DDC Enterprise Ltd., a publicly listed company on the NYSE American exchange, has announced a groundbreaking $100 million strategic alliance.

The alliance comes in partnership with Animoca Brands to advance its Bitcoin-focused treasury strategy.

The announcement, released through a joint press statement, confirms that both companies have signed a non-binding memorandum of understanding (MoU).

Under this MoU, DDC will help develop and implement strategies that allow Animoca Brands to optimize yields from its Bitcoin holdings.

The move reflects the growing institutional adoption of Bitcoin as a core treasury asset and marks a significant milestone in DDC’s ongoing commitment to digital asset innovation.

DDC Share Price Surges Over 20% on Strategic Move

Following the news, DDC’s stock surged more than 20%, rising by $2.24 to $13.00 on the day of the announcement.

Investors welcomed the company’s aggressive push into Bitcoin strategy and its partnership with Animoca Brands, widely recognized for its pioneering work in the Web3 and digital asset space.

The sharp rise in DDC’s share price suggests strong market confidence in the firm’s ability to leverage Bitcoin as a modern treasury asset.

Also, it reflects growing investor interest in companies strategically aligning themselves with blockchain and cryptocurrency innovation.

Yat Siu Joins DDC’s Bitcoin Visionary Council

As part of the collaboration, DDC has recruited Animoca Brands co-founder and executive chairman Yat Siu to join its newly established Bitcoin Visionary Council.

The advisory body is designed to guide DDC’s expanding Bitcoin ecosystem and treasury efforts.

DDC CEO Norma Chu highlighted the significance of Yat Siu’s appointment, stating that his industry experience and network will enhance the company’s strategic direction.

“Together, we’re committed to innovation, disciplined risk management, and unlocking Bitcoin’s full potential as a modern treasury asset,” Chu said.

Siu’s addition not only strengthens the alliance but signals DDC’s intention to play a leading role in shaping Bitcoin-centric corporate treasury models.

Also Read: SharpLink Gaming Increases Ethereum Holdings with Additional $2 Million Stake

DDC Joins Wave of Companies Embracing Bitcoin Reserves

DDC’s strategic alignment with Bitcoin mirrors the moves of other publicly traded firms that have recently adopted aggressive accumulation strategies.

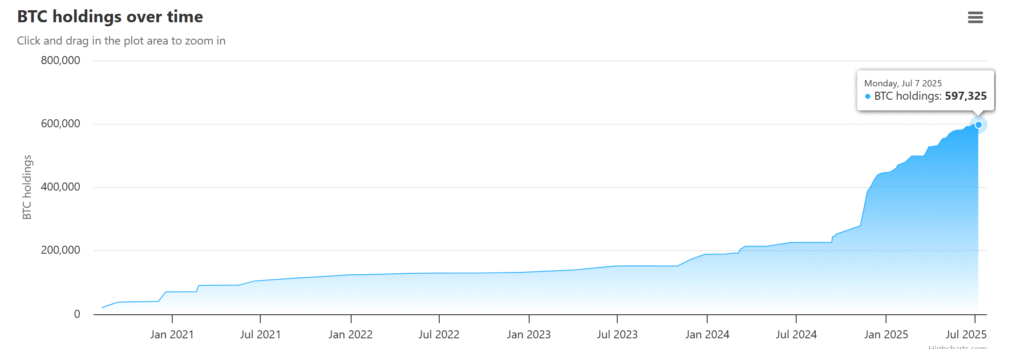

Inspired by companies like Strategy (formerly MicroStrategy), which now holds over 597,325 BTC valued at $70 billion as of July 2025, DDC is positioning itself as a serious contender in the space.

The company’s adoption of Bitcoin as a core reserve asset aligns with broader trends, where corporate Bitcoin holdings swelled by 131,000 BTC in Q2 2025, an 18% increase from the previous quarter.

By joining forces with Animoca Brands and tapping industry leaders like Yat Siu, DDC aims to replicate similar success while contributing to the maturing landscape of institutional Bitcoin integration.

Institutional Bitcoin Adoption Reaches New Heights

The DDC-Animoca Brands alliance emerges at a time when institutional Bitcoin adoption is accelerating at an unprecedented pace.

Public companies now collectively hold over 847,000 BTC on their balance sheets, and the second quarter of 2025 saw spot Bitcoin exchange-traded funds (ETFs) grow by 8%, adding another 111,000 BTC to institutional portfolios.

These developments have helped push Bitcoin’s price above the $118,000 mark, its highest on record.

The momentum behind Bitcoin’s growing use as a treasury reserve asset suggests a paradigm shift in corporate finance, one where digital assets are becoming a staple in long-term strategic planning.

With its latest alliance, DDC is firmly planting its flag in this evolving financial frontier.