A prominent cryptocurrency investor, commonly referred to as a “whale,” has incurred a staggering $14.6 million loss after liquidating a significant portion of their Melania Meme ($MELANIA) token holdings.

According to data from Onchain Lens earlier today, the investor initially acquired 13.97 million $MELANIA tokens for $28.9 million USDC in January but decided to sell them off in a single transaction for just $14.31 million USDC.

The major loss highlights the extreme volatility of meme coins, where rapid price shifts can lead to substantial financial setbacks.

The sell-off, executed just four hours ago, has sparked discussions on the risks associated with speculative crypto investments, particularly in highly volatile meme coin markets.

$MELANIA Token Price Plummets Amid Selling Pressure

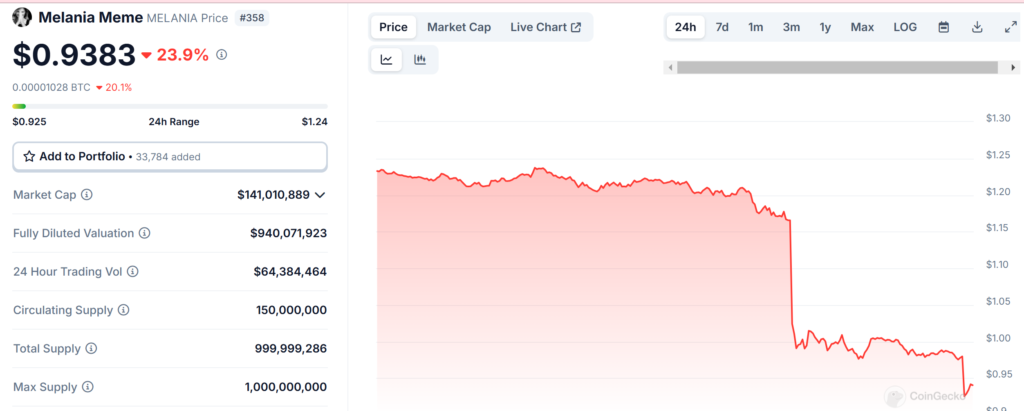

Following the whale’s large-scale liquidation, the price of Melania Meme ($MELANIA) has taken a significant hit, currently trading at $0.9311. This represents a sharp 24.45% decline in the past 24 hours, further extending a seven-day downtrend of 24.90%.

The massive sell-off appears to have intensified market panic, with increased selling pressure from other investors.

Despite this downturn, the token still maintains a notable market capitalization of $141 million, supported by a circulating supply of 150 million $MELANIA tokens.

The high volatility suggests that traders are reacting strongly to the whale’s exit, potentially leading to further price instability in the near future.

Market Sentiment Shaken as Whale’s Exit Raises Concerns

Large-scale exits by major investors can have a lasting impact on market sentiment, often leading to uncertainty and hesitation among smaller investors.

The whale’s decision to sell at a massive loss raises concerns about the long-term stability of $MELANIA, as well as the sustainability of its hype-driven value.

Meme coins are known for their speculative nature, where rapid price surges can be followed by steep corrections.

The recent trading volume of $64.38 million in the last 24 hours suggests that traders are closely monitoring the situation, with some fearing further declines.

If confidence in $MELANIA continues to erode, the token may face increased sell-offs, exacerbating its price downturn.

Can $MELANIA Recover or Is the Downtrend Set to Continue?

With $MELANIA facing heavy selling pressure, the key question now is whether the token can recover from its losses or if the bearish trend will persist.

Historically, meme coins have demonstrated the ability to rebound quickly, often fueled by social media trends, influencer endorsements, and renewed investor interest.

However, the recent liquidation by a high-profile investor may hinder short-term recovery efforts. While some traders remain optimistic, others are wary of further depreciation.

The coming days will be crucial in determining whether buyers step in to stabilize the token or if the downward trend continues, potentially leading to further losses for remaining holders.

Other Traders’ Profits and Losses in $MELANIA Memecoin

Some traders saw massive gains while others suffered heavy losses. One investor turned $680K into $43.5M by capitalizing on $MELANIA’s surge.

Another whale, despite making $39.15M in earlier profits, lost $3.46M after offloading 600K $TRUMP and 740K $MELANIA tokens.

A politically driven investor faced a $2.47M loss on a $9.5M $TRUMP investment as the token plunged 34.79%. Their $MELANIA holdings, worth $11M, also dropped 65.29%, showing the risks of speculative assets tied to political narratives.

On the winning side, a trader turned 2,500 Solana ($688K) into $66M through $MELANIA trades in just four hours, securing $2.14M in profits while holding 5M tokens for further potential gains.

These cases highlight $MELANIA’s extreme volatility, where strategic timing can yield massive profits or devastating losses.