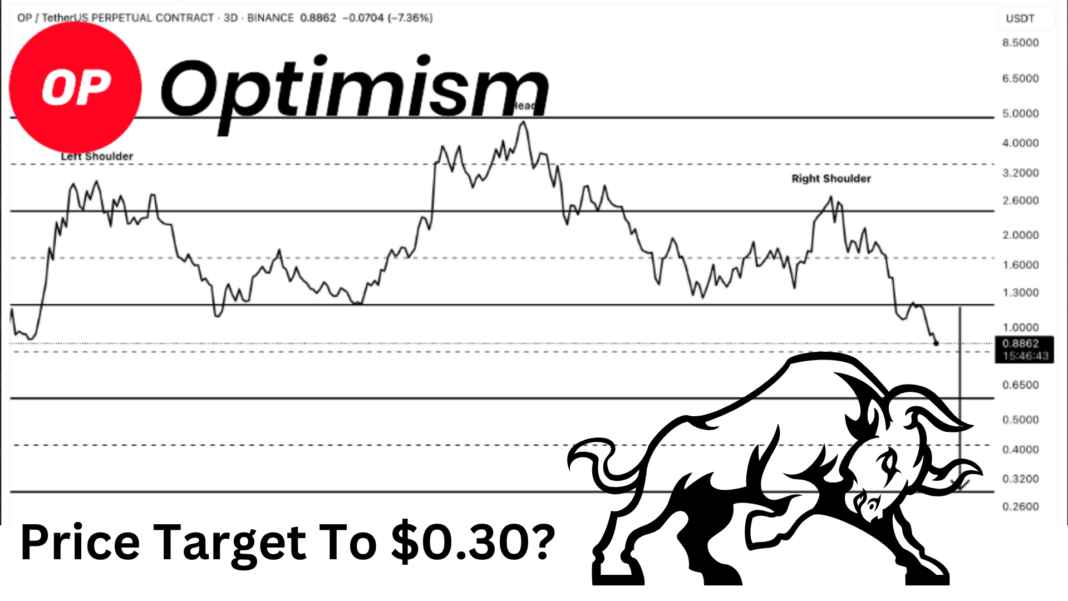

Crypto analyst Ali Martinez recently took to X (Twitter) to note that Optimism ($OP) is breaking out of a head-and-shoulders pattern. He suggested this could signal a move toward $0.30.

Martinez’s observation caught the attention of traders who keep an eye on technical patterns. The head-and-shoulders formation is often seen as a sign of a potential reversal. This technical signal has sparked interest among market participants.

A Pioneer in Layer-Two Scaling-Optimism

Optimism is one of the early projects in the layer-two scaling movement for Ethereum. It has built a reputation for reliability. The project launched the OP Mainnet L2 and released an open-source rollup development kit known as the OP Stack.

These tools have gained respect in the crypto space for their performance. Optimism aims to unite the fragmented Ethereum L2 ecosystem. The project envisions a connected network it calls the Superchain. This ambition could change how Ethereum scales in the future.

$OP’s Price Actions and Recent Pressure

At the moment, Optimism is trading at $0.9240. It has shown a modest gain of 1.34% over the last 24 hours. The global market cap for OP stands at $1.49 billion, and its 24-hour trading volume has increased by 88%.

Despite these gains, the OP token has faced significant pressure over the past week. It has dropped by more than 15% during this period. This decline raises concerns among investors and traders about short-term market volatility. The mixed signals make it a critical time for the token.

What This Means for Investors?

The breakout signal could hint at a renewed upward trend for OP. However, the recent drop of over 15% suggests that caution is necessary. Investors must weigh the potential technical gains against the market pressure.

This blend of bullish signals and short-term setbacks shows the inherent volatility in the crypto market. It also reflects the challenges that come with a highly competitive space.

Also Read: Crypto Analysts Ali Martinez Goes Bullish On XRP, Predicts $11 For 2025

Traders need to consider both the technical analysis and market sentiment before making decisions.

Institutional Moves and Network Influence

Last year, Grayscale Investments introduced new investment funds for Optimism’s governance token. The Grayscale Optimism Trust is one of the more popular funds in the layer-two arena. Optimism’s influence goes beyond its token.

It supports a network that includes major players like Coinbase’s Base and Uniswap’s Unichain. According to DefiLlama, Optimism supports approximately $91.62 billion in total value locked. Its technology stack has been adopted by other layer-two solutions.

This has led Optimism to dub its interconnected network the “superchain.” The term reflects its ambition to bring various L2s together under one banner.

The current market dynamics show both promise and challenges for Optimism. While technical patterns hint at a potential breakout, short-term market pressures cannot be ignored.