions of their cash reserves into BTC, indicating a growing trend of institutional confidence.

These moves suggest that Bitcoin is being increasingly perceived as a viable hedge and long-term store of value amid global market shifts.

Also Read: Exclusive: Bitcoin Prices Might Not Hit $200K-$250K In 2025 Despite Bull Run, Says Analyst

Michael Saylor and U.S. Political Backing Add to Bullish Sentiment

Michael Saylor, Executive Chairman of Strategy, added fuel to Bitcoin’s rally by publicly asserting that “winter is not coming back,” referencing the previous bearish market cycle.

In a Bloomberg interview, Saylor projected that Bitcoin could eventually reach $1 million, praising the current U.S. administration’s support for digital assets.

He named several influential figures, including Scott Bessent and Paul Atkins, as vocal Bitcoin advocates.

Saylor’s bullish outlook reinforces institutional confidence and signals that the most volatile phase of Bitcoin’s development may be over.

The growing support from both political and financial leaders may drive further adoption and legitimacy of cryptocurrencies across global markets.

Also Read: ARK Invest Ups Bitcoin Price Projection For 2030 to $2.4M, Citing Institutional Adoption

Market Dynamics Point to Continued Momentum for Bitcoin

Bitcoin’s recent climb is not occurring in isolation. It is part of a broader trend where geopolitical resolutions, corporate buy-ins, and regulatory clarity are converging to form a fertile environment for digital assets.

While Trump’s assertive rhetoric and the finalized US-China trade deal are boosting investor sentiment.

The underlying momentum is also being driven by increasing on-chain activity, growing public trust in decentralized finance, and the reduced fear of regulatory crackdowns.

With 20 million BTC in circulation and daily volumes crossing $66 billion, Bitcoin is operating at an unprecedented scale.

Should this trajectory continue, digital assets may soon become a dominant pillar in both traditional and decentralized finance systems globally.

Also Read: Blockstream CEO Adam Back Pledges To Buy All 21M BTC If Bitcoin Price Crashes To Nearly Zero