The cryptocurrency market has been hit with its most intense wave of liquidations since the collapse of FTX, wiping out over $273 billion in just 24 hours.

The turmoil was triggered by the U.S. President Donald Trump’s surprise announcement of sweeping tariffs on imports from Canada, Mexico, and China.

The policy move sent shockwaves through global financial markets, with U.S. stock futures plummeting and cryptocurrencies experiencing a sharp downturn.

Investors are increasingly concerned that prolonged high interest rates, combined with escalating trade tensions, could lead to sustained economic instability, prompting aggressive sell-offs across both traditional and digital asset markets.

Crypto Market Cap Shrinks by $273 Billion as Trading Volume Surges

The broader crypto market has taken a significant hit, with the total market capitalization dropping by 8.85% in the last 24 hours, falling to $3.09 trillion.

The sharp decline reflects the massive $273.47 billion in liquidations across various assets, highlighting the severity of the ongoing sell-off.

However, despite the downturn, trading activity has surged, with the total crypto market volume increasing 183.03% in the past day, reaching $319.86 billion.

Decentralized finance (DeFi) protocols have also felt the impact of the market turbulence, with DeFi’s total trading volume currently standing at $20.45 billion, accounting for 6.39% of the total crypto market’s 24-hour volume.

Meanwhile, stablecoins have dominated trading, with their total volume reaching $295.74 billion, making up a staggering 92.46% of all crypto trading activity within the last day.

The surge in stablecoin activity suggests that investors are seeking safety amid heightened volatility.

Futures Market Liquidations See Over $2 Billion Wiped Out

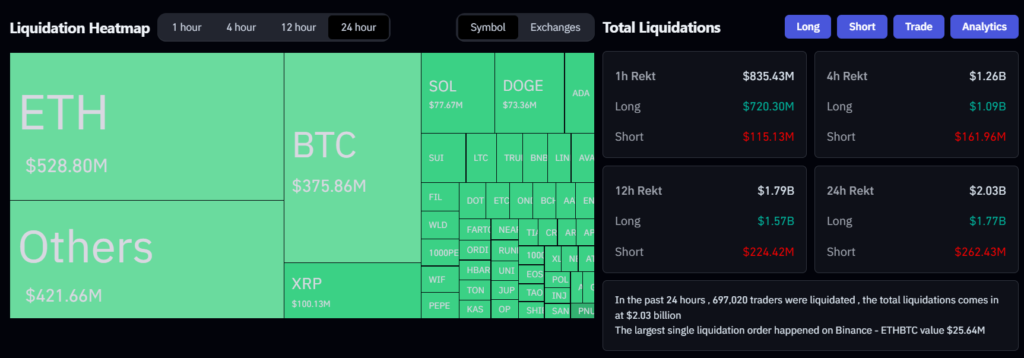

According to data from Coinglass, a staggering $2.028 billion worth of liquidations took place across the crypto market in the past 24 hours.

The majority of these liquidations came from long positions, which accounted for $1.766 billion, while short positions saw $262 million in liquidations.

Ethereum (ETH) bore the brunt of the losses, with $529 million in liquidations, followed by Bitcoin (BTC) at $376 million.

The liquidation frenzy reflects the extreme volatility introduced by macroeconomic uncertainties, as traders with leveraged positions were forced to exit amid the sudden price downturn.

Also Read: Crypto Sentiment Plummets to 18-Month Low As Bitcoin Struggles Below $92K

Altcoins Plummet as Bitcoin’s Sharp Drop Sparks Market-Wide Selloff

The impact of Bitcoin’s sharp pullback cascaded across the broader crypto market, leading to severe losses among major altcoins.

Ethereum (ETH) saw a steep 20.82% decline in just 24 hours, while Solana (SOL) dropped by 15.76%. XRP recorded a staggering 28.63% loss, and DeFi tokens such as AAVE and UNI plummeted by 27.67% and 29.09%, respectively.

Other significant losses included Optimism (OP) dropping 32%, Arbitrum (ARB) falling 30.06%, and Starknet (STRK) leading the decline with a 34.62% crash.

The widespread drop highlights the fragility of the market in response to external economic shocks, with investors rapidly offloading riskier assets.

Global Trade War Fears Add to Economic Uncertainty

The broader economic landscape remains tense as Canada, Mexico, and China vowed to retaliate against Trump’s newly imposed tariffs.

The U.S. president announced a 25% levy on Canadian and Mexican imports, alongside a 10% tax on Chinese goods, set to take effect on Tuesday.

The move, which Trump framed as a measure to address illegal immigration and drug trafficking, has ignited fears of a global trade war.

In response, affected nations have pledged countermeasures, potentially worsening inflation and leading to increased costs for various goods, including cars, steel, and food.

Economists warn that these retaliatory actions could further destabilize global markets, exacerbating the ongoing crypto market crisis.