A prominent Pi Network community figure, known as Mr Spock, has publicly urged the project’s Core Team to take “bold economic steps” to restore the value of Pi Coin ($PI).

His recommendations via his post on X include implementing an aggressive buyback program to purchase Pi from the open market and permanently burning all transaction fees rather than recycling them.

The rationale is that reducing the circulating supply through such measures would create scarcity, potentially driving prices upward.

He also proposed stopping traditional mobile mining, locking unused tokens, and shifting to a utility-based mining model that rewards contributors who directly enhance the Pi ecosystem.

According to Mr Spock, pioneers have already contributed for years, and it is now time for the Core Team to convert Pi’s long-discussed potential into tangible market strength.

Market Speculation Over Possible Secret Buybacks

Following Mr Spock’s remarks, market analysts and Pi enthusiasts have speculated that the Core Team may already be quietly engaging in buybacks.

Reports highlight that a wallet labeled “ODM” has accumulated millions of Pi tokens in recent months, sparking debate about whether it is linked to the project’s leadership.

Some believe these acquisitions could be part of a strategy to stabilize prices, while others suggest they may be intended for future exchange listings, liquidity improvements, or ecosystem development grants.

The speculation is fueled by blockchain data revealing that 46 million Pi coins were withdrawn from the OKX exchange and transferred to a wallet named “Pi Foundation 2,” allegedly controlled by the Core Team.

Such movements are often used to reduce selling pressure during volatile market conditions.

The Potential Impact of a Buyback and Burn Strategy

Buyback and burn mechanisms are common in the cryptocurrency world as a deflationary tactic to increase token value.

While Pi Network does not currently have an official coin burn program, community discussions have centered on how this could help stabilize prices.

A permanent burn of transaction fees within the Pi ecosystem could be implemented through smart contracts or directly in Pi-based apps.

The burn would not only reduce oversupply, mainly caused by years of mobile mining, but also appeal to institutional investors looking for strong tokenomics.

However, analysts caution that burning tokens is not a “magic bullet” and must be accompanied by real-world utility, adoption, and consistent demand to produce lasting price growth.

Core Team’s Efforts to Strengthen Fundamentals

The Pi Core Team has already taken several steps aimed at reinforcing the network’s foundation.

Rather than sending large quantities of tokens to centralized exchanges, they are allocating Pi to verified business partners through Know Your Business (KYB) checks.

The approach is intended to promote legitimate ecosystem growth and prevent unnecessary market dumping.

Additionally, Pi Coin has expanded its presence through a listing on Swapfone, a US-regulated mobile exchange, marking a step toward broader legitimacy and accessibility.

Still, the absence of a Binance listing remains a sore point for many investors, who see buybacks and burns as immediate measures that could help control supply and stabilize prices.

Also Read: Pi Network Regains Momentum After Crash, Investors Wonder If $2 Level Is on Cards?

Current Market Performance of Pi Coin

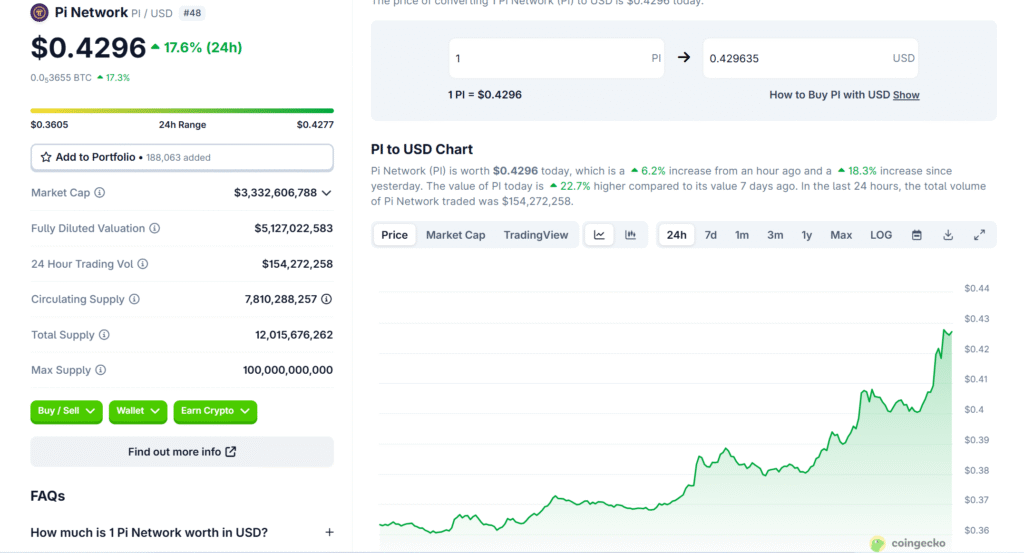

Despite its long-term challenges, Pi Coin has recently experienced a notable price recovery.

At the time of writing, $PI was valued at $0.4296, witnessing an increase of about 6.2% and 18.3% in an hour and in 24 hours, respectively, and a fabulous 22.7% in a week.

The trading volume of the coin in 24 hours also showed drastic changes and went up to $154.27 million. This provides further evidence of active markets and growing investor interest.

While these figures reflect short-term bullish momentum, the endurance of this rally could tie in with the Pi Core Team’s willingness to carry out aggressive economic maneuvers propounded by community leaders such as Mr Spock.

Meanwhile, investors are looking for signs that the initiation of official buyback and burn operations can firmly cement Pi’s recovery.

Also Read: PI Network Token Drops Below $1 Amid Scam Allegations