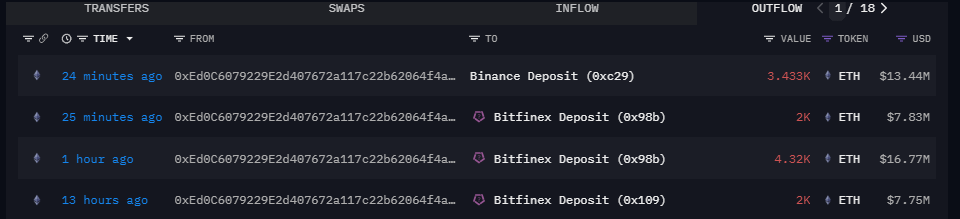

According to monitoring by crypto data analytics, a suspected Abraxas Capital address deposited a staggering 5,433 ETH, worth approximately $21.27 million, to the Binance and Bitfinex cryptocurrency exchanges.

The large transfer occurred just 30 minutes ago, signaling a significant move by a prominent crypto whale.

Escalating ETH Deposits Over 13 Hours

Upon further investigation, it was revealed that this same whale address has deposited a total of 11,753 ETH, valued at around $45.79 million, to the aforementioned exchanges over the past 13 hours.

The series of large-scale transfers suggests the investor may be looking to capitalize on their Ethereum holdings and realize substantial profits.

Estimated $10.9 Million in Realized Gains

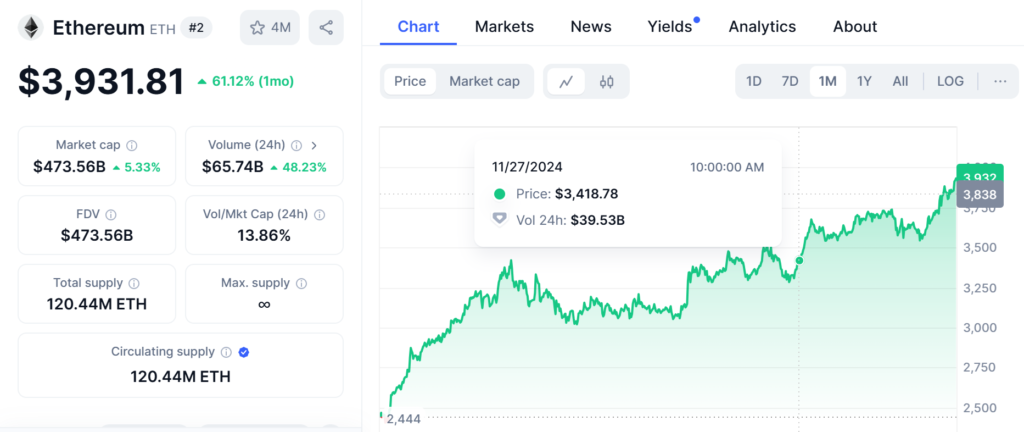

Delving into the details, the cost basis for the 11,753 ETH deposited is estimated to be $2,968 per coin.

Given that the current Ethereum price is trading at $3,937.45, the crypto investor is poised to realize an impressive profit of approximately $10.9 million on this trade.

This exemplifies the significant gains that can be achieved through savvy Ethereum investments, especially as the cryptocurrency has experienced a 61.12% price increase over the past period.

Potential Implications and Market Impact

The actions of this crypto whale, in moving such a substantial amount of ETH to centralized exchanges, could have broader implications for the Ethereum market.

This type of large-scale selling pressure, if sustained, may exert downward force on Ethereum’s price in the short term.

Also Read: Ethereum Whale Earns $1.8 Million Profit in Single Day Through 19th Round of Trading

However, it’s important to note that the investor’s motivations may vary, and they may have strategic reasons for cashing out a portion of their holdings at this time.

The Resilience of the Ethereum Ecosystem

Despite the potential short-term market impact, the Ethereum network has demonstrated remarkable resilience and growth in recent times.

With a circulating supply of 120 million ETH and a market capitalization of over $474 billion, Ethereum remains one of the most prominent and influential blockchain platforms in the cryptocurrency industry.

As the network continues to evolve and attract more developers, users, and institutional investors, its long-term prospects appear promising, even in the face of significant profit-taking by individual investors.

Also Read: Ethereum Investor Scoops Up 1.58 Million D.O.G.E in 121 ETH Transaction