Crypto analyst Ali Martinez via X, made an analysis on NEAR Protocol ($NEAR) as it forms a potential inverse head-and-shoulders pattern on the charts.

The pattern, often seen as a bullish signal, suggests that NEAR could experience a breakout that would propel its price upward by approximately 15%, targeting a price of $2.40.

The formation of this pattern has caught the attention of traders, as breaking out of the immediate trendline at $2.10 could trigger the anticipated bullish momentum.

Market watchers are eager to see if this pattern confirms the upward trajectory or if other market factors intervene.

NEAR’s Price Movement and Market Capitalization

Today, the price of NEAR Protocol stands at $2.13, reflecting a 5.08% increase in the last 24 hours. This marks a short-term recovery from a recent 13.77% decline over the past week.

Despite this recent downturn, NEAR’s market activity remains strong, with a 24-hour trading volume of over $154 million.

The token’s circulating supply is currently 1.2 billion, and NEAR Protocol is valued at a market cap of approximately $2.56 billion.

While the token’s recent price fluctuation has sparked uncertainty, the current bullish indicators are beginning to garner attention from both retail and institutional traders.

Also Read: Crypto Analyst Predicts Chainlink Price Drop To $7.50 After Breaking A Rising Trendline

Open Interest and RSI Indicate Bullish Sentiment for NEAR

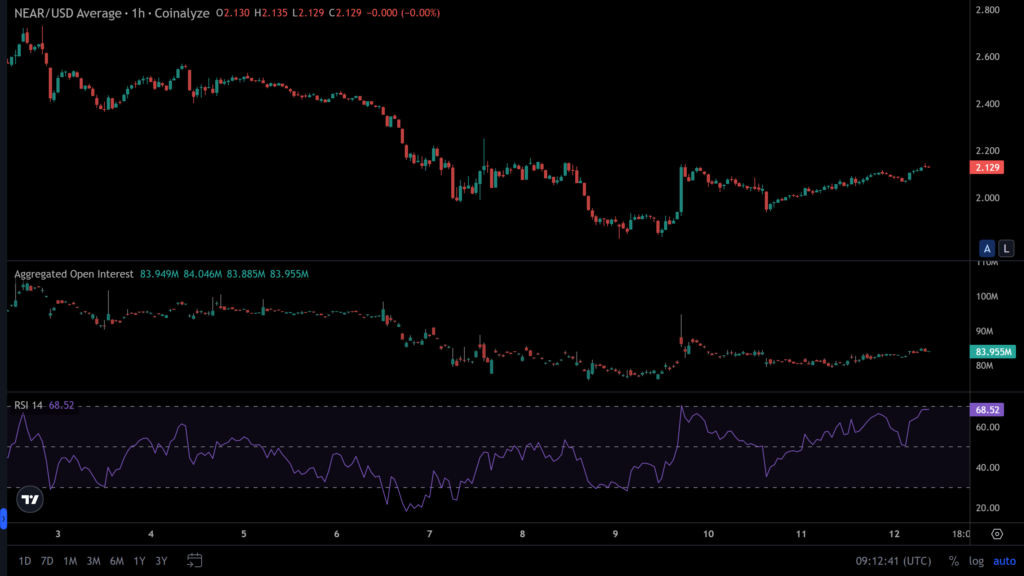

Further supporting the optimistic outlook for NEAR is the token’s rising open interest and strong relative strength index (RSI) readings.

NEAR’s open interest surged by 6.27% in the past 24 hours, reaching a value of $84 million, which points to increasing market participation and growing investor confidence.

Additionally, the RSI of NEAR currently sits at 68.52, indicating that the token is experiencing strong bullish momentum.

An RSI in this zone typically suggests that the asset is poised for further upward movement, reinforcing the analysis of an impending breakout to $2.40 if the inverse head-and-shoulders pattern completes.

Market Sentiment and Potential for a 15% Price Increase

The convergence of technical factors surrounding NEAR, including the formation of the inverse head-and-shoulders pattern, increasing open interest, and a bullish RSI, suggests a strong likelihood of a price breakout in the near future.

If the price of NEAR successfully clears the resistance at $2.10, the anticipated 15% move toward $2.40 could come to fruition, signaling a period of upward price action.

Traders and analysts are closely monitoring these indicators, as they reflect an optimistic sentiment toward NEAR’s short-term price potential.

However, market conditions and broader crypto trends will also play a key role in determining the ultimate outcome for the token’s price.