A prominent cryptocurrency whale has made an impressive cumulative profit of $11.9 million after selling more than 59,000 AAVE tokens within a short span of 17 hours.

According to data from Spot On Chain, as reported by Odaily Planet Daily, the whale deposited exactly 59,001 AAVE to FalconX, a well-known crypto trading platform.

The total value of these deposits was approximately $9.76 million, with an average selling price of $165.5 per AAVE.

The rapid liquidation highlights the tactical maneuvers of large investors, commonly referred to as “whales,” who strategically capitalize on price fluctuations to secure significant returns.

By executing swift sell-offs, the trader demonstrated expertise in leveraging market movements for maximum profitability.

Large-Scale Transactions and Remaining AAVE Holdings

Out of the total 59,001 AAVE tokens liquidated, 29,000 AAVE, worth approximately $4.75 million, were offloaded just before the report was published.

The aggressive and well-coordinated selling strategy underscores the whale’s ability to influence the market while efficiently managing their holdings.

Despite the substantial liquidation, the trader has retained 8,425 AAVE tokens, currently valued at around $1.38 million.

With a realized profit of $11.9 million and an estimated total profit, including unrealized gains, reaching $12.3 million, the trader has achieved an extraordinary return rate of 85%.

The case exemplifies the potential for well-timed trades in the crypto market, where significant gains can be made through calculated buying and selling strategies.

AAVE Price Decline and Market Reaction to Whale Activity

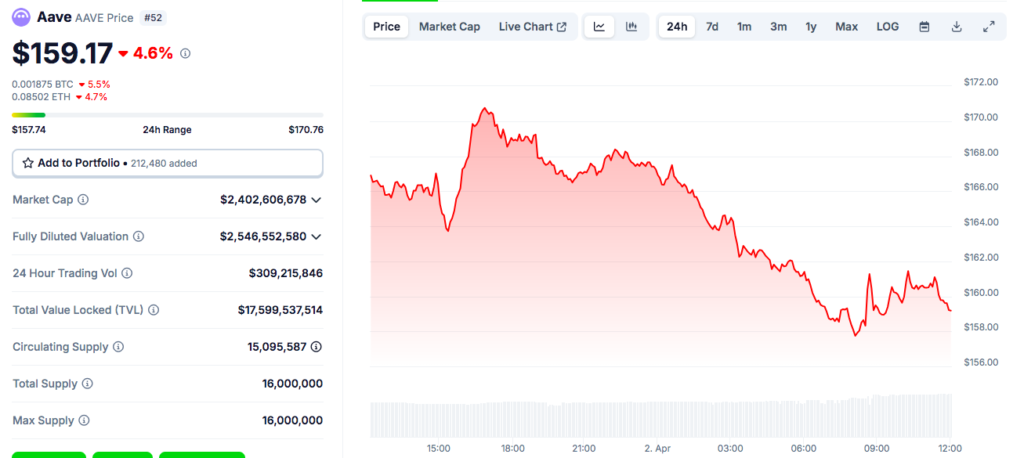

The large-scale sell-off had a noticeable impact on the AAVE token’s market performance. Following the liquidation, AAVE’s price declined to $159.17, reflecting a 4.65% drop in the past 24 hours.

Over the past seven days, the token has suffered a more substantial decrease of 14.90%, further demonstrating how major sell-offs can exert downward pressure on prices.

With a circulating supply of 15 million AAVE, the total market capitalization of Aave now stands at approximately $2.4 billion.

The whale’s selling activity likely contributed to the short-term volatility and price decline, reinforcing the influence that large transactions have on the overall market.

Investors will be closely monitoring AAVE’s movement in the coming days to assess whether the token can recover or if further downside pressure persists.

Other Whale Profits Amid Large-Scale Crypto Liquidations

The whale activity in AAVE is part of a broader trend, with other major crypto traders securing significant profits through strategic liquidations.

A long-term Ethereum investor recently netted a staggering $65.68 million profit after selling 34,125 ETH that had been accumulated at just $44 per token.

Similarly, another whale who had accumulated 160,000 AAVE at market lows sold 96,600 AAVE for a $7.44 million profit, executing structured sell-offs to minimize market impact.

Additionally, an XRP investor offloaded 26 million XRP after 2.3 years, securing a massive $56.87 million profit.

Despite slight price dips following these liquidations, AAVE, ETH, and XRP have demonstrated strong liquidity and resilience, maintaining substantial market capitalizations.

These instances highlight how well-timed trades by influential investors can shape price trends and create lucrative opportunities in the crypto market.