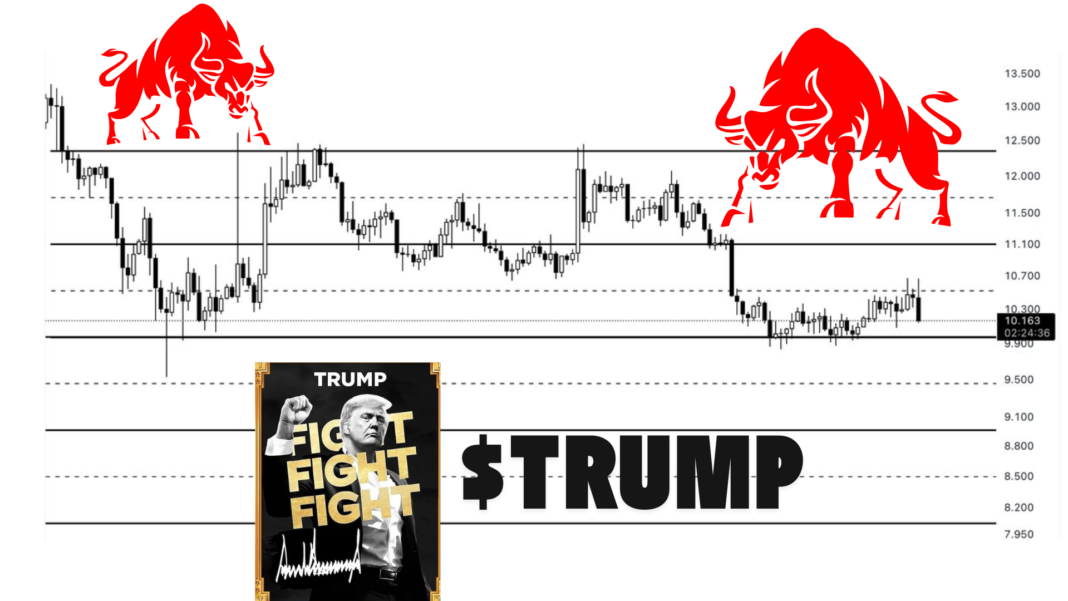

Renowned crypto analyst Ali Martinez has issued a cautionary forecast for the $TRUMP token, suggesting that the cryptocurrency could experience a significant price drop if it fails to maintain its crucial $10 support level.

Martinez shared his analysis on the X platform, warning traders that a breach below $10 could lead to a swift decline, potentially bringing the price down to as low as $8.

The prediction has sparked concerns within the crypto community, as investors closely monitor the token’s movements.

The forecast has fueled considerable debate among traders, with many questioning whether the $10 support level will hold or if further price declines are imminent.

The Significance of the $10 Support Level

Support levels play a critical role in technical analysis as they represent price points where buying pressure typically increases, helping to prevent further declines in an asset’s value.

In the case of the $TRUMP token, the $10 support level is seen as a pivotal threshold. If the token remains above this price, it could stabilize and potentially rebound, offering investors a glimmer of hope for recovery.

However, if the price falls below $10, it could trigger a wave of additional selling pressure, further exacerbating the decline.

Martinez’s warning underscores the psychological importance of the $10 mark for investors and traders alike, as it will likely influence the token’s near-term performance and market sentiment.

Market Performance and Volatility of $TRUMP Token

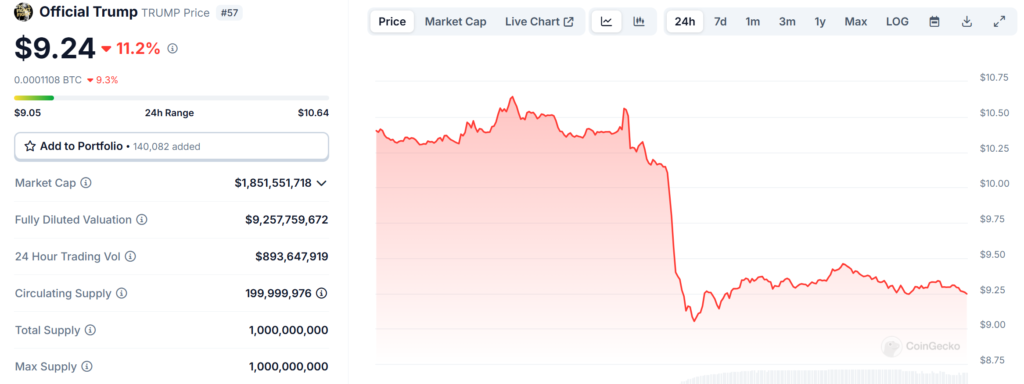

Currently, the $TRUMP token is trading at $9.24, reflecting a significant drop in value. In the last 24 hours, the token has seen a decrease of 11.24%, while its seven-day decline stands at 19.30%.

These downward movements have intensified concerns, particularly in light of the recent warning about a potential price plunge to $8.

Despite boasting a market capitalization of approximately $1.85 billion, based on a circulating supply of 200 million tokens, the recent volatility is evident.

The sharp decline in price has raised red flags for many traders, urging them to approach the token with caution.

The market’s current instability highlights the risks involved with $TRUMP, especially if it fails to hold the critical $10 support.

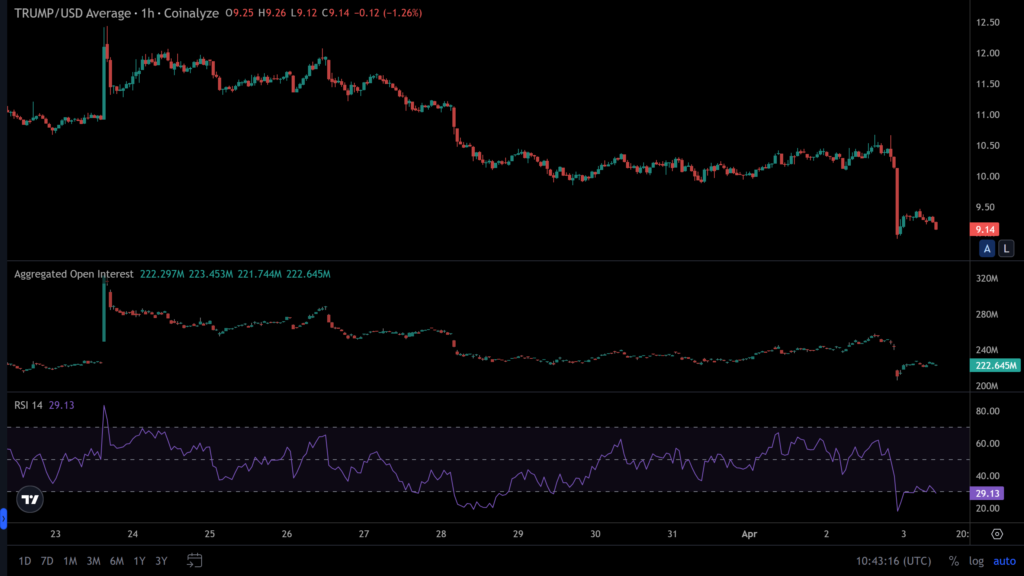

Declining Open Interest and RSI Suggest Weakening Momentum

Further signs of weakness in the $TRUMP token are seen in its open interest and relative strength index (RSI).

The open interest, which measures the total value of open positions in a particular asset, has dropped by 10.84% in the past 24 hours, now standing at $222.3 million.

The decline suggests that traders may be losing confidence in the token, with fewer participants taking positions. Additionally, the RSI for $TRUMP is currently at 29.13, indicating that the token is in oversold territory.

An RSI value below 30 often signals a lack of buying momentum, further supporting the notion that $TRUMP may face continued downward pressure if it cannot reclaim its $10 support level.