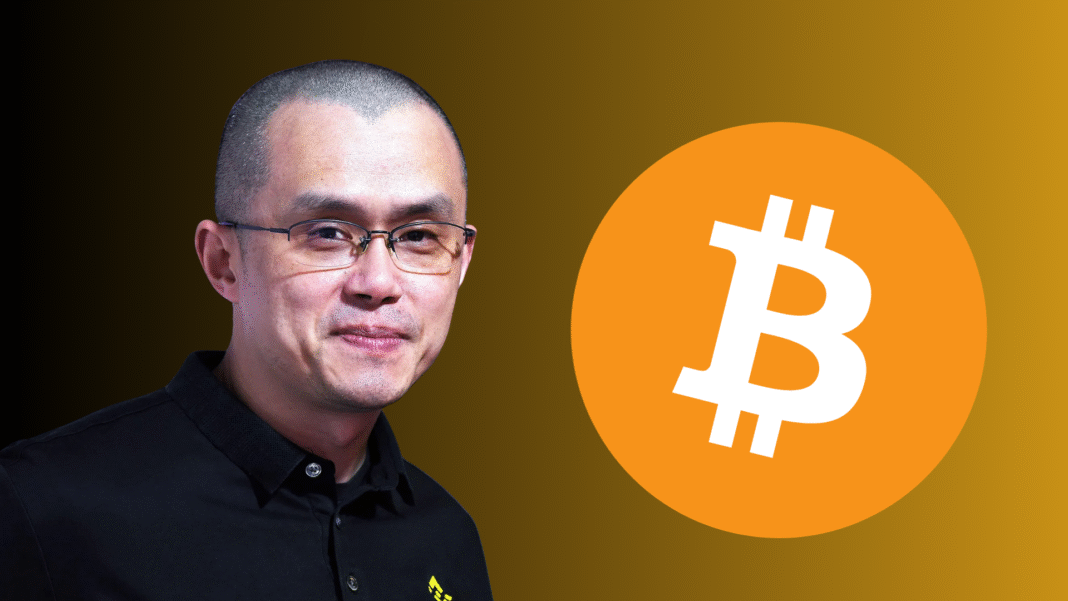

Changpeng Zhao, widely known as CZ and the former CEO of Binance, has shared a sobering message with the cryptocurrency community amid ongoing market turbulence.

In a post on X (formerly Twitter), CZ emphasized the importance of robust risk management in the volatile world of digital assets.

His key message to investors was stark but clear: “If your crypto goes to zero, can you survive?”

The rhetorical question serves as a reminder for both seasoned and new investors to evaluate their financial resilience and make emotionally and strategically sound decisions in the crypto space.

CZ’s Three Pillars of Crypto Risk Management

To guide investors through the instability that often defines the crypto market, CZ outlined three crucial principles for managing investment risk.

First, he advised investors to assess the worst-case scenario and ask themselves whether they could still sustain their current lifestyle if their entire crypto portfolio were wiped out.

Second, he urged people to reflect on how many failures they can endure, emphasizing the importance of psychological and financial endurance in a market known for rapid fluctuations.

Third, he encouraged investors to deeply understand their investments before participating.

According to CZ, lack of understanding is a major risk factor, and education should come before action in the world of digital finance.

The Context: A Broader Message About Risk in and out of Crypto

CZ’s latest comments come on the heels of an earlier post in which he stated: “Investing in crypto is risky. Not investing in crypto is also risky.” This broader message highlights the dual nature of risk in today’s financial landscape.

While crypto assets can fluctuate wildly, avoiding them altogether might also mean missing out on technological innovation and potential financial opportunities.

CZ’s framing pushes investors to think beyond the binary of investment versus non-investment and instead to adopt a thoughtful, informed approach that balances risk and reward.

A Call for Emotional Preparedness and Financial Literacy

CZ’s remarks are not just technical advice, they reflect a broader philosophy of emotional and financial preparedness.

The psychological pressure of market dips, especially those that result in significant financial losses, can be overwhelming.

By encouraging investors to reflect on how many attempts they can survive, CZ brings attention to the importance of resilience, both mentally and materially.

He advocates for a mindset that is prepared for setbacks, recognizing that survival in crypto markets often hinges not just on strategy, but on endurance and continual learning.

A Timely Reminder Amid Regulatory Pressure and Market Uncertainty

CZ’s guidance also arrives at a moment when the crypto industry faces mounting regulatory scrutiny and persistent market uncertainty.

His own departure from Binance’s CEO role amid legal challenges underscores how even the most prominent figures in crypto are not immune to disruption.

By offering practical advice rooted in personal reflection and education, CZ’s message resonates with a community that is often lured by hype and speculation.

In a space where fortunes can be made or lost overnight, his counsel serves as a valuable reminder: risk is inevitable, but how you prepare for it can make all the difference.

Also Read: Binance’s CZ Says He Isn’t a Memecoin Trader but Supports the Community, Predicts $BTC $500k to $1M