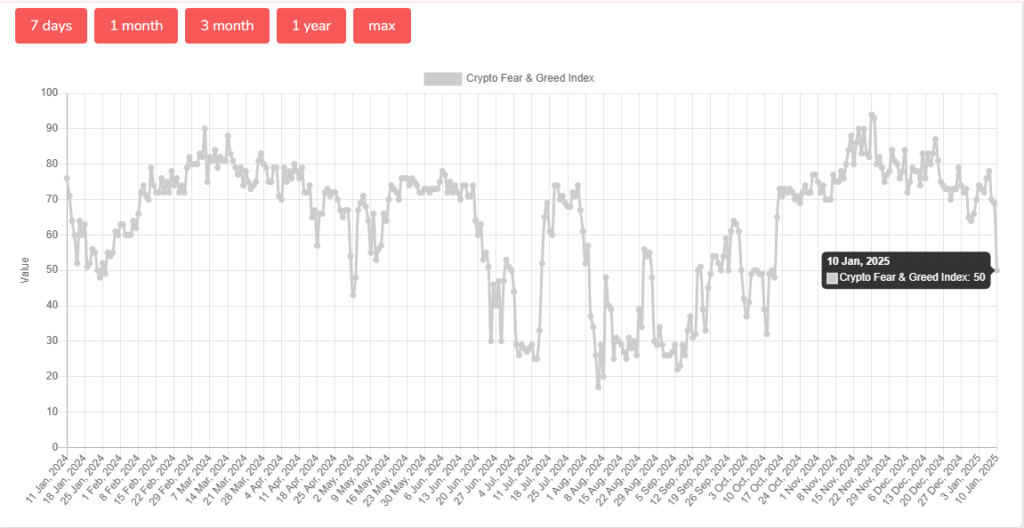

The crypto fear and greed index, which gauges sentiment in the cryptocurrency market and Bitcoin, dropped 19 points in a single day on January 10th, according to data from CoinMarketCap.

The level was the lowest the index has dropped since October 14, indicating that the overall market is trying to take cues about the future trajectory of Bitcoin, but hasn’t been able to pick on any optimistic signals.

Crypto Fear and Greed Index Turns to Neutral

After three months in the “Extreme Greed” and “Greed” zones, market sentiment fell into the “Neutral” zone, marking one of the index’s largest daily declines in recent years. The index now stands at 50 out of 100.

The drop in the sentiment comes in parallel to Bitcoin’s prices trading lower than expectations. The OG-cryptocurrency was trading below $92K levels for most of January 10th, struggling to find upbeat cues.

Also Read: U.S Entities Bitcoin Holdings Reaches Records, Accounts To 65% More Than Non-U.S Entities

Bitcoin Inches Lower As Market Conditions Turn Uncertain

The fall in the prices of Bitcoin comes as heightened fears over slower US interest rate drops and possible government coin sales weakened sentiment toward cryptocurrency.

As traders turned to safe havens like gold and the dollar due to increased economic uncertainty, cryptocurrency prices likewise mostly followed a decline in more general risk-driven markets.

Along with a general apprehension about taking risks, reports that the Department of Justice had been granted permission by a court to sell over $6.5 billion worth of Bitcoin that had been seized from the Silk Road illegal market further put pressure on the cryptocurrency.

Although the DOJ sale boosted pressure on Bitcoin sellers, it also dashed expectations that incoming President Donald Trump would turn the government’s stockpiles of confiscated tokens into a strategic reserve.

Trump has hinted at the prospect of a Bitcoin strategic reserve and pledged to implement laws that are favorable to cryptocurrencies.

Bitcoin Market Parameters: What Do They Say?

With the fall in Bitcoin prices, the market indicators around BTC have also changed. During the previous 30 days, Bitcoin saw 3.55% price volatility and 16/30 (53%) green days.

With 12 technical analysis indicators indicating optimistic signals and 17 indicating bearish signs, the overall sentiment for Bitcoin price prediction still hangs in the doldrums.

One well-liked indicator that most market participants use for determining if a cryptocurrency is overbought (above 70) or oversold (below 30) is the Relative Strength Index (RSI) momentum wave. With the RSI rating at 46.88 right now, the Bitcoin market is in a neutral state.