ConsenSys CEO and Ethereum co-founder Joseph Lubin has made a significant announcement regarding the Trump family’s entrance into the cryptocurrency space, revealing a massive $250 million Ethereum (ETH) purchase.

The substantial investment is reportedly part of a broader strategy to establish a presence in the decentralized finance (DeFi) sector.

The revelation gains additional weight when considered alongside Eric Trump’s separate $117 million cryptocurrency investment, which included $47 million each in Ethereum and Bitcoin, symbolically tied to Donald Trump’s potential 47th presidency.

The combined investment strategy represents a dramatic shift from the Trump administration’s previously skeptical stance on cryptocurrencies, potentially signaling a new era in the relationship between traditional political power structures and digital assets.

Political and Regulatory Landscape

The investment comes at a crucial junction in the cryptocurrency regulatory landscape.

Joseph Lubin’s observations about Solana’s active engagement with Washington D.C. policymakers, contrasted with Ethereum’s relative lack of formal representation, highlights the evolving political dynamics within the blockchain sector.

Notably, Lubin has predicted that Donald Trump’s potential return to the White House could lead to the dismissal or settlement of numerous SEC cases against crypto companies, suggesting a significant shift in the regulatory environment.

The perspective gains particular relevance given ConsenSys’s own challenges with current regulations, as evidenced by Lubin’s criticism of the SEC’s approach to digital asset regulation, which he characterized as an “abuse of power.”

Market Impact and Corporate Developments

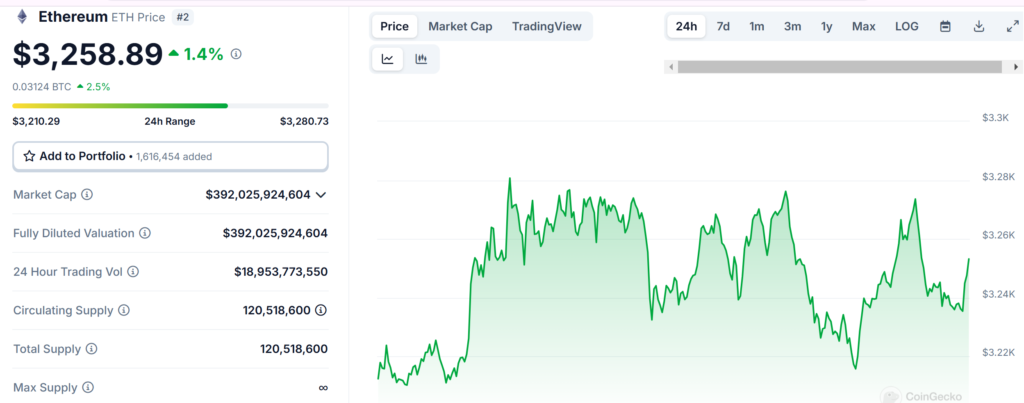

The market has responded to these developments with measured optimism, as Ethereum’s price reached $3,258.89, showing a 1.45% increase over 24 hours despite a 4.27% weekly decline.

The cryptocurrency’s market capitalization remains robust at approximately $392 billion, supported by a circulating supply of 120 million ETH.

However, ConsenSys itself is navigating challenges, as evidenced by its recent announcement of over 160 job cuts worldwide.

The corporate restructuring, occurring amid regulatory and economic pressures, indicates the complex balance between innovation and operational sustainability in the blockchain sector.

Technological Advancement and Infrastructure Development

Amid these political and market developments, ConsenSys continues to advance its technological infrastructure.

A significant development is the transition of Infura DIN (Decentralized Infrastructure Network) to become an EigenLayer Actively Validated Service (AVS).

The strategic move aims to enhance the scalability, reliability, and efficiency of web3 networks for developers.

The evolution of Infura DIN into a decentralized API marketplace represents ConsenSys’s ongoing commitment to building robust blockchain infrastructure, even as the company navigates regulatory challenges and market dynamics.

The technological advancement, coupled with the Trump family’s substantial investment in the ecosystem, suggests a potential convergence of political influence, regulatory reform, and technological innovation in the blockchain space.

Also Read: ConsenSys CEO Predicts Trump’s Re-Election Will End A Lot Of SEC & Crypto Legal Battles