A major cryptocurrency investor, commonly referred to as a “whale,” is currently facing significant unrealized losses amounting to $1.67 million after amassing over 5.17 million Uniswap (UNI) tokens.

According to Onchain Lens, the investor’s total UNI holdings were initially worth approximately $38.42 million, but market downturns have since eroded their value.

Notably, after a period of inactivity lasting 3.5 months, the whale withdrew 508,810 UNI—valued at around $3.58 million—from Coinbase, signaling continued engagement with the market.

However, despite their large-scale holdings, fluctuations in the cryptocurrency space have resulted in substantial losses, highlighting the inherent volatility and risk associated with investing in digital assets.

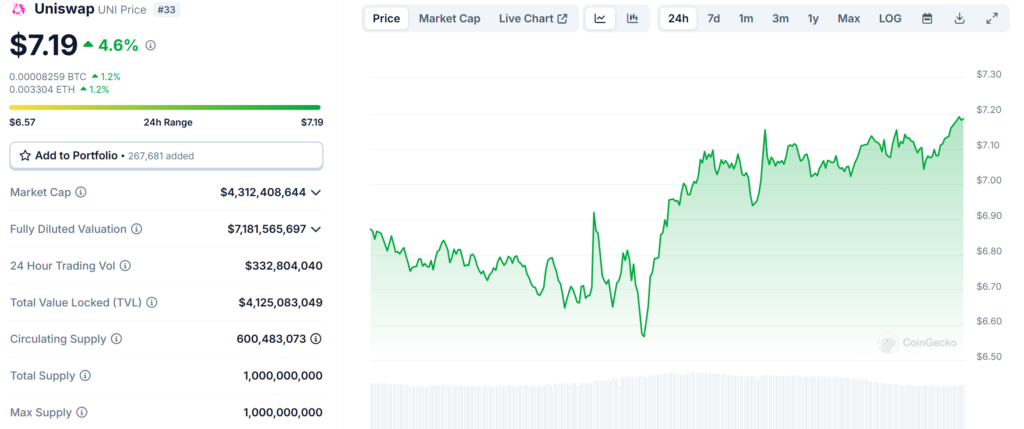

UNI Price Sees Recovery but Remains Below Previous Levels

Uniswap’s (UNI) price has shown signs of a modest rebound, currently trading at $7.19 after a 4.58% increase in the past 24 hours.

The token’s trading volume has exceeded $332.8 million within the same period, indicating heightened market activity.

However, despite this short-term price recovery, UNI remains down 14.09% over the past week, contributing to the whale’s unrealized losses.

The token maintains a circulating supply of 600 million UNI, positioning it with a market capitalization of approximately $4.31 billion.

While the recent price increase may offer some hope for investors, the whale’s long-term profitability remains uncertain, as broader market trends continue to shape the asset’s performance.

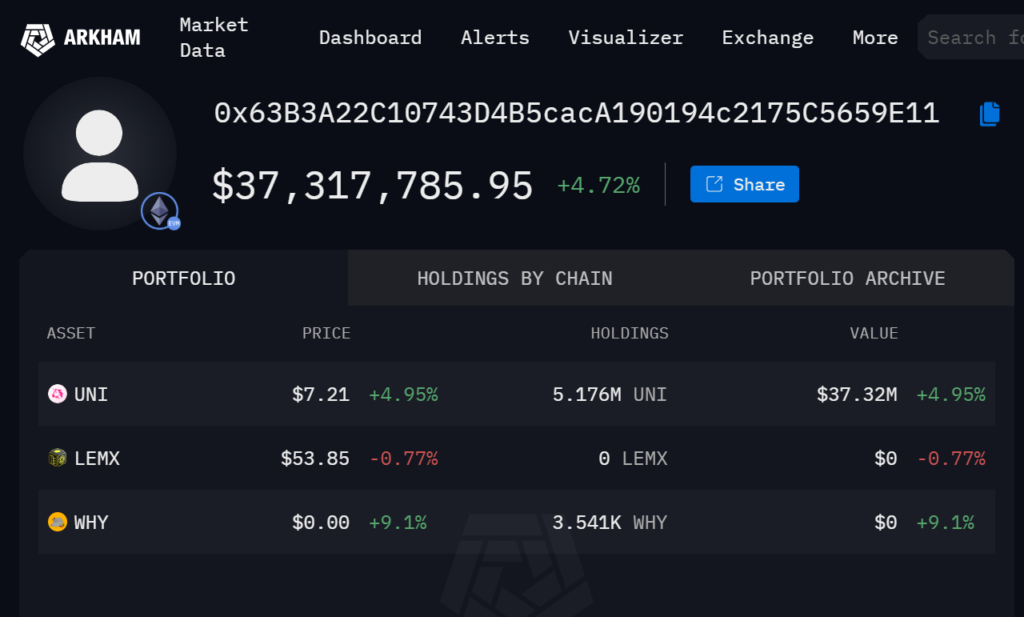

Heavy UNI Allocation Highlights Investment Strategy and Risks

The whale’s portfolio is heavily concentrated in Uniswap, with a total UNI holding now valued at approximately $37.11 million following a 4.67% price increase.

Unlike more diversified investors, this whale appears to have placed most of their capital into UNI, with holdings in other assets such as LEMX and WHY tokens currently valued at zero.

The strong reliance on a single asset demonstrates confidence in UNI’s long-term growth but also exposes the investor to heightened risk.

If Uniswap’s price continues its upward trajectory, the whale could recover their losses and secure profits.

However, any additional declines in the token’s value could deepen their unrealized losses, underscoring the importance of diversification in crypto investment strategies.

Broader Market Sentiment and Other On-Chain Losses

The whale’s accumulation of UNI, despite recent losses, suggests ongoing belief in Uniswap’s potential within the decentralized finance (DeFi) ecosystem.

Large-scale withdrawals from exchanges like Coinbase often indicate a strategy of long-term holding rather than immediate selling, reinforcing investor confidence in UNI’s future performance.

However, this case is not isolated, as other traders have recently faced substantial losses in the volatile crypto market.

One whale suffered a $4.7 million unrealized loss after accumulating $143.1 million worth of Mantra (OM), while another trader, Ansem, recorded over $325,000 in losses after selling large amounts of WIF and FARTCOIN tokens.

Additionally, another investor faced a massive $14 million loss on PEPE and BEAM but quickly reinvested $6.26 million in ONDO, hoping for a turnaround.

These cases highlight the unpredictable nature of the cryptocurrency market, where even experienced investors can face setbacks due to rapid price swings and changing market sentiment.