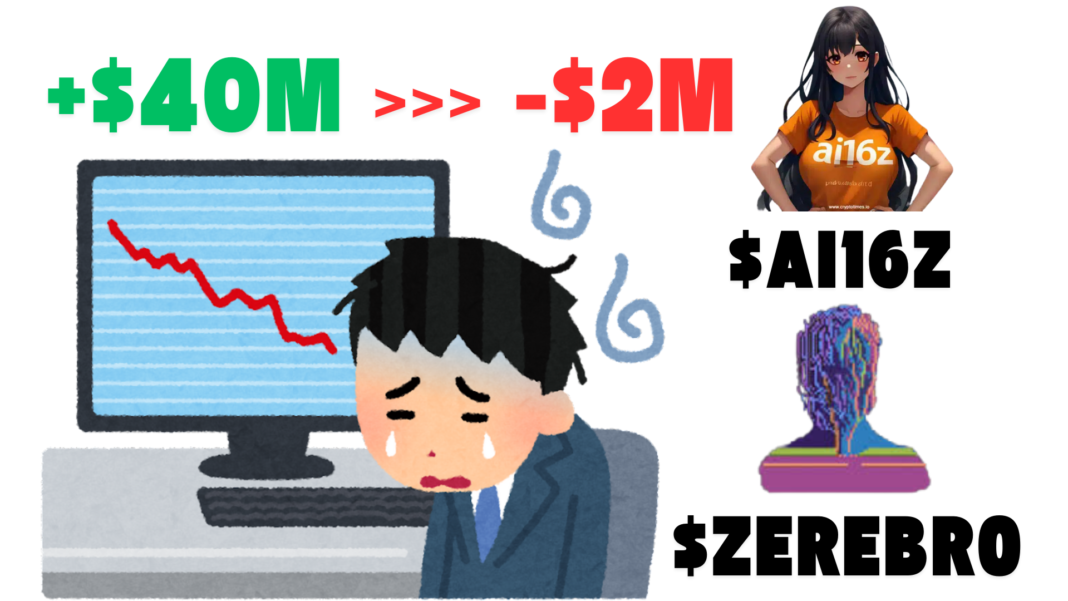

A cryptocurrency whale experienced a major setback after failing to capitalize on a potential $40.8 million profit from his holdings in ai16z (AI16Z) and Zerebro (ZEREBRO).

On January 2, the trader’s portfolio as reported by Lookonchain on X showed unrealized gains exceeding $40 million, but instead of seizing the opportunity to sell, he opted to hold onto his positions, hoping for further market gains.

Unfortunately, as the market turned downward, those gains quickly evaporated.

The trader was eventually forced to liquidate his positions, resulting in a $2 million net loss—an outcome that starkly contrasts with the profit he could have made.

A Costly Series of Trades Leads to Heavy Losses

The trader’s decision to hold on to his assets proved costly, as the value of his holdings continued to decline over time.

After offloading his Zerebro (ZEREBRO) holdings on January 9, he faced a loss of nearly $1 million.

Despite this initial setback, the trader decided to hold his ai16z (AI16Z) tokens, anticipating a market recovery.

However, the price of AI16Z continued to fall, and just 10 hours ago, he was forced to sell 21.34 million AI16Z tokens for $9.18 million, incurring another $1 million loss.

The unfortunate series of trades highlights the risks of waiting too long in a volatile market, where even experienced traders can suffer steep losses when market conditions change unexpectedly.

Also Read: Crypto Trader Turns $680K Into $43.5M Profit on $MELANIA Memecoin

Volatility in Market Performance of ai16z and Zerebro

The price movements of both ai16z and Zerebro reflect the unpredictable nature of the cryptocurrency market.

AI16Z is currently trading at $0.3847, showing a modest 11.07% increase over the past 24 hours but a significant 40.92% drop over the past week.

With a circulating supply of 1.1 billion AI16Z tokens, the token’s market capitalization stands at $426.2 million.

Similarly, Zerebro has seen a 14.47% price increase in the last 24 hours, but it, too, has suffered a sharp 39.31% decline over the past week, bringing its market cap to $60.47 million.

These steep fluctuations are a reminder of the inherent volatility in the cryptocurrency market, where prices can swing dramatically, turning potential profits into substantial losses if traders fail to time their exits strategically.

Lessons Learned from the Trading Blunder

This trading misstep serves as an important lesson in the volatile world of cryptocurrency trading.

The trader’s failure to take profits when they were available highlights the danger of holding onto assets for too long, especially in a market known for its unpredictability.

While the allure of higher returns can tempt traders to delay selling, the case of this whale’s $2 million loss emphasizes the importance of strategic exits and disciplined risk management.

By failing to sell his holdings when he had the chance, the trader missed out on a massive profit and instead faced substantial losses, underscoring the need for traders to balance ambition with caution in the fast-moving crypto markets.

Other Notable Onchain Trader Activity

While this case serves as a cautionary tale, other traders have been more fortunate in their decision-making.

One crypto trader managed to turn a 35.5 SOL investment, worth $8,193, into a staggering $2.4 million by strategically trading the $JellyJelly token.

On the flip side, another trader faced a loss of $317K after a $1 million trade in $VINE went wrong, with the token price dropping by 35%.

These contrasting stories highlight the high-risk, high-reward nature of the crypto market, where profits and losses can be decided by quick decision-making and the unpredictable swings of token prices.

Also Read: Crypto Trader Bags 10.18M ZACHXBT Tokens, Books $508K Profit In 22 Minutes