A significant market analysis from crypto analyst Ali Martinez has emerged, suggesting that Bitcoin’s current bull market could be entering its final phase, with an estimated 90 to 250 days remaining.

The projection is based on comprehensive historical data from previous halving cycles, which have shown consistent patterns in market peaks.

Historical evidence supports this analysis, with the 2013 halving cycle reaching its peak after 367 days, while both the 2017 and 2021 cycles topped out approximately 527 days post-halving.

Given that the most recent halving occurred 276 days ago, these patterns suggest a potential market peak sometime in mid-to-late 2024, aligning with historical timing sequences.

Market Performance and Price Dynamics

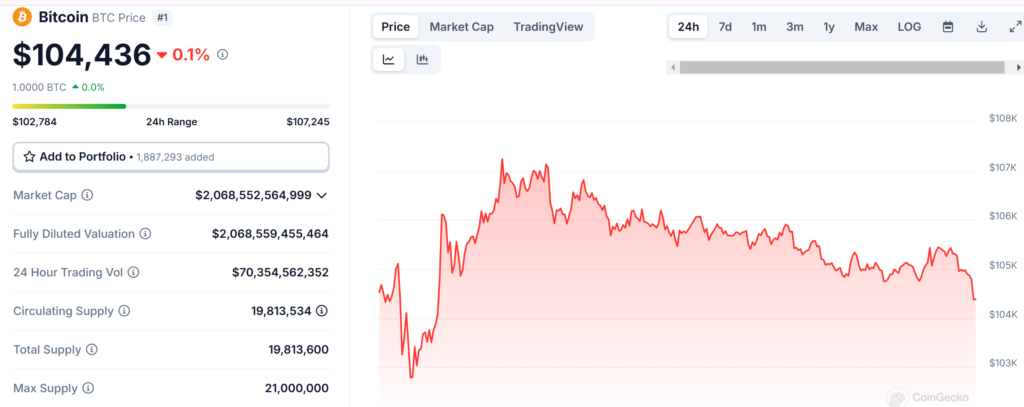

Bitcoin’s current market performance showcases significant strength, with the cryptocurrency trading at $104,436 and maintaining a substantial 24-hour trading volume of $70,354,562,352.

While showing a minimal 24-hour decline of -0.09%, Bitcoin has demonstrated robust weekly growth with a 7.77% increase over the past seven days.

The total market capitalization stands at an impressive $2,068,552,564,999, supported by a circulating supply of 20 Million BTC.

Notably, current market patterns are showing similarities to the 2015-2018 cycle, which experienced a remarkable price increase of over 500%, suggesting potential for similar dramatic growth in the current cycle despite prices already exceeding the $100,000 milestone.

Institutional Development and Market Integration

Significant institutional developments are reshaping the cryptocurrency landscape, particularly in the United States.

Crypto.com has made a strategic move by launching an institutional-grade trading platform in the U.S., expanding beyond their existing retail trading services.

The development coincides with notable high-profile investment activity, including Eric Trump’s confirmed $117 million cryptocurrency purchase, strategically divided with $47 million each allocated to Ethereum and Bitcoin.

The investment was symbolically structured to commemorate Trump’s potential 47th presidency, representing a significant vote of confidence in blockchain technology’s role in future financial systems.

Market Implications and Future Outlook

The convergence of these developments presents a complex picture for Bitcoin’s immediate future.

While historical cycle analysis suggests a potential conclusion to the current bull market within the next three to eight months, strong institutional integration and high-profile investments indicate growing mainstream acceptance and potential for sustained growth.

Market participants should note that while historical patterns provide valuable insights, contemporary factors such as increased institutional participation.

Evolving regulatory frameworks, and broader macroeconomic conditions could significantly influence market outcomes.

The combination of technical analysis and fundamental developments suggests a critical period ahead for Bitcoin and the broader cryptocurrency market, requiring careful monitoring of both cyclical patterns and emerging market dynamics.