The cryptocurrency trading community has witnessed a dramatic reversal of fortune earlier today for the prominent trader known as “Traderpow.”

Initially celebrated for an extraordinary profitable trade in $TRUMP tokens, the trader’s recent investment decisions have led to substantial losses.

Traderpow’s with the address 8zFZH….hc7Zd journey began with a remarkable success story, purchasing 1.03 million $TRUMP tokens at $1.79 per token and successfully selling them at $23.84, generating an impressive profit of $22.7 million.

However, the trader’s subsequent decision to reinvest heavily in the same token has resulted in significant losses. The recent purchase of 309,514 $TRUMP tokens required an investment of $16.7 million, with tokens acquired at an average price of $53.93.

As the token’s value plummeted to $25.27, this position has deteriorated into an unrealized loss of $8.48 million, demonstrating how quickly fortunes can change in the volatile cryptocurrency market.

Market Dynamics and Token Performance

The $TRUMP token’s market performance has exhibited extreme volatility, contributing to the significant losses experienced by large-scale traders.

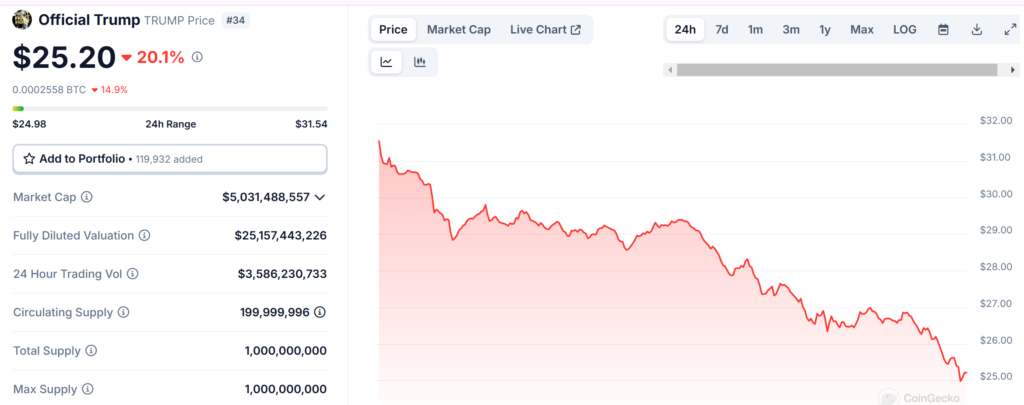

Current market data shows the token trading at $25.27, marking a sharp decline of 20.17% in just 24 hours and an even more dramatic 57.09% decrease over a week.

Despite maintaining a substantial trading volume of $3.58 billion in the last 24 hours, the token’s market capitalization has contracted to approximately $5.03 billion.

The severe market downturn has affected not only individual traders but has also influenced the broader sentiment surrounding politically-themed cryptocurrencies.

The rapid price fluctuations demonstrate the inherent risks in speculative token trading, where market momentum can quickly reverse, leading to substantial financial implications for investors of all sizes.

Broader Impact on Whale Trading Activities

The ripple effects of this market downturn extend beyond Traderpow’s losses, affecting other significant players in the cryptocurrency space.

Another notable whale trader has reported losses of $3.46 million after trading both $TRUMP and $MELANIA tokens, despite previously accumulating profits of $39.15 million.

The trader’s experience mirrors Traderpow’s situation, with losses spanning multiple politically-themed tokens – specifically, $2.91 million lost on $TRUMP trades and an additional $550,000 on $MELANIA tokens.

Furthermore, a separate whale investor has encountered a $2.47 million loss on a $9.5 million $TRUMP investment, while simultaneously holding $11 million worth of $MELANIA tokens that have experienced a dramatic 65.29% value reduction.

These parallel situations illustrate a broader pattern of significant losses among large-scale cryptocurrency investors.

Market Implications and Risk Assessment

These high-profile trading losses serve as a compelling case study in the risks inherent to cryptocurrency trading, particularly in the realm of politically-themed tokens.

The experiences of these whale traders highlight several crucial market dynamics: the dangers of overconcentration in specific tokens, the importance of timing in market entry and exit, and the potential pitfalls of chasing previous successful trades.

The rapid decline in both $TRUMP and $MELANIA tokens, despite their initially promising performance, underscores the speculative nature of these assets and the need for careful risk management strategies.

For market participants, these events provide valuable lessons about the importance of diversification and the potential consequences of large-position trading in volatile cryptocurrency markets.

Also Read: Whales Dominate 94% Of $TRUMP And $MELANIA Memecoins With 40 Wallets Under Their Control, Report