A prominent crypto analyst has forecasted a significant price surge for Bitcoin (BTC), predicting that the cryptocurrency could climb to $108,233 in the coming weeks.

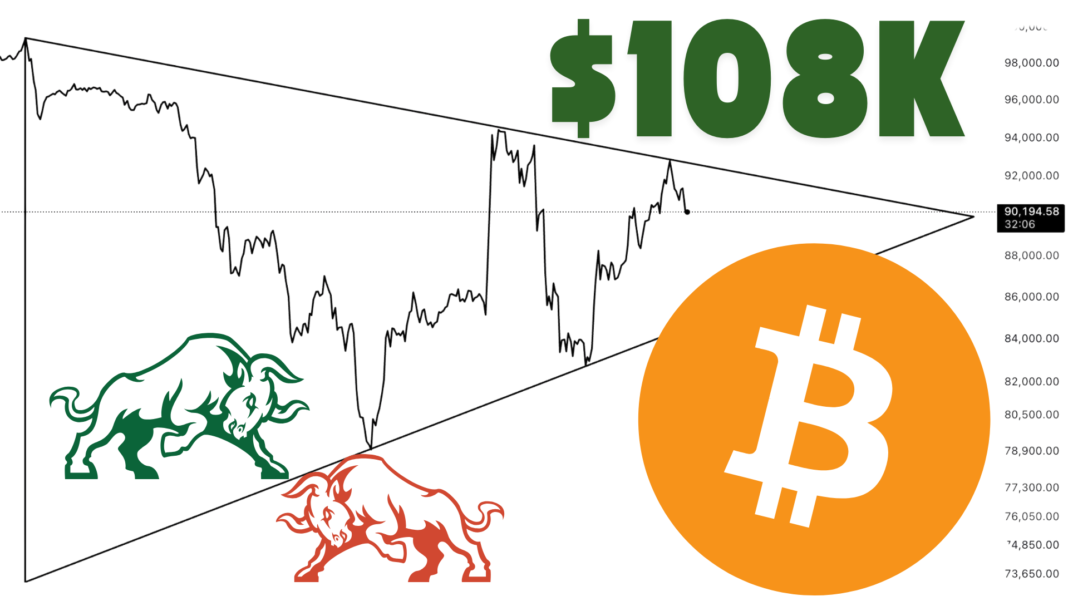

According to the analyst Ali Martinez, Bitcoin is currently consolidating within a triangle pattern, a well-known technical formation that often precedes major breakouts.

The pattern suggests that Bitcoin could be gearing up for a substantial 20% price movement, depending on whether it breaks upward or downward.

As speculation intensifies, the prediction has sparked widespread discussion among traders and investors, with many keeping a close watch on market signals to confirm the anticipated bullish trend.

Bitcoin Faces Short-Term Dip Despite Weekly Gains

While long-term projections remain optimistic, Bitcoin has faced a short-term decline, falling by 4.77% in the last 24 hours to $87,916.23.

Despite this setback, Bitcoin has still posted an 8.41% gain over the past week, showcasing its resilience in an otherwise volatile market.

The cryptocurrency’s 24-hour trading volume has exceeded $57.69 billion, reflecting sustained market interest and activity. With a total market capitalization of approximately $1.73 trillion, Bitcoin continues to dominate the crypto landscape.

However, its recent price fluctuations serve as a reminder of the market’s unpredictable nature, prompting investors to tread cautiously while assessing future trends.

Also Read: Hong Kong Lawmakers Propose Bitcoin Inclusion in Fiscal Reserves, Aims At Holding BTC For Longer

Technical Indicators Signal Imminent Breakout

The triangle pattern forming on Bitcoin’s price chart is a critical technical indicator, often signaling an impending breakout.

If BTC surpasses its resistance level, it could trigger the projected rally to $108,233, marking a 20% increase from its current valuation.

On the other hand, a breakdown from the pattern could lead to bearish movement, possibly pushing prices lower.

Analysts emphasize that the direction of the breakout will largely depend on broader market sentiment, macroeconomic conditions, and investor confidence.

Key factors, such as institutional adoption and regulatory updates, will play a crucial role in determining Bitcoin’s next major price movement.

Market Reactions Amid Growing Institutional and Regulatory Interest

Investor sentiment remains a driving force behind Bitcoin’s price trajectory, with external influences such as government policies, institutional investments, and global economic conditions shaping the market landscape.

The recent volatility follows news that U.S. President Donald Trump has signed an executive order to establish a Strategic Bitcoin Reserve, leading to sharp price movements.

The order, announced by White House AI and Crypto Czar David Sacks, aims to create a federal Bitcoin stockpile using assets seized from criminal and civil forfeiture cases.

The development has added another layer of complexity to the market, with traders closely monitoring regulatory shifts and institutional adoption to gauge Bitcoin’s future price direction.

As the market approaches a critical juncture, both short-term traders and long-term holders must adapt their strategies accordingly to navigate the ever-evolving crypto space.