A prominent Bitcoin trader, known as a “whale” in the cryptocurrency space, has successfully executed a high-stakes short trade, accumulating over $7.5 million in unrealized profits.

According to Lookonchain data, the trader initially shorted Bitcoin (BTC) at approximately $96,500 on February 22, anticipating a significant price drop.

His prediction proved accurate as Bitcoin plummeted below the $80,000 mark, allowing him to close his position near the bottom at around $78,900.

The strategic move demonstrates the extreme volatility of the crypto market and highlights the substantial profit potential for experienced traders who can accurately time market fluctuations.

Bitcoin’s Recent Decline and the Trader’s Next Moves

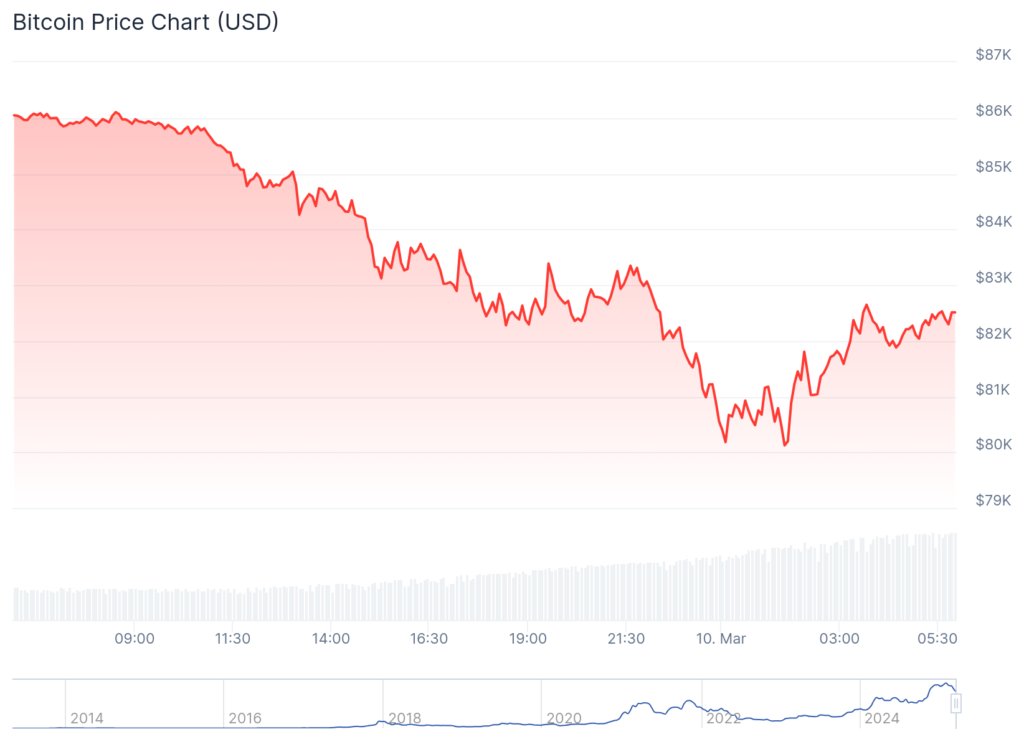

Bitcoin has faced substantial downward pressure in recent days, losing over 10% of its value within the past week.

Currently trading at $82,497.13, the cryptocurrency has recorded a 4.10% decline in the past 24 hours, with a staggering $38.9 billion in trading volume.

The recent drop was partly influenced by macroeconomic factors and shifting investor sentiment. Amid these turbulent conditions, the whale re-entered a short position at the peak of $94,424 following Bitcoin’s surge past $94,000, which was fueled by Trump’s executive order.

He has now set additional short positions between $92,449 and $92,636, with profit-taking limit orders placed between $70,475 and $74,192, indicating his belief that Bitcoin’s decline may not be over.

A Display of Expert Market Strategy

The trader’s precise execution of his short positions highlights a deep understanding of Bitcoin’s price movements and market behavior.

Shorting, which involves selling an asset with the intention of buying it back at a lower price, carries substantial risks and requires expert market analysis.

By successfully predicting Bitcoin’s recent bottom and capitalizing on the price decline, the whale has demonstrated exceptional timing and risk management.

His trading activity has also impacted broader market sentiment, as other investors and institutional players take note of these large-scale trades and adjust their strategies accordingly.

Market Implications and the Future of Bitcoin

This significant short position raises questions about Bitcoin’s near-term stability and investor confidence in its price trajectory.

The sharp decline has led to a wave of liquidations in the futures market, further intensifying volatility. Analysts are now debating whether Bitcoin will rebound from its recent dip or continue its downward trend in the coming weeks.

A short position of this scale suggests that at least some major investors remain skeptical of Bitcoin’s ability to sustain high price levels in the short term.

With global economic factors and regulatory developments adding to the uncertainty, Bitcoin’s next major move remains unpredictable.

Recent High-Stakes Trades Highlight Market Volatility

The crypto market has witnessed several high-profile trades recently, reflecting both immense profit opportunities and significant risks.

A PEPE whale secured a $406K floating profit after spending $3.95M WETH to acquire 20,511 AAVE at $193 per token, benefiting from AAVE’s 25.6% price surge in just 24 hours.

Meanwhile, an Ethereum whale leveraged a 50x short position on ETH at $3,220, generating an unrealized profit of $58 million.

However, not all traders have been as fortunate, 11 insider investors made $43.8 million by dumping LIBRA tokens immediately after launch, causing an 85% price collapse and triggering allegations of market manipulation.

These events underscore the high-risk, high-reward nature of cryptocurrency trading, with fortunes made and lost in mere hours.