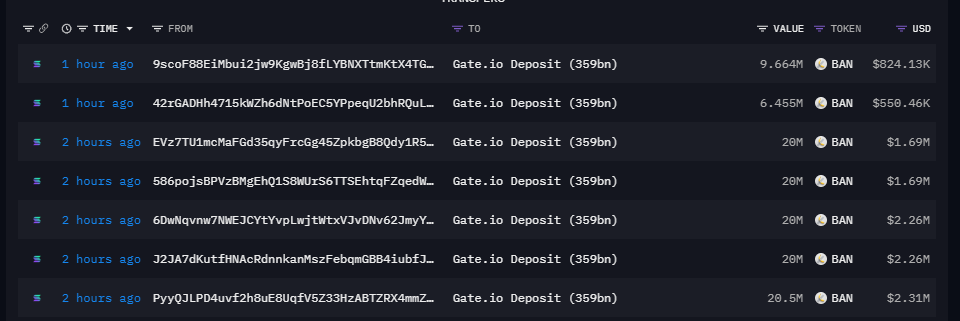

A group of crypto investors is facing a potential loss of approximately $5.63 million after moving 116.62 million BAN tokens to the centralized exchange Gate within the last two hours.

On-chain data indicates that these transactions originated from seven newly created wallets, collectively representing 11.66% of BAN’s total supply.

The timing of this large-scale transfer has raised concerns about an impending sell-off, as the investors initially acquired the tokens just two days ago at an average price of $0.133.

With BAN currently trading at $0.07815, selling at this rate would cement a significant loss, leading to broader speculation about further price declines and increased market volatility.

Large Token Transfers Spark Fear of Market Instability

The sudden movement of such a substantial portion of BAN tokens has created unease among traders, prompting speculation about the investors’ intentions.

If the tokens are liquidated in bulk, it could apply significant downward pressure on BAN’s price, potentially triggering a cascading effect of panic selling.

The size of the transfer suggests a strategic decision—either an attempt to cut losses before further depreciation or an orchestrated exit from the market.

Given the unpredictable nature of memecoins, major transactions like this tend to generate widespread uncertainty, making existing holders wary of potential price crashes. This uncertainty could fuel additional sell-offs, further exacerbating BAN’s volatility.

Also Read: Crypto Trader Faces $1M Loss In Hours After Opening $2.5M $BERA Memecoin Long Position

Poor Market Timing Increases Financial Risk for Investors

The investors initially purchased BAN at $0.133, expecting potential gains, but rapid market shifts have placed them in a difficult financial position.

Just two days later, the token’s price has plunged to $0.07815, reflecting a severe decline. This downturn, combined with a 38.05% drop in BAN’s value over the past 24 hours, highlights the risks associated with speculative trading in volatile markets.

If the investors choose to sell now, they will realize substantial losses, but holding onto the tokens in hopes of a recovery also carries risks.

Their urgent decision to deposit the tokens on a centralized exchange suggests that they may be preparing to cut their losses, an action that could send shockwaves through the market.

Broader Crypto Market Sees Increased Floating Losses

This potential BAN token loss is not an isolated event, as other traders and investment firms have also suffered substantial setbacks in the volatile crypto landscape.

Galaxy Digital, which invested $16.41 million in $PNUT, $ai16z, and $arc memecoins, is currently sitting on $8.49 million in floating losses, reflecting the inherent risks of speculative investments.

Additionally, a Binance Smart Chain (BSC) investor lost $1.7 million after investing $5 million in $BROCCOLI tokens, following an unfavorable price movement triggered by a tweet from Binance CEO CZ.

Another whale investor faced a $2.21 million loss after offloading 4.09 million $FARTCOIN in under an hour, causing a sharp 19% decline in its price.

These cases reinforce the challenges of navigating the unpredictable world of memecoins, where sentiment-driven volatility can lead to both massive gains and devastating losses.

Also Read: Crypto Trader Who Made $2.9M Profit from $TRUMP Suffers $1.8 Million Loss on $CAR Trade